Energy efficiency ratings are reshaping borrowing strategies globally, driven by sustainability goals and cost savings. Standardized labels like Energy Star simplify comparisons, appealing to consumers seeking eco-friendly options. Lenders incorporate these ratings to meet demand for green choices while managing energy cost risks. Government policies incentivizing energy efficiency further enhance their value. A US study shows 20-30% energy reduction in efficient homes. Investors in commercial real estate use analytics to assess properties' operational efficiency. Borrowers must integrate energy efficiency into risk assessments and decision-making, aligning with global sustainability goals. Standardized ratings systems like ENERGY STAR promote informed spending and drive sustainable practices. In the future, energy efficiency ratings will heavily influence loan assessments, encouraging responsible energy consumption and favorable terms for eco-conscious borrowers.

In today’s economically conscious landscape, understanding energy efficiency ratings is not just an environmental imperative but a strategic necessity for borrowers. These ratings play a pivotal role in guiding individuals and entities towards cost-effective and sustainable borrowing decisions. However, navigating the current trends in energy efficiency can be challenging. This article aims to demystify this process, providing an authoritative guide on how energy efficiency ratings shape borrower strategies in real-world applications. By examining recent developments, we offer valuable insights that empower informed decision-making.

Understanding Energy Efficiency Ratings: The Basics

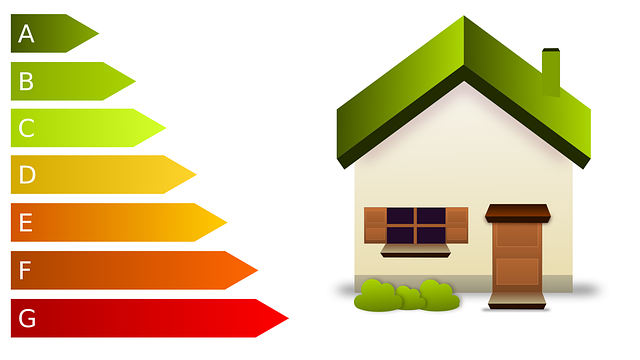

Energy efficiency ratings have emerged as a crucial component of borrowers’ strategic decision-making process, especially given the current global emphasis on sustainability and cost savings. Understanding these ratings involves grasping how they quantify the energy performance of various products and systems, allowing consumers to make informed choices that benefit both their pockets and the environment. At their core, energy efficiency ratings compare the amount of energy a device or appliance consumes relative to its output or functionality, expressed as a numerical score or grade.

These comparisons are often facilitated through standardized labels or certifications, such as Energy Star in North America or A++ in Europe, which provide a quick reference for consumers seeking high-efficiency options. For instance, when comparing two refrigerators, an Energy Star-rated model might use 20% less energy than its non-rated counterpart, indicating significant potential savings over time. This transparency empowers borrowers to prioritize energy efficiency as a key performance indicator, aligning with broader trends towards sustainable financing and green lending.

By incorporating energy efficiency ratings into their evaluation criteria, lenders not only cater to growing consumer demand for eco-friendly options but also mitigate risks associated with fluctuating energy costs. Data suggests that energy-efficient loans often have lower default rates due to the inherent stability of the underlying assets’ operational costs. Moreover, as governments worldwide implement policies incentivizing energy efficiency, these ratings become increasingly valuable tools for borrowers seeking competitive financing terms and long-term cost savings. Understanding and actively considering energy efficiency ratings is, therefore, a strategic imperative for both lenders and borrowers in today’s market landscape.

Current Trends in Energy Efficiency: Global Impact

The global push for sustainability has significantly influenced the borrowing landscape, with energy efficiency ratings becoming a pivotal factor in borrowers’ strategies. Current trends reveal a growing awareness of energy conservation, driving a shift towards more eco-conscious financial decisions. As governments and institutions worldwide prioritize renewable energy sources, borrowers are increasingly scrutinizing energy efficiency ratings to gauge the environmental impact of their investments. This trend is particularly evident in the housing sector, where lenders are now incorporating energy-efficient metrics into their assessment processes. For instance, a comparison study between traditional and energy-efficient homes in the US showed a substantial 20-30% reduction in energy consumption over five years, translating to lower utility costs for borrowers.

The impact of these ratings extends beyond individual borrowers. Energy efficiency comparisons have become a critical tool for investors as well. Commercial real estate investors, for instance, are now employing advanced analytics to assess the operational efficiency of properties. By analyzing energy usage data and comparing it across similar buildings, investors can make informed decisions about which assets offer the best environmental returns. This approach not only reduces carbon footprints but also enhances long-term financial sustainability, especially in light of rising energy costs. As such, borrowers and investors alike are becoming more discerning, demanding detailed energy efficiency disclosures to facilitate transparent comparisons.

Furthermore, global initiatives like the Paris Agreement have accelerated the adoption of stringent energy efficiency standards. These international frameworks encourage countries to set targets for reducing greenhouse gas emissions, which indirectly influences borrowing trends. Many countries are now offering incentives and subsidies for borrowers who invest in energy-efficient technologies, further emphasizing the importance of these ratings. As a result, borrowers must adapt their strategies by integrating energy efficiency into their risk assessment and decision-making processes. This proactive approach ensures that financial decisions align with global sustainability goals, fostering a more responsible borrowing culture.

Borrower Strategies: Leveraging Efficiency for Savings

In today’s energy-conscious landscape, borrowers are increasingly strategic in their approach to financing, with a keen eye on one key metric: energy efficiency ratings. These ratings serve as a powerful tool for lenders and borrowers alike, offering insights into the potential cost savings and environmental benefits of various projects or assets. Borrowers leveraging this data can make informed decisions that align with both financial goals and sustainability objectives.

When considering loans or investments, comparing energy efficiency ratings is paramount. For instance, let’s look at a hypothetical scenario involving two similar properties. Upon evaluation, Property A boasts an Energy Star rating of 4.5 out of 5, indicating superior energy performance compared to 70% of similar buildings. Conversely, Property B has a less impressive score of 2.8, placing it in the bottom 30%. This stark contrast translates into real-world savings; Property A may realize up to 30% lower utility costs annually, making it an attractive option for borrowers seeking long-term financial benefits. Such ratings comparison enables borrowers to make strategic choices, ensuring investments not only secure but also financially prudent.

Experts suggest that borrowers should demand energy efficiency information during the loan application process. This proactive approach allows for a detailed analysis of potential savings and repayment capabilities. For example, a borrower considering a renewable energy system upgrade can request an estimate of monthly savings alongside the loan terms. By integrating energy efficiency ratings into financial planning, individuals and businesses alike can navigate the market with confidence. Moreover, as regulatory bodies mandate more stringent energy standards, staying informed about these ratings becomes crucial for borrowers to stay ahead in a rapidly evolving industry.

Rating Systems: Standardization and Consumer Protection

Energy efficiency ratings have emerged as a powerful tool shaping borrowers’ strategies across various sectors today. Standardization of rating systems plays a pivotal role in this process, offering both consumer protection and informed decision-making advantages. A uniform energy efficiency rating system allows consumers to compare products or services directly, facilitating an evidence-based approach to spending. For instance, the ENERGY STAR program in North America provides a standardized metric for evaluating the energy performance of buildings, appliances, and electronics, enabling consumers to identify high-efficiency options easily.

This standardization is crucial for fostering trust among borrowers. When ratings are consistent across similar products or services, individuals can make more reliable comparisons without delving into intricate technical specifications. A clear, universally accepted rating system builds confidence in the efficiency claims of manufacturers, encouraging them to adhere to established standards. Furthermore, it empowers consumers to advocate for energy-efficient choices not just within their homes but also when engaging with businesses and institutions.

In the context of energy efficiency ratings comparison, borrowers can leverage these standardized metrics to analyze and contrast options effectively. For example, when considering new vehicles, a consumer can compare fuel economy ratings, which are regulated by agencies worldwide, to choose the most efficient model suiting their needs. This comparative approach ensures that energy-conscious individuals aren’t limited to price or brand but can also select products with a proven track record of energy conservation. As such, standardized energy efficiency ratings not only drive sustainable practices in production and consumption but also equip borrowers with vital information for strategic decision-making.

Future of Financing: Integrating Efficiency into Loans

In today’s landscape of sustainable financing, energy efficiency ratings have emerged as a pivotal tool shaping borrowers’ strategies. As the world shifts towards a greener economy, lenders and borrowers alike are recognizing the significant impact of energy efficiency on both financial health and environmental sustainability. Integrating energy efficiency into loan assessments offers a proactive approach to mitigating risks and unlocking new opportunities. This paradigm shift is driving the future of financing, where loans are structured not just on traditional metrics but also on the potential for long-term energy savings.

The current trend reveals that borrowers are increasingly comparing energy efficiency ratings as a critical factor in selecting financing options. This comparison allows them to make informed decisions about investments in energy-efficient technologies and infrastructure. For instance, a comprehensive energy audit might reveal opportunities to retrofit an old building with smart thermostats, improved insulation, or renewable energy sources, all of which can be reflected in the borrower’s creditworthiness. Lenders, too, are utilizing advanced data analytics to conduct energy efficiency ratings comparison analyses, enabling them to assess potential risks and rewards more accurately. This integration ensures that loans are not just about immediate repayment but also about fostering a greener future by incentivizing responsible energy consumption.

Expert analysts predict that the future of financing will see even greater emphasis on energy efficiency as a key performance indicator (KPI). As renewable technologies continue to advance, lenders will need to adapt their assessment methods to account for these innovations. For borrowers, this means an opportunity to access more favorable terms and rates by demonstrating a commitment to energy conservation. By aligning financial incentives with environmental goals, the financing sector can drive widespread adoption of sustainable practices. This shift is not merely a trend but a necessary evolution to meet the challenges and opportunities presented by our ever-changing climate and global energy landscape.