Floodplain maps are critical tools for real estate professionals assessing property risks in flood-prone areas. These maps visually represent high-risk zones based on historical data, elevation, and proximity to water bodies. Key insights include the 100-year floodplain, elevation's impact, and using past floods as guidance. FEMA's FIRMs define Special Flood Hazard Areas (SFHAs), influencing building codes, insurance, and lending criteria. Understanding these maps is essential for property valuations, insurance, and mitigation strategies, ensuring safer investments and financial stability in flood-prone regions.

In the realm of real estate, understanding one’s environment is paramount for informed decision-making. Among the critical tools at a professional’s disposal is the floodplain map, offering invaluable insights into areas prone to flooding. As we navigate the complexities of modern development, ensuring properties are situated in safe locations is not just a best practice—it’s an essential component of responsible stewardship. This article delves into the significance of floodplain maps and elucidates their role in guiding real estate professionals toward making sound investments while mitigating risks associated with inundation.

Understanding Floodplain Maps: A Basic Guide for Real Estate Professionals

Floodplain maps are critical tools for real estate professionals navigating the complexities of property acquisition and development, particularly in areas prone to flooding. These detailed maps, produced by regulatory agencies, illustrate zones at risk of periodic inundation, offering invaluable insights into potential flood hazards. Understanding how to interpret and utilize these maps is essential, especially when dealing with mortgage lenders who often require comprehensive floodplain analysis as part of the loan approval process.

For instance, a real estate agent assisting clients in purchasing property along a riverbank should be adept at interpreting floodplain data. The map will indicate Special Flood Hazard Areas (SFHAs), where flooding is considered recurrent and significant. Within these zones, building codes often mandate specific measures to mitigate flood risks, such as raising structures above potential flood levels or implementing advanced drainage systems. By familiarizing themselves with these guidelines, agents can guide buyers towards making informed decisions, avoiding potentially costly renovations post-purchase. Moreover, lenders will require detailed floodplain analyses to assess the borrower’s risk and determine appropriate insurance requirements, ensuring both the security of the investment and compliance with regulatory standards.

Real estate professionals must also consider that floodplain maps are dynamic, updated regularly as our understanding of flood patterns evolves. This means properties previously deemed safe might be re-categorized over time, impacting development plans and resale values. Staying abreast of these changes is vital for professionals to provide accurate advice to clients and ensure compliance with lender borrower requirements related to floodplain mapping. Engaging the services of qualified surveyors or environmental consultants can facilitate this process, offering specialized insights that complement the data provided by floodplain maps.

Identifying High-Risk Areas: Interpreting Floodplain Map Data

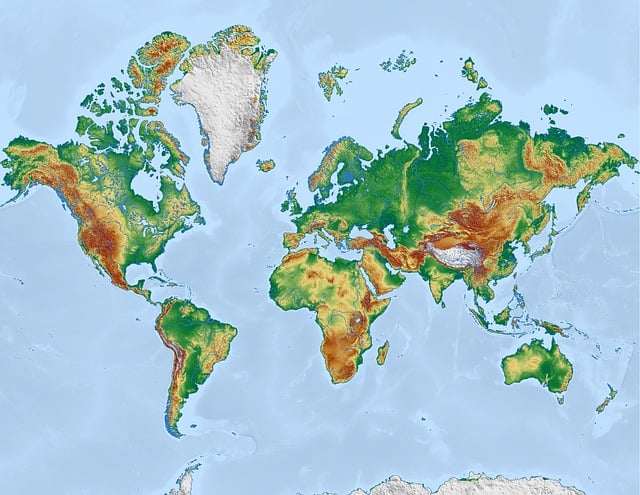

Floodplain maps are indispensable tools for real estate professionals when assessing property risks, especially in flood-prone areas. These detailed maps visually represent zones prone to flooding based on historical data and topography. Interpreting this data requires a nuanced understanding to accurately identify high-risk areas. By delving into the layers of information presented on a floodplain map, lenders and borrowers alike can make informed decisions regarding property acquisition and financing.

One critical aspect to consider is the classification of zones as either within or outside the 100-year floodplain, which corresponds to an area with a one percent chance of flooding in any given year. Properties located within these areas are considered higher risk. For instance, a recent study revealed that approximately 9.7 million housing units in the United States lie in high-risk flood zones, highlighting the significance of this data for both lenders and borrowers. When evaluating a property, lenders often require borrowers to obtain a current floodplain map to assess potential risks and determine appropriate insurance requirements, as mandated by federal regulations. This process ensures that financing decisions are aligned with actual flood risk levels.

Real estate professionals should also pay close attention to changes in elevation and proximity to water bodies. Even properties slightly elevated can be at risk during severe weather events. Moreover, understanding the historical flooding data associated with a particular area is crucial. Maps often include annotations indicating past flood events, which can provide valuable insights into future potential risks. By combining these factors, professionals can effectively identify high-risk areas and advise borrowers accordingly, ensuring both safety and financial responsibility.

Regulatory Requirements: How Floodplain Maps Impact Property Transactions

Floodplain maps are critical tools for real estate professionals navigating property transactions, particularly in low-lying areas prone to flooding. These detailed maps, often maintained by local governments or national mapping agencies, illustrate zones at risk of inundation during flood events, providing essential data for informed decision-making. Regulatory bodies mandate their use in various jurisdictions, ensuring that buyers, lenders, and developers are fully cognizant of the inherent risks associated with prospective properties.

For instance, in the United States, the Federal Emergency Management Agency (FEMA) produces and updates Flood Insurance Rate Maps (FIRMs), which define Special Flood Hazard Areas (SFHAs). These maps play a pivotal role in guiding floodplain management policies, including building codes, zoning regulations, and insurance requirements. Real estate professionals must consider these mappings meticulously when facilitating transactions. Lenders, in particular, are bound by regulatory frameworks that incorporate floodplain map borrower requirements. They assess the risk associated with lending in designated areas, often demanding additional measures to safeguard both property and investment.

When a property falls within a mapped floodplain, potential buyers face stricter guidelines and higher insurance premiums. This scenario necessitates proactive communication between all parties involved. Real estate agents should educate clients about these regulations, offering valuable insights into the feasibility of construction or renovation plans. Similarly, lawyers can provide expert advice on navigating the legal complexities surrounding flood-prone properties. By understanding and adhering to these regulatory requirements, professionals can ensure a smoother process, mitigate risks, and contribute to more sustainable development practices.

Assessing Property Value: The Influence of Floodplain Mapping on Appraisals

Floodplain maps are critical tools for real estate professionals when assessing property value. These detailed geographic representations identify areas prone to flooding, providing essential data for lenders, appraisers, and buyers alike. When evaluating a property’s worth, particularly in low-lying or nearwater locations, understanding the implications of a floodplain map is paramount. The map influences not only insurance considerations but also lending criteria and appraisal methodologies, shaping the overall market value of affected properties.

For instance, properties located within designated floodplains often face stricter borrower requirements from lenders. These requirements may include higher interest rates, reduced loan amounts, or mandatory purchase of flood insurance. Such measures reflect the increased financial risk associated with properties in these areas. According to a study by the Federal Emergency Management Agency (FEMA), approximately 70% of U.S. counties have special flood hazard areas mapped, affecting millions of properties and their owners.

Appraisers play a pivotal role in this process by meticulously examining the floodplain map alongside traditional valuation methods. They consider factors such as property elevation, distance to water bodies, and recent flooding history. For example, an appraiser might assess that a property’s elevated foundation, coupled with its proximity to a river, significantly mitigates flood risks. This analysis can lead to a higher property valuation compared to similarly situated but lower-elevated properties. Conversely, properties with frequent historical flooding or those in areas prone to severe storms and rising sea levels may face diminished valuations.

Real estate professionals must stay abreast of changing floodplain maps due to evolving climate patterns and development practices. Regularly updating assessments based on these maps ensures accurate property valuations and helps buyers make informed decisions. By embracing the intricacies of floodplain mapping, lenders, appraisers, and real estate agents can navigate the market with confidence, providing transparency and ensuring fairness in the valuation process for all involved parties.

Mitigation Strategies: Protecting Investments in Flood-Prone Regions

In regions prone to flooding, understanding and utilizing floodplain maps are pivotal for real estate professionals aiming to protect investments. These maps, meticulously designed by regulatory bodies, delineate areas at varying risk levels based on historical data, hydrological studies, and topographical features. They serve as indispensable tools for assessing and mitigating potential risks associated with floodplains, thereby safeguarding properties and ensuring the financial well-being of borrowers.

For instance, a recent study revealed that nearly 14% of commercial real estate in low-to-moderate income neighborhoods across the US are located within 30 days’ travel distance of a flooding event. This underscores the urgency for professionals to incorporate floodplain mapping into their decision-making processes. The map borrower requirements often stipulate that lenders must evaluate properties against these maps to ascertain if they fall within a Special Flood Hazard Area (SFHA), prompting tailored mitigation strategies. These strategies can range from structural enhancements like elevated foundations and water-proofed finishes, to non-structural measures such as flood insurance policies and elevation certificates.

Implementing effective mitigation measures can significantly reduce the financial exposure for both property owners and lenders. In areas where floods are a recurring phenomenon, proactive approaches have proven invaluable. For instance, in hurricane-prone coastal towns, buildings constructed on raised platforms or using flood-resistant materials not only withstand stronger waters but also enhance resale value, reflecting the market’s preference for flood-safe properties. By adhering to updated floodplain map borrower requirements and integrating these insights into project planning, real estate professionals can contribute to a more resilient and sustainable built environment.