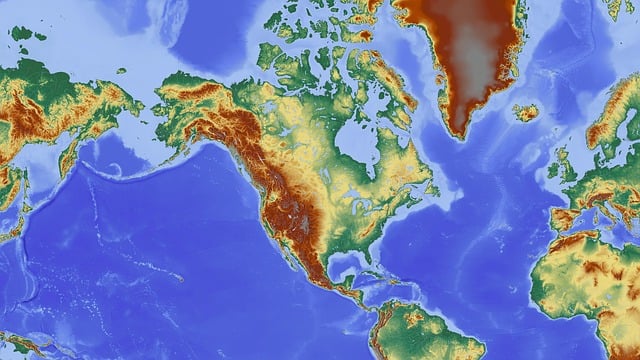

Understanding a floodplain map is crucial for property buyers, especially in high-risk areas. These maps, based on historical data and geographic features, identify zones prone to flooding, with specific determinations of 100-year and 500-year floodplains. Lenders use them to dictate mortgage eligibility and mandatory insurance requirements, like federal flood insurance for high-risk properties. Reviewing the map beforehand enables buyers to assess risk levels and secure appropriate loan terms. Consulting local experts and scrutinizing annotations is essential for informed decision-making. Floodplain maps guide zoning regulations, building designs, and mitigation strategies to ensure safety standards in high-risk zones. Mandatory flood insurance protects investments, even in low-to-moderate risk areas. By understanding these considerations, borrowers can navigate floodplain purchases effectively.

Floodplains pose a significant risk to property buyers, often overlooked until it’s too late. Navigating the complexities of these areas demands a detailed understanding of floodplain maps—essential tools for assessing risk. However, deciphering these maps can be challenging for many. This comprehensive report aims to demystify floodplain maps, providing an authoritative guide tailored for prospective buyers. We’ll break down key elements, explain common terminologies, and offer practical insights to ensure informed decisions when purchasing property in flood-prone areas. By the end, readers will possess the knowledge needed to confidently navigate this critical aspect of real estate transactions.

Understanding Floodplain Maps: A Basic Guide for Buyers

When considering purchasing property, especially in areas prone to flooding, understanding a floodplain map is crucial for informed decision-making. A floodplain map is a detailed tool that identifies zones at risk of flooding based on historical data and geographic features. For homebuyers, these maps offer vital insights into potential risks associated with the property and surrounding area.

These maps visually represent low-lying areas susceptible to inundation from rivers, streams, or coastal waters during severe weather events. They are created by combining topographical information with flood history data, allowing for precise determination of 100-year and 500-year floodplains. Lenders and borrowers alike should pay close attention to these maps as they have significant implications for mortgage eligibility and insurance requirements. The floodplain map borrower requirements often dictate the type of loan a buyer can access and the level of flood insurance coverage needed. For instance, properties located within a 100-year flood zone typically demand more stringent lending standards and mandatory purchase of federal flood insurance.

The process involves reviewing the map to assess the property’s distance from water bodies and its topographical features. If the land falls within a designated floodplain, lenders will require additional documentation and may offer adjusted loan terms or products suitable for high-risk areas. Understanding these requirements beforehand empowers buyers to approach their search with awareness and ensures they can navigate the floodplain map borrower requirements successfully while securing financing for their new home.

Interpreting Your Local Map: What to Look For

When considering a property purchase, especially in areas prone to flooding, understanding your local floodplain map is crucial for informed decision-making. These maps, meticulously created by regulatory agencies, serve as a vital tool to assess flood risks and guide development within a region. As a prospective buyer or borrower, interpreting this data is essential to ensure you’re making a sound investment and adhering to necessary regulations. The floodplain map provides critical insights into the historical and potential flood zones, offering valuable information for both new constructions and renovations.

Examining your local map, look for detailed annotations identifying specific areas as either in or outside of the floodplain. These maps typically utilize color-coding or shading to represent different risk levels—from low-risk areas to those at highest susceptibility to flooding events. Pay close attention to the watercourse markings, which indicate rivers, streams, and other bodies of water that have historically experienced overflow during severe weather conditions. Understanding these features is key to gauging potential risks. For instance, a property near a map-marked stream might require specific measures to mitigate flood damage, such as elevated construction or advanced drainage systems.

Moreover, familiarizing yourself with the floodplain map borrower requirements early in the process can streamline your financing. Lenders and mortgage underwriters often use these maps to evaluate risk and determine lending terms. Some areas may have stricter regulations due to higher flood risks, potentially influencing loan amounts, interest rates, or even insurance requirements. Being proactive by scrutinizing the map and consulting with local experts can help borrowers prepare for potential challenges and secure the best financing options available in their region.

Assessing Risk: Analyzing Flood History and Data

When considering a property purchase, especially in areas prone to flooding, understanding the floodplain map is crucial for borrowers. Assessing risk through a meticulous analysis of historical and current data allows lenders and buyers alike to make informed decisions. The floodplain map serves as a critical tool in this evaluation process, illustrating high-risk zones where flooding has occurred in the past or poses an ongoing threat.

By examining comprehensive datasets including historical flood events, river flow rates, topography, and climate change projections, experts can identify areas likely to experience flooding under various scenarios. For instance, data from recent years might reveal recurring floodplain areas, prompting a closer look at these sites’ vulnerability and the potential impacts on future owners. This analysis becomes increasingly vital as climate change contributes to more frequent and severe weather events.

Lenders often require borrowers to conduct thorough due diligence when purchasing properties in flood-prone regions. The floodplain map borrower requirements typically involve assessing the property’s location relative to these maps, understanding local zoning regulations regarding flood risks, and evaluating structural measures that could mitigate potential damage. It is advisable for buyers to consult with professionals who specialize in this field to interpret data accurately and consider all relevant factors before making a decision.

Legal Implications: Zoning Regulations and Insurance Requirements

The acquisition of a property located within a floodplain presents unique legal considerations for prospective buyers, particularly when navigating zoning regulations and insurance requirements. A detailed understanding of these aspects is crucial for informed decision-making, as it can significantly impact financial outcomes and long-term property ownership. The primary tool in this process is the floodplain map, which serves as an indispensable resource for both lenders and borrowers alike. This map identifies areas prone to flooding, guiding zoning authorities in enforcing regulations that mitigate potential risks.

Zoning regulations play a pivotal role in managing land use within flood-prone regions. These rules dictate permitted land uses, building designs, and construction practices, ensuring compliance with safety standards. For instance, certain zoning ordinances may restrict building heights or prohibit specific structures in high-risk zones to minimize the impact of potential floods. Borrowers intending to construct or renovate properties in these areas must adhere to these regulations, often requiring specialized engineering solutions to meet code requirements. The floodplain map borrower requirements extend beyond construction, influencing property development and renovation plans to ensure compliance with local zoning laws.

Insurance is another critical aspect affected by the location of a property on a floodplain. Lenders typically mandate flood insurance for borrowers in high-risk zones as a safeguard against financial loss. These policies are designed to cover damages caused by flooding events, offering peace of mind and financial protection. However, it’s essential for borrowers to understand that standard home insurance policies generally do not cover flood damage, making dedicated flood insurance mandatory. Recent data from the National Flood Insurance Program (NFIP) indicates a significant increase in flood insurance claims in low-to-moderate-risk zones, reflecting the growing importance of this coverage. Borrowers should thoroughly review their insurance options and policy terms to ensure adequate protection for their investment.

Protecting Your Investment: Mitigation Strategies and Resources

When considering a property purchase, especially in areas prone to flooding, understanding your location’s floodplain map is crucial for protecting your investment. This detailed guide aims to empower borrowers with insights into navigating these maps and implementing effective mitigation strategies. The floodplain map serves as a critical tool for assessing flood risks, guiding development practices, and ensuring the safety of communities. It categorizes areas based on their susceptibility to flooding, providing essential information for prospective buyers and lenders.

For instance, in regions like coastal areas or regions with significant rainfall, a borrower might find that parts of their desired property fall within a Special Flood Hazard Area (SFHA), as designated by the Federal Emergency Management Agency (FEMA). This classification indicates high flood risk, prompting borrowers to explore mitigation measures before purchasing. One such strategy involves elevating critical structures above potential flood levels, ensuring the safety and integrity of the property. Many resources are available to assist borrowers in understanding these requirements; FEMA offers detailed guidelines and tools to help lenders and buyers navigate SFHA-related regulations. Additionally, consulting with local building departments and engineers can provide tailored advice for specific properties.

Another aspect to consider is insurance coverage. Lenders often require flood insurance for properties located in high-risk areas, as highlighted by the floodplain map. This insurance protects against financial losses stemming from flooding events, a crucial step in mitigating risks associated with such locations. Moreover, borrowers can explore additional resources like the National Flood Mitigation Program (NFMP), which offers grants and loans to implement flood protection measures, further enhancing the resilience of their investment. By proactively addressing these considerations, borrowers can make informed decisions, ensuring their properties remain secure and valuable assets despite potential floodplain challenges.