Understanding FHA Loans is crucial for real estate sellers aiming to navigate today's market. These loans offer lower down payments (3.5%) but come with Mortgage Insurance Premium (MIP) costs, affecting pricing and overall expenses. Sellers must meet property standards, disclose issues transparently, and budget for additional fees like appraisal and legal costs. By mastering FHA loan requirements and costs, sellers can attract a wider buyer base and facilitate transactions in a competitive market.

In today’s competitive real estate market, understanding financing options is paramount for both buyers and sellers. Among the myriad of loan types, FHA loans stand out as a powerful tool for sellers, offering accessibility and favorable terms. However, navigating these government-backed loans can be complex. This article provides an in-depth analysis tailored for professional sellers, demystifying the FHA loan process with practical insights. We’ll explore key aspects, from eligibility criteria to closing costs, empowering you to make informed decisions that drive successful transactions. By the end, you’ll grasp how FHA loans can streamline your selling journey.

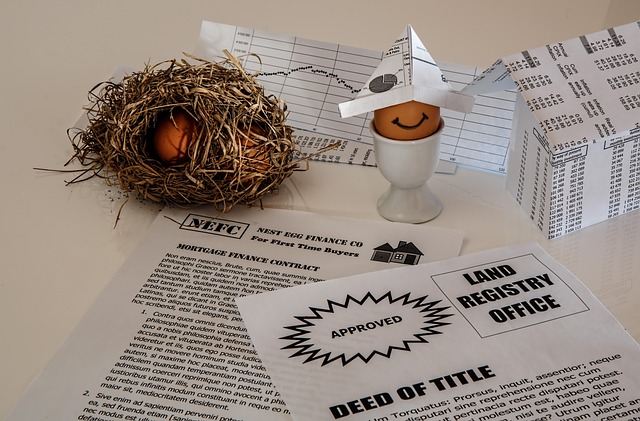

Understanding FHA Loans: A Basic Guide for Sellers

Understanding FHA Loans is a crucial aspect of real estate for sellers, especially in today’s competitive market. An FHA loan, or Federal Housing Administration loan, is designed to make homeownership more accessible by providing financing to buyers who may not qualify for traditional mortgages. This type of loan offers several advantages for first-time homebuyers and those with limited funds, but it also comes with certain requirements and costs that sellers should be aware of.

One key feature of FHA loans is their low down payment requirement, typically just 3.5% of the purchase price. This can significantly reduce the upfront costs for buyers, making homeownership more attainable. However, this also means sellers might face a higher risk of default since the buyer’s financial commitment is relatively lower. To mitigate this risk, the FHA introduces Mortgage Insurance Premium (MIP). The MIP cost can vary but is generally 1.75% of the loan amount for most borrowers and is paid in two parts: an upfront payment at closing, and annual payments throughout the life of the loan. For example, if a buyer purchases a home for $200,000 with a 3.5% down payment, they would pay an initial MIP of $3,500 plus ongoing annual payments.

Sellers should be prepared for these additional costs when working with FHA loan buyers. It’s essential to understand that while the lower down payment can attract more potential buyers, it may also result in higher insurance expenses. When listing a property, sellers can strategically price their homes to account for these extra costs, ensuring a fair deal for both parties. By being well-informed about FHA loans and their associated fees, sellers can effectively navigate this market segment and contribute to a successful transaction.

Eligibility Criteria: Who Qualifies for FHA Financing?

The Federal Housing Administration (FHA) loan program offers an attractive option for sellers looking to enter the real estate market. While eligibility criteria can vary based on location and market conditions, understanding who qualifies for FHA financing is essential. These loans are designed to promote homeownership and provide a path for prospective buyers who might not meet conventional lending standards. Sellers should know that FHA loans have specific requirements regarding credit history, down payments, and property types, ensuring these properties meet certain safety and quality guidelines.

To qualify, borrowers typically need a minimum FICO score of 580 for a 3.5% down payment. Higher scores open doors to lower interest rates and more favorable loan terms. It’s important to note that while FHA loans are more flexible than conventional loans, they require a mortgage insurance premium (MIP), which can add to the overall cost. The MIP is typically 1.75% of the loan amount for a term of 15 years or less, and 0.85% for loans above $625,000, up to 30 years. For example, a buyer purchasing a $250,000 home would pay around $4,375 in upfront MIP, representing approximately 1-3% of the purchase price, depending on the loan size and term.

Sellers should also be aware that properties must meet FHA property standards. This includes structural integrity, safe living conditions, and compliance with local building codes. An FHA-approved lender will conduct an inspection to ensure the property meets these criteria before finalizing the loan. By understanding these eligibility guidelines, including MIP costs, sellers can effectively position their homes in the market, attracting a broader range of buyers who may rely on FHA financing.

The Benefits of FHA Loans: Advantages for Home Sellers

For home sellers navigating the complex landscape of mortgage financing, FHA loans stand out as a powerful tool offering significant advantages. These government-backed mortgages, insured by the Federal Housing Administration (FHA), provide an attractive option for borrowers who may have struggled to qualify for conventional loans due to credit issues or higher debt-to-income ratios. By understanding the benefits of FHA loans, sellers can make informed decisions and position themselves for a smoother selling process.

One of the key advantages lies in the reduced stringent requirements. FHA loans are known for their more lenient criteria, especially regarding credit scores and down payments. This is particularly beneficial for first-time home buyers or sellers with less-than-perfect credit histories. For instance, whereas conventional loans often mandate a 20% down payment, FHA loans can require as little as 3.5%, making homeownership more accessible. Additionally, these loans offer flexibility in terms of loan limits, allowing borrowers to secure larger sums for property acquisition.

The cost considerations associated with FHA loans are also worth noting. The mortgage insurance premium (MIP) attached to FHA loans is typically lower compared to private mortgage insurance (PMI) on conventional loans. In many cases, this can result in substantial savings over the life of the loan, especially for borrowers who plan to stay in their homes for an extended period. According to recent data, the average annual cost of MIP for an FHA loan is approximately 1-3 times lower than PMI, making it a more economical choice for many sellers. This financial advantage, coupled with the accessibility and flexibility they offer, positions FHA loans as an attractive option for those looking to sell their properties in today’s competitive real estate market.

Loan Process Demystified: Steps to Secure an FHA Loan

Securing an FHA loan can be a crucial step for sellers looking to navigate the real estate market with confidence. This government-backed mortgage program offers flexibility and accessibility, but understanding the process is essential for a successful transaction. Let’s demystify the steps involved in obtaining an FHA loan, providing a clear roadmap for both seasoned and first-time sellers.

The journey begins with pre-approval, where sellers demonstrate their financial readiness. This involves providing detailed financial information to a lender, who will assess income, assets, and creditworthiness. Pre-approval not only gives sellers a competitive edge but also provides valuable insights into the loan amount they can afford. For instance, an FHA loan requires a minimum down payment of 3.5%, making pre-approval critical in qualifying for the best terms. Sellers should aim to improve their credit scores, as it directly impacts the interest rate and overall loan cost. According to recent data, a higher credit score can result in savings of hundreds or even thousands of dollars over the life of the loan.

Once pre-approved, sellers can start actively shopping for a property within their budget. During this phase, they’ll work closely with a real estate agent to find suitable options. An important consideration is the Mortgage Insurance Premium (MIP), a requirement for FHA loans. The initial MIP cost is typically 1% of the loan amount at closing and may be rolled into the mortgage. However, sellers should be aware that subsequent policy premiums can vary based on loan-to-value ratios—a higher loan-to-value ratio will result in a higher MIP cost, potentially adding 0.5% to 1% of the loan balance over 20 years (on average). As such, it’s crucial to explore options and work with a lender who can offer competitive rates and fees.

The loan process involves several key steps, including application submission, documentation verification, credit check, property appraisal, and final approval. Sellers should be prepared to provide extensive documentation, such as tax returns, bank statements, and pay stubs. A thorough understanding of this process empowers sellers to manage expectations and make informed decisions regarding their real estate journey.

Property Preparation: Ensuring FHA Approval for Your Home

Preparing your property for an FHA loan is a crucial step to ensure smooth selling and secure approval. The Federal Housing Administration (FHA) loan program offers attractive options for home sellers, especially in today’s competitive market. However, understanding what the FHA requires can be intricate. One of the key aspects that often demands attention is property preparation, which goes beyond typical home staging. This process involves addressing various factors to meet the FHA’s standards and avoid potential delays or denials.

A significant component of this preparation is ensuring your home’s condition aligns with the FHA’s guidelines for safety and quality. This includes conducting necessary repairs, replacing outdated fixtures, and improving overall livability. For instance, fixing a leaky roof, updating electrical systems to modern standards, and enhancing fire safety measures are essential. These improvements not only increase the property’s value but also mitigate potential risks that could lead to loan denial or additional costs post-closing. It’s important to note that sellers should aim for substantial enough updates to warrant a higher sales price, which can help offset the FHA loan mip cost (Mortgage Insurance Premium) of 1-3% of the loan amount, as required by the program.

Additionally, property preparation involves documenting and disclosing any existing issues. Sellers must be transparent about potential red flags like water damage, structural problems, or environmental concerns. Promptly addressing these matters demonstrates good faith and reduces the likelihood of unexpected complications during the FHA loan process. Remember, an honest assessment and timely repairs can save sellers from costly surprises and ensure a smoother transition to homeownership for buyers.

Closing Costs and Beyond: Navigating the Financial Landscape

Navigating the financial landscape surrounding an FHA loan is crucial for sellers, especially when considering closing costs. While these loans offer significant advantages in terms of down payment requirements and flexible credit standards, understanding the associated expenses is essential. The Federal Housing Administration (FHA) loan program has evolved to support first-time homebuyers, but it’s important to recognize that borrowers are still responsible for various fees. One key aspect to consider is the FHA loan mip cost, which can vary from 1% to 3% of the loan amount and is paid monthly throughout the life of the mortgage. This cost, known as Mortgage Insurance Premium (MIP), serves as a protection mechanism for lenders in case of default.

For sellers, budgeting for these additional expenses is vital. Closing costs typically include appraisal fees, title search charges, and various legal fees, on top of the MIP. To provide context, the average closing cost for an FHA loan can range from 2% to 5% of the purchase price, depending on market conditions and individual circumstances. For a $300,000 home, this could equate to $6,000 to $15,000 in total fees. Sellers should plan accordingly and consider negotiating certain fees with their lenders or real estate agents to mitigate these costs.

Moreover, understanding the long-term implications of an FHA loan is practical advice for sellers. While the initial lower down payment requirements make homeownership more accessible, the MIP remains a consistent expense. It’s essential to weigh this cost against other mortgage options and consider how it fits within your long-term financial plans. With proper preparation and knowledge, sellers can successfully navigate these financial aspects of an FHA loan, ensuring a smoother transition into homeownership.