Understanding Buyer's Agent Agreements is key to transparent real estate transactions. These agreements detail realtor closing costs, which include fees (1%-3% of purchase price), appraisal fees, title search/insurance, and administrative expenses. Early discussion and comparison of rates from different agents ensure fair distribution based on market norms. In Arizona, closing costs for a $400,000 home can range up to $12,000, with agent fees between $4,000 and $12,000. Transparency from agents ensures clients are aware of all charges before signing, facilitating smoother transactions.

In the complex world of real estate transactions, understanding realtor closing costs is paramount for both buyers and sellers. As property markets continue to evolve, ensuring a transparent and cost-efficient process has become increasingly crucial. The Buyer’s Agent Agreement plays a pivotal role in this, serving as a strategic tool to mitigate unexpected expenses and protect buyer interests. This article delves into the intricacies of this agreement, providing an authoritative guide that elucidates its key provisions and demonstrates how it can significantly reduce realtor closing costs, fostering a more equitable and informed real estate experience.

- Understanding Buyer's Agent Agreement Basics

- Negotiating Terms: Costs and Realtor Obligations

- Finalizing the Contract: Closing Costs Explained

Understanding Buyer's Agent Agreement Basics

Understanding Buyer’s Agent Agreement Basics

When purchasing a home, engaging a real estate agent is a significant step towards achieving your dream property. However, navigating the complexities of realtor closing costs and associated agreements can be daunting for many buyers. Herein lies the importance of comprehending the Buyer’s Agent Agreement—a pivotal document that outlines the terms and expectations between the buyer and their representative. This agreement ensures transparency and protects both parties from potential disputes related to fees and commissions.

A typical Buyer’s Agent Agreement details the agent’s responsibilities, including market analysis, property search, negotiation support, and guidance throughout the transaction process. Moreover, it clarifies fee structures, which often include a commission based on a percentage of the final purchase price. For instance, real estate agent fees at closing can range from 1% to 3% of the total cost, varying based on market conditions and the agent’s level of expertise. It’s crucial for buyers to be aware that these fees are distinct from other realtor closing costs, such as title search fees, appraisal costs, or any inspection expenses.

In Arizona, West USA Realty prioritizes open communication regarding fee structures. We believe in demystifying realtor closing costs to empower our clients. By providing clear and comprehensive agreements, we ensure buyers fully understand their financial obligations. This approach fosters trust and strengthens the client-agent relationship, ultimately leading to a smoother real estate transaction. As such, buyers should actively engage with their agents to discuss any concerns regarding fees and commissions, ensuring a mutually beneficial arrangement.

Negotiating Terms: Costs and Realtor Obligations

Negotiating the terms of a Buyer’s Agent Agreement is a critical step in any real estate transaction, as it sets clear expectations for both the client and the realtor. One of the most crucial aspects to focus on during this negotiation process is understanding and agreeing upon the costs involved—realtor closing costs and real estate agent fees at closing. These expenses can vary widely depending on market conditions, the complexity of the deal, and the specific agreement between buyer and agent.

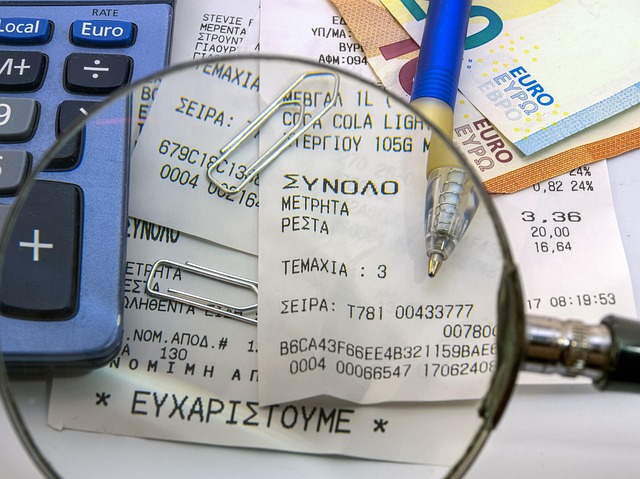

Realtor closing costs encompass a range of charges that are typically paid by the buyer or seller upon successful completion of a real estate transaction. Examples include appraisal fees, title search costs, and various administrative fees associated with processing the transaction. According to recent industry data, these costs can average around 2-5% of the purchase price for residential properties, though they may be higher in competitive markets. It’s essential that buyers are well-informed about these expenses and have a clear understanding of how they will be paid, as negotiating these terms upfront can prevent unexpected financial surprises later.

West USA Realty, a leading real estate firm, advises clients to discuss realtor closing costs early in the process. By doing so, both parties can align on expectations and ensure that any associated fees are fairly distributed based on market norms. Furthermore, buyers should inquire about potential concessions or cost savings offered by sellers, especially if they are paying cash or have a strong financial position. For instance, some real estate agents may negotiate lower closing costs in exchange for a higher commission rate at closing, which can range from 1% to 3% of the sales price, depending on local market practices and the agent’s expertise.

In terms of practical advice, buyers should aim to get a detailed breakdown of estimated realtor closing costs before signing any agreement. This transparency allows them to factor these expenses into their budget and potentially adjust their financing plans accordingly. Additionally, it’s wise to compare real estate agent fees at closing offered by different agents to ensure competitive rates without compromising the level of service provided. By being proactive in negotiating these terms, buyers can not only manage their financial outlay but also establish a collaborative relationship with their realtor, fostering a successful partnership throughout the entire real estate journey.

Finalizing the Contract: Closing Costs Explained

When finalizing a Buyer’s Agent Agreement, understanding the various realtor closing costs is paramount. These expenses extend beyond the initial purchase price, encompassing a suite of fees that can significantly impact your overall real estate transaction. West USA Realty experts emphasize transparency in these charges to ensure clients are fully informed.

Commonly incurred realtor closing costs include appraisal fees, which assess the property’s value; title search and insurance premiums, covering potential ownership disputes; and various administrative expenses related to document preparation and recording. Additionally, real estate agent fees at closing can range from 1% to 3% of the purchase price, negotiable based on market conditions and services rendered. These fees cover the agent’s time, expertise, and marketing efforts throughout the buying process.

For instance, in Arizona, average realtor closing costs for a $400,000 home might total around $5,000 to $12,000, with real estate agent fees ranging from $4,000 to $12,000. Such variances underscore the importance of meticulous budgeting and clear communication with your agent. West USA Realty’s commitment to transparency ensures clients understand every fee before signing, allowing for informed decisions that align with their financial goals.

To mitigate unexpected costs, we recommend reviewing all estimated charges thoroughly. Discuss any concerns with your realtor, who should be prepared to break down each itemized expense. Proactive communication and a thorough understanding of realtor closing costs can significantly enhance the smooth execution of your real estate transaction.