Real estate investors need a deep understanding of warranty deeds for risk mitigation. This legal document guarantees clear title ownership, crucial in competitive markets like Arizona. Investors should analyze location, market conditions, and economic indicators for strategic decision-making. Diversifying investments through geographic locations, property types, and niche markets enhances returns. Consulting legal experts skilled in local laws ensures proper warranty deed documentation to safeguard interests. Effective management post-purchase involves maximizing rental income for long-term gains. Focus on location, use of warranty deeds, and due diligence to attract tenants or sell at premium prices.

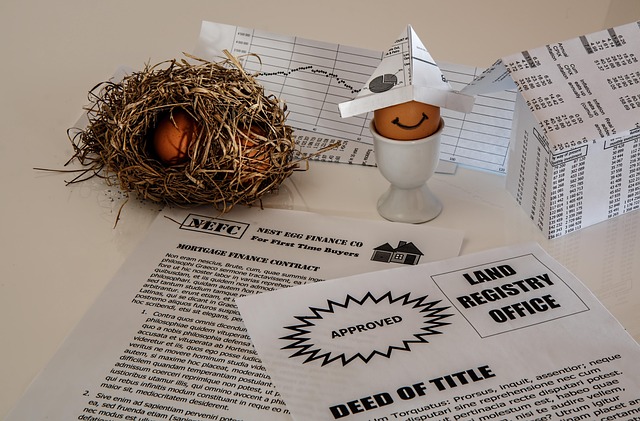

Real estate investing holds an iconic place in the financial world, serving as a cornerstone for many individuals’ wealth generation. However, navigating this complex landscape can be daunting for beginners. The intricate jargon, ever-changing market dynamics, and legal intricacies often create a significant barrier to entry. This article aims to demystify real estate investing, providing a comprehensive guide for aspiring investors. We’ll explore fundamental concepts, dispel common myths, and offer practical advice on securing sound investments, including the crucial role of a warranty deed in safeguarding your interests.

- Understanding Real Estate Investment Basics

- Assessing Property: Location & Market Conditions

- Financing Options for Investors: Loans & Funding

- The Legalities: Contracts, Titles & Warranty Deed

- Strategies for Property Acquisition & Management

- Maximizing Returns: Rental Income & Resale Value

Understanding Real Estate Investment Basics

Understanding Real Estate Investment Basics is crucial for any aspiring investor looking to navigate this lucrative sector. At its core, real estate investing revolves around acquiring properties with the potential for capital appreciation or generating consistent rental income. A key concept to grasp is the warranty deed, a legal document that guarantees clear title to a property, offering investors peace of mind and security. This ensures that the property is free from any hidden liens or encumbrances, providing a solid foundation for investment strategies.

When delving into real estate investments, it’s essential to differentiate between various types of deeds, with a particular focus on the general warranty deed. This document provides comprehensive protection by promising that the seller has full authority to convey the property and that there are no undisclosed claims or legal issues. For instance, in the competitive Arizona market, where West USA Realty specializes, a robust understanding of local real estate laws and practices is vital. The general warranty deed is commonly used in such scenarios, ensuring transparency and reducing potential risks for both buyers and sellers.

Practical insights for investors include conducting thorough due diligence on properties and deeds. Examining public records and seeking professional legal advice are essential steps before finalizing any investment. By understanding the intricacies of warranty deeds, investors can make informed decisions, mitigate risks, and strategically navigate the real estate market. This knowledge allows them to identify lucrative opportunities, whether through flipping houses or long-term rental investments. Ultimately, a solid grasp of these fundamentals equips individuals to become successful and confident real estate investors.

Assessing Property: Location & Market Conditions

When assessing a property for investment, two critical factors are its location and the current market conditions. The location of a property can significantly impact its value, potential for appreciation, and rental income. For instance, properties in urban centers or proximity to major corporate headquarters often command higher prices due to high demand from tenants and buyers alike. Conversely, suburban or rural locations might offer more affordable entry points but may experience slower growth or even depreciation without adequate market stimulation.

Market conditions are equally vital. Investors should examine recent sales data, rental rates, and vacancy levels in the area to gauge the health of the local real estate market. For example, a consistent increase in property values over several quarters suggests a robust market, while a surge in new developments could indicate oversaturation. Understanding these dynamics is crucial for making informed decisions. A general warranty deed, which provides broader protection compared to other types, can offer peace of mind for investors. In areas like West USA Realty’s focus, where real estate trends are dynamic, having a comprehensive legal document assuring property rights and protections—such as a general warranty deed—is essential for safeguarding investments.

Moreover, keeping an eye on economic indicators at the regional level is beneficial. Local employment rates, income growth, and infrastructure developments can all influence the future prospects of a neighborhood or city. For instance, areas with growing tech industries often see increased demand for housing, driving up property values. By thoroughly assessing location and market conditions, investors can identify promising opportunities that align with their investment strategies. This proactive approach not only minimizes risks but also maximizes returns over the long term.

Financing Options for Investors: Loans & Funding

When it comes to financing options for real estate investors, loans and funding play a crucial role in turning aspirations into reality. Understanding various lending mechanisms is paramount for any investor looking to navigate the market effectively. One common and secure option is the warranty deed, which provides a robust framework for both buyers and lenders. A general warranty deed, in particular, offers comprehensive protection by ensuring clear title ownership and safeguarding against hidden encumbrances or defects. This legal document acts as a promise from the seller that they have good title to the property and the right to sell it, free of any claims or liens.

Investors can leverage this mechanism to secure funding for their ventures. In many cases, traditional loans from banks or mortgage lenders are a viable path. These institutions offer a range of loan products tailored to real estate investors, including fixed-rate mortgages and adjustable-rate mortgages (ARMs). For instance, an ARM may appeal to those anticipating future rate declines, while fixed-rate mortgages provide stability with consistent monthly payments. West USA Realty, a leading real estate brand, often advises clients to carefully consider their financial goals and risk tolerance when selecting the right loan type.

Alternative financing options are also available for investors looking beyond conventional loans. Hard money loans, provided by private lenders, can be faster and more flexible but typically come with higher interest rates and fees. Crowd-funding platforms have gained popularity, allowing investors to pool resources and invest in real estate projects directly. This democratic approach democratizes access to real estate investment but requires careful due diligence to assess project viability. Moreover, understanding the legal aspects, such as the intricacies of a general warranty deed, is essential for protecting investments and ensuring a solid foundation for future growth.

The Legalities: Contracts, Titles & Warranty Deed

When delving into real estate investing, understanding the legalities is paramount. One of the cornerstone documents you’ll encounter is the contract—a legally binding agreement between the buyer and seller that outlines the terms of the transaction. It’s crucial to have a comprehensive grasp of these contracts, as they can vary widely in complexity and terminology. Always seek professional advice from real estate experts like West USA Realty to ensure you’re protected.

Beyond contracts, titles play a critical role in securing your investment. A title is proof of ownership and confirms that the property has no liens or claims against it. It’s akin to a warranty—ensuring the property is free and clear for future use and sale. The general warranty deed, a common legal instrument, offers broad protection by guaranteeing that the seller owns the property free from any hidden defects or claims. In some cases, investors may opt for an extended title insurance policy to safeguard against unforeseen issues.

A key element in many real estate transactions is the warranty deed, specifically designed to transfer ownership and ensure the legitimacy of the sale. This document guarantees that the grantor (seller) has the right to convey the property and provides protections for both parties. For instance, a standard warranty deed includes provisions that shield the buyer from any encumbrances or undisclosed issues that may arise after the deed is recorded. It’s essential to thoroughly review these documents with a legal professional before finalizing any deal.

When considering a real estate investment, remember that every state has its own nuances in property laws and deed types. For example, a general warranty deed provides broader protections than a quitclaim deed. Always consult local experts for insights tailored to your region. West USA Realty’s team of professionals can guide you through these intricacies, ensuring your investment is not only profitable but also legally sound.

Strategies for Property Acquisition & Management

Investing in real estate requires a strategic approach to property acquisition and management. A key aspect is securing clear and marketable titles, which can be ensured through the use of a general warranty deed. This legal document provides buyers with protection against potential claims or encumbrances on the property, offering peace of mind and solidifying ownership. When purchasing a property, it’s advisable to engage a professional real estate agent, such as West USA Realty, who can guide investors through the process and ensure all necessary documents are in order, including the warranty deed.

After acquisition, effective property management becomes paramount. This involves tasks like maintaining the property, handling tenant relations, and ensuring rental income is maximized while expenses are minimized. A well-managed investment can generate substantial returns over time. For instance, according to recent market data, residential real estate investments in major urban areas have yielded average annual returns of 10% or more. Regular inspections, prompt repairs, and fair but competitive renting rates are strategies proven to foster positive tenant experiences and long-term property value appreciation.

Another strategic aspect is diversifying the investment portfolio. Real estate investors can mitigate risks by acquiring properties in different locations, targeting varied property types (e.g., residential, commercial), or focusing on niche markets. A diversified portfolio not only spreads risk but also presents opportunities for higher returns during varying economic cycles. When considering a general warranty deed for these diverse investments, it’s essential to consult legal experts who understand the nuances of local real estate laws and can draft or review such documents to ensure they protect the investor’s interests effectively.

Maximizing Returns: Rental Income & Resale Value

Maximizing returns in real estate investing is a delicate balance between generating consistent rental income and achieving substantial resale value. A key strategic element to achieve this is understanding and leveraging the warranty deed, specifically the general warranty deed, which offers broader protections compared to other types. The latter ensures that the title is free from any hidden defects or encumbrances, enhancing the property’s overall value and appeal.

For investors, a general warranty deed provides peace of mind, knowing that they stand behind the property’s title for any unforeseen issues. This assurance can be invaluable in competitive markets where quick flips or long-term rentals are common strategies. For instance, in cities like Phoenix, Arizona—a hub for real estate activity, per West USA Realty—investors who utilize general warranty deeds may find it easier to attract tenants or sell at premium prices. Data from the National Association of Realtors shows that properties with clear titles often command higher selling prices and shorter days on the market, indicating a healthier investment return.

Practical advice for maximizing returns involves thoroughly reviewing any existing deed documents during the due diligence phase. Ensure that the warranty is comprehensive and covers all known and unknown defects. If necessary, employ legal professionals to draft or audit a general warranty deed, minimizing potential risks. This proactive approach can prevent costly title disputes and facilitate smoother transactions, ultimately contributing to better investment outcomes.