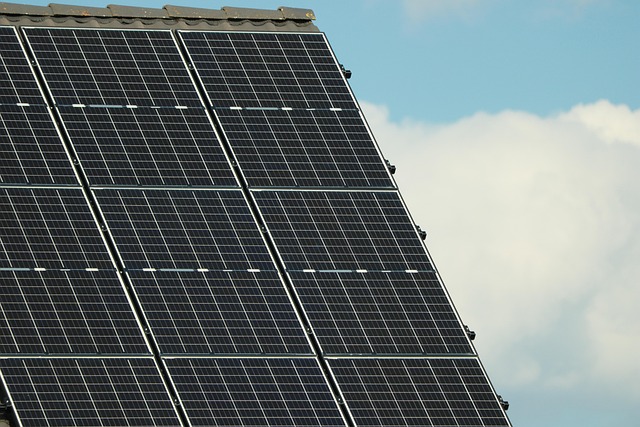

Solar incentives offer real estate professionals significant benefits by offsetting solar panel installation costs, enhancing property value, and attracting eco-conscious buyers/tenants. Key aspects include understanding borrower requirements, assessing eligibility early, staying informed about local and federal grants/rebates, and strategically integrating solar panels during renovations. These incentives maximize savings, promote sustainability, and position professionals as experts in sustainable living.

In today’s rapidly evolving real estate landscape, embracing sustainable practices is not just an environmental imperative but a strategic business decision. Solar incentives have emerged as powerful tools to accelerate the adoption of solar energy in properties, offering significant financial benefits and enhanced property values. However, navigating the complex web of incentives can be a challenge for professionals. This trusted guide aims to demystify solar incentives, providing a comprehensive overview that equips real estate experts with the knowledge needed to capitalize on this natural resource effectively.

Understanding Solar Incentives: A Comprehensive Overview

Solar incentives have emerged as a powerful tool to drive the adoption of solar power among real estate professionals. Understanding these incentives is crucial for both developers and investors looking to navigate this evolving landscape. This comprehensive overview aims to demystify the process, focusing on how solar incentives can be harnessed to benefit various stakeholders in the industry.

The primary driver behind solar incentives is the government’s push for renewable energy integration and sustainable practices. These incentives often manifest as tax credits, rebates, or grants designed to offset the initial installation costs of solar panels. For instance, the federal Solar Tax Credit allows homeowners and businesses to deduct 26% (as of 2023) of eligible solar system costs from their taxable income. Such benefits can significantly reduce the financial barrier for adopting solar energy, making it a more attractive investment option for real estate projects.

When considering solar incentives, it’s essential to understand the borrower requirements attached to these programs. These may include eligibility criteria related to property ownership, system size, and revenue generation potential. For commercial properties, lenders might assess the business’s creditworthiness and cash flow to determine loan eligibility. Developers can leverage data on past projects and market trends to demonstrate the viability of solar integration, thereby meeting borrower requirements and unlocking access to these incentives. Additionally, staying informed about state-specific initiatives is vital, as varying policies can offer unique advantages for different regions.

Real estate professionals should approach solar incentives with a strategic mindset. By carefully evaluating project feasibility, financial projections, and available incentives, developers can make informed decisions that enhance the overall value proposition of their properties. For example, integrating solar panels into new construction projects not only attracts environmentally conscious tenants but also provides long-term cost savings. Furthermore, leveraging these incentives can contribute to achieving sustainability goals, fostering a positive public image, and potentially increasing property values over time.

Navigating Solar Incentive Programs for Real Estate Professionals

Navigating Solar Incentive Programs for Real Estate Professionals requires a strategic approach to unlock significant financial benefits for clients. As solar energy gains traction, understanding these incentives becomes paramount for industry experts. Solar incentives are designed to promote the adoption of renewable energy, and when leveraged effectively, they can substantially enhance the value proposition of real estate properties.

Real estate professionals play a pivotal role in guiding borrowers through this process, ensuring they access available financial support for solar panel installations. One key aspect is recognizing that these programs often come with specific borrower requirements. For instance, many incentives require homeowners to meet certain energy-efficiency standards or demonstrate a viable long-term savings potential. By assessing a property’s eligibility early on, agents can set realistic expectations and help borrowers prepare accordingly. Data from the U.S. Energy Information Administration shows that homes equipped with solar panels have seen average utility bill reductions of 20-30%, making these incentives particularly attractive for prospective buyers or renters.

When assisting clients, professionals should also stay informed about local and federal programs offering grants, rebates, or loan programs with low-interest rates. For example, the federal Investment Tax Credit (ITC) offers a substantial tax credit for solar panel installations, while many states provide additional incentives like property tax exemptions or cash-back rewards. A practical approach is to help borrowers compare these options based on their location and financial situation. Additionally, keeping up with program eligibility criteria is essential as they can change periodically. By staying current on these developments, real estate professionals ensure their clients access the most relevant and lucrative solar incentives available in the market.

Maximizing Savings: Solar Incentives and Their Benefits

Solar incentives have emerged as a powerful tool for maximizing savings and promoting sustainable energy practices within the real estate industry. These incentives, designed to offset the upfront costs of solar panel installation, offer significant benefits both to homeowners and professionals alike. Understanding how these programs work is crucial in navigating the current market dynamics, especially with the increasing popularity of renewable energy solutions.

For real estate professionals, leveraging solar incentives can be a strategic move that enhances property values and attracts environmentally conscious buyers. Many governments and utility companies provide financial incentives, such as tax credits, rebates, or net metering, to encourage the adoption of solar power. For instance, in regions with high electricity costs, installing solar panels can result in substantial long-term savings. Borrowers who meet specific requirements for these programs can enjoy reduced loan interest rates and lower overall borrowing costs, making solar energy a more affordable option. According to a recent study, homes equipped with solar panels have shown an average increase in property value of 2.1% compared to non-solar homes in the same neighborhood.

Maximizing savings through solar incentives requires a thoughtful approach. Professionals should guide clients in evaluating their energy consumption patterns and understanding local incentive programs. Some borrowers may be eligible for grants or low-interest loans, further offsetting installation costs. By staying informed about changing regulations and incentive structures, real estate professionals can position themselves as experts in sustainable living. This knowledge enables them to provide valuable advice, ensuring clients make informed decisions that benefit both their wallets and the environment.

Implementing Solar Power: Strategies for Successful Real Estate Deals

Implementing solar power can significantly enhance the value and sustainability of real estate properties, making it a strategic must for professionals in the industry. When advising clients or managing deals, real estate experts should consider solar incentives as a key component in their strategies. These incentives, often in the form of tax credits, rebates, and grants, are designed to offset the initial installation costs, making solar energy more accessible and attractive to borrowers. For instance, the federal Solar Tax Credit allows homeowners to deduct 26% of qualified expenses from their taxable income, with no cap on the credit amount for 2022.

A deep understanding of these solar incentives is crucial when assisting clients in navigating the borrower requirements. Real estate professionals should guide their customers through the application processes and help them leverage available funds. For commercial properties, the U.S. Department of Energy’s Office of Energy Efficiency & Renewable Energy offers various financing options and grants to encourage the adoption of solar technologies. These incentives not only provide financial benefits but also contribute to a property’s long-term sustainability, appealing to eco-conscious buyers and tenants.

When structuring deals, professionals can strategically time the implementation of solar power systems to maximize savings. For example, when a property is up for renovation or a major upgrade, integrating solar panels can be cost-effective. Many states also offer expedited permit processes for renewable energy projects, further streamlining the installation process. By staying updated on local and federal incentives, real estate experts can advise clients on the best timing to invest in solar, ensuring they stay ahead of the curve in a rapidly evolving market.