A comprehensive plan is vital for first-time homebuyers to successfully navigate the mortgage process. This involves assessing financial health, understanding lender requirements, defining budget, researching local closing costs, comparing mortgage rates, pre-approving a loan, and strategically searching for homes based on both appeal and essential factors like safety and amenities. The plan guides informed decisions, ensuring emotional readiness alongside financial stability for this significant life change.

In the competitive real estate market, first-time homebuyers often face a daunting journey fraught with uncertainties. Navigating financial complexities, understanding legal requirements, and comprehending the vast array of choices can be overwhelming. This educational guide aims to empower newcomers by offering a comprehensive plan, tailored to their unique needs. We will dissect the process step-by-step, from pre-approval to move-in, ensuring a smooth transition into homeownership. By the end, readers will possess the knowledge and confidence to embark on this significant chapter with clarity and assurance.

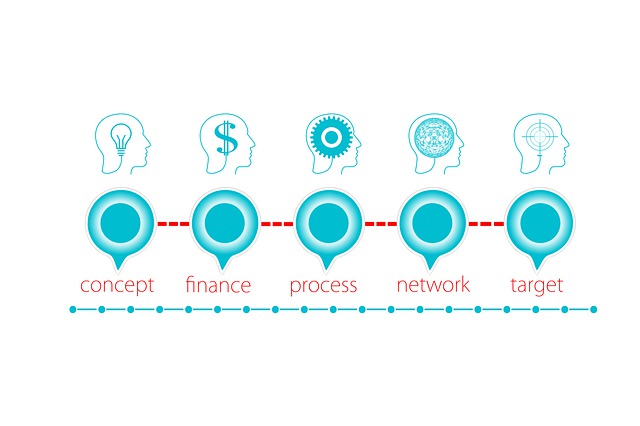

Understanding Your Home Buying Journey: A Comprehensive Plan

Understanding Your Home Buying Journey: A Comprehensive Plan is essential for first-time borrowers to navigate the complex process with confidence. The journey begins with assessing your financial health and understanding borrower requirements. Lenders typically assess your credit score, debt-to-income ratio, and employment stability. For instance, a FICO score above 740 and a low debt-to-income ratio enhance your chances of securing favorable loan terms.

Next, define your budget and set realistic expectations. Consider not only the down payment but also closing costs, which can vary widely. Researching average closing costs in your area provides a benchmark. Additionally, explore different mortgage options tailored to your needs. Fixed-rate mortgages offer stability while adjustable-rate mortgages (ARMs) initially provide lower interest rates. A comprehensive plan includes comparing rates from multiple lenders to ensure you’re getting the best deal.

Pre-approval is a critical step before searching for homes. It involves providing financial documentation to a lender who verifies your borrower requirements. This not only gives you a clear idea of your budget but also makes your offers more competitive. A study by the National Association of Realtors revealed that pre-approved buyers were 73% more likely to purchase a home within the next 60 days compared to those without pre-approval.

Once pre-approved, actively search for properties matching your criteria. Engage with a reputable real estate agent who can guide you through the process. During viewings, consider factors beyond the property’s appeal. Assess neighborhood safety, school districts, and proximity to amenities. Remember, a comprehensive plan involves making an informed decision that aligns with your long-term goals and financial stability.

Research and Preparation: Laying the Foundation for Success

For first-time homebuyers, the journey towards securing a home can be both exhilarating and daunting. A well-executed comprehensive plan, built upon thorough research and preparation, is the bedrock of success in this endeavor. This involves understanding not just the financial aspects but also the legal, market, and personal considerations that shape your future living environment.

Research and Preparation serve as the cornerstone of any successful home buying journey. It’s a crucial phase where borrowers lay the foundation for their financial stability and long-term satisfaction with their purchase. A comprehensive plan in this stage involves several key steps. First, evaluate your financial position by assessing savings, income, and existing debts. This step is vital as it determines your budget and helps identify potential challenges like down payment requirements or mortgage affordability. For instance, according to recent data, a 20% down payment is often recommended to avoid private mortgage insurance (PMI), which can significantly impact overall costs.

Next, educate yourself about the real estate market in your desired location. Stay informed about property trends, average home prices, and neighborhood dynamics. This knowledge empowers you to make sensible offers and navigate negotiations effectively. Additionally, pre-approval for a mortgage is an essential part of preparation. It not only provides a clear understanding of borrowing power but also signals to sellers that you are a serious buyer committed to the process. A comprehensive plan borrower requirements include ensuring your credit score is in a healthy range, as it directly influences interest rates and loan terms offered by lenders.

Beyond financial considerations, prepare emotionally and mentally for the transition. Buying a home is a significant life change, so addressing any personal concerns or doubts is crucial. Engage in open dialogue with your family or support system to ensure everyone understands and supports this milestone decision. This phase of preparation fosters a sense of calm amidst the excitement, enabling you to approach the home-buying process with clarity and confidence.

Navigating the Market: Strategies for First-Time Buyers

Navigating the housing market as a first-time buyer can be an exciting yet daunting endeavor. A comprehensive plan is essential to ensure a smooth journey from initial search to successful purchase. This involves understanding your financial position, defining preferences, and employing strategic approaches to find the right property at a favorable price.

One of the primary steps in any comprehensive plan for borrower requirements is evaluating your financial health. Lenders will assess your income stability, debt levels, and credit score to determine loan eligibility and terms. Maintaining a strong credit profile by paying bills on time and keeping credit card balances low can significantly improve borrowing power. It’s also wise to save for a down payment; typically, 20% of the property price is recommended, though some programs offer lower requirements. A larger down payment not only reduces the amount borrowed but often results in better interest rates over time.

Researching the market and setting realistic expectations are crucial. Analyze neighborhood trends, compare property values, and identify emerging areas with potential growth. This knowledge will help when making offers. For instance, understanding local market dynamics can reveal undervalued properties or areas poised for development. Additionally, defining must-haves versus nice-to-haves in terms of features and location streamlines the search process. A well-informed borrower is better equipped to navigate negotiations and secure a favorable deal, adhering to their comprehensive plan borrower requirements throughout.