A quitclaim deed is a straightforward legal tool for transferring property ownership with minimal formalities. It shields sellers from future claims while providing buyers with assurance of clear title, crucial in complex land ownership situations. Key elements include precise property description, intent to convey all rights, and release of future claims. Best practices involve professional consultation, thorough research, meticulous preparation, clear communication, and adherence to local laws for a secure transfer process.

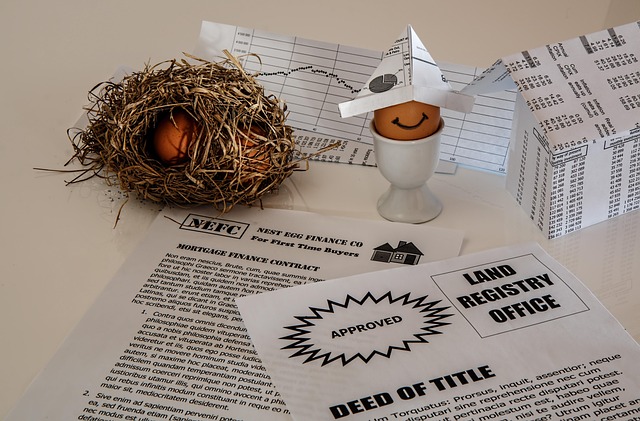

In the intricate dance of real estate transactions, understanding legal documents is paramount for both sellers and buyers. Among these, the quitclaim deed stands as a powerful instrument, offering a straightforward path to transferring property ownership. However, navigating this process can be challenging, especially for sellers who seek clarity and assurance. This article emerges as your trusted guide, providing an authoritative explanation of the quitclaim deed, backed by insights from legal experts. We demystify its purpose, implications, and usage, empowering sellers with the knowledge to make informed decisions, ensuring a seamless transition in their real estate journey.

Understanding Quitclaim Deeds: Basics for Sellers

A quitclaim deed is a straightforward legal instrument that conveys or releases an interest in property, typically used to transfer ownership rights with minimal formality. This brief document provides a simple way for sellers to ensure they have no further claims or liabilities associated with the property they are selling. When a seller uses a quitclaim deed, they are essentially waiving any right, title, or interest they may have in the property and transferring it to the buyer.

For sellers, understanding the implications of a quitclaim deed is crucial, especially when dealing with borrowers. In many real estate transactions, borrowers require assurance that the seller has clear title to the property, free from any encumbrances or claims. A quitclaim deed serves as a powerful tool to fulfill this requirement by providing evidence that the seller has relinquished all rights to the property. This is particularly important in regions where multiple parties may have an interest in the same land, such as joint tenancy or tenant-in-common situations.

A practical example could involve a seller who inherited property from a relative and later discovers potential claims from distant relatives. To protect the buyer and ensure a clear transfer of ownership, the seller can execute a quitclaim deed, releasing any unknown future claims they may have. This simple act significantly reduces legal complexities and risks for both parties involved. When preparing or reviewing such documents, sellers should always consult with legal professionals to ensure all aspects are addressed accurately and in compliance with local regulations, especially when dealing with borrower requirements related to property transactions.

When to Use a Quitclaim Deed: Scenarios Explained

A quitclaim deed is a powerful legal tool that can be employed in various scenarios, offering sellers a straightforward way to transfer property rights with minimal formalities. While often associated with simple transactions, this document holds significance in diverse situations, especially when specific goals or borrower requirements are at play. This section delves into the strategic use of quitclaim deeds, providing valuable insights for professionals navigating complex real estate landscapes.

One common scenario where a quitclaim deed is applicable involves situations where a seller wishes to transfer property without any reservations about existing encumbrances. For instance, if an individual owns a piece of land with minimal legal clouds and intends to sell it quickly, a quitclaim deed ensures a swift and clear transfer. This simplicity makes it an attractive option for both parties, especially in hot real estate markets where speed is paramount. Moreover, when dealing with borrowed funds, lenders may require a quitclaim deed as part of the loan agreement, ensuring their interest remains unsecured. Such agreements are particularly relevant for borrowers seeking to refinance or transfer property ownership while honoring existing debt obligations.

In addition to these scenarios, quitclaim deeds can facilitate smooth transitions in joint ownership situations. When two individuals co-own a property and one party decides to sell their share, a quitclaim deed allows for a clean transfer of that portion without disrupting the remaining partnership. This approach is beneficial when partners wish to maintain a business or personal relationship while parting ways regarding property ownership. By using this document, they can ensure a swift and amicable resolution, avoiding potential disputes that might arise from more complex legal arrangements.

Drafting a Valid Quitclaim Deed: Essential Elements

A quitclaim deed is a powerful legal instrument used to transfer ownership rights, free of any encumbrances or conditions. When drafting this document, it’s crucial to include specific essential elements to ensure its validity and enforceability. This process demands meticulous attention to detail, especially when considering the quitclaim deed borrower requirements. Sellers must clearly define the property in question, state their intention to convey all rights they possess, and provide a release from any potential future claims. For instance, a simple statement such as “The grantor hereby releases and quits claim to any and all right, title, or interest in the aforementioned property” signifies the transfer of ownership while protecting the borrower by eliminating any ambiguity.

Legal experts emphasize that the clarity and specificity in a quitclaim deed are paramount. Each component must be tailored to the unique circumstances of the transaction. For example, if the property has historical significance or unique features, these details should be meticulously recorded. Furthermore, the date of conveyance is a critical element, as it determines the effective transfer of ownership rights, influencing tax implications and potential future disputes. Sellers should seek expert advice to ensure their quitclaim deed adheres to legal standards and effectively meets borrower requirements, streamlining the entire process.

Actionable advice for sellers involves consulting with real estate attorneys or legal professionals specialized in property transactions. These experts can provide tailored guidance on crafting a comprehensive quitclaim deed, addressing potential issues and ensuring compliance with local laws. By integrating these best practices, sellers not only safeguard their interests but also contribute to a transparent and legally sound property transfer process, fostering trust between all parties involved.

Transferring Ownership: Legal Implications and Benefits

Transferring ownership through a quitclaim deed is a straightforward yet legally significant process, offering both advantages and implications for sellers. Unlike more complex deeds, a quitclaim deed is a simple document stating that the grantor (seller) relinquishes all rights, titles, and interests in a property to the grantee (buyer). This type of deed is particularly useful when selling partial interests or when there’s no clear chain of title, as it provides a clear, unencumbered transfer.

From a legal perspective, one of the primary benefits of using a quitclaim deed is its simplicity and speed. It doesn’t require extensive property appraisals or complex negotiations, streamlining the sales process. Moreover, it shields both parties from future claims by the grantor, as any unknown or undisclosed issues are waived upon signing. This is particularly beneficial for borrowers who have assumed ownership through mortgage transfers, ensuring they’re released from any potential liability associated with the property’s previous ownership. For instance, a borrower who has taken over title due to foreclosure can use a quitclaim deed to transfer the property to a buyer, clearing their name and minimizing future legal complications.

However, it’s crucial to understand that while quitclaim deeds offer convenience and clarity, they don’t convey marketable title. Sellers should be transparent about any known issues with the property to avoid future disputes. In some states, additional documentation or affidavits may be required to protect buyers from undisclosed problems. For example, in areas prone to environmental hazards, sellers might need to disclose specific risks to ensure buyer awareness. By adhering to these practices, both parties can navigate the transaction securely, making the quitclaim deed a reliable tool for efficient property transfers.

Common Mistakes to Avoid with Quitclaim Deeds

When it comes to transferring property ownership, a quitclaim deed is a powerful tool, but its use often comes with potential pitfalls for sellers. Many who are unfamiliar with this legal document make common mistakes that can have significant consequences. Understanding these errors and learning from them is essential to ensuring a smooth transfer process when utilizing a quitclaim deed. One of the primary mistakes is neglecting to fully disclose any encumbrances or existing liens on the property, which can lead to disputes down the line. Sellers might assume that their responsibility ends once they sign the document, but it’s crucial to remember that a quitclaim deed borrower requirements include transparency and accurate representation of title history.

Another frequent error is rushing into the process without proper legal counsel or consultation. While DIY methods are encouraged for many tasks, property transactions require expertise due to the potential complexities involved. An attorney specializing in real estate law can help sellers avoid mistakes related to zoning regulations, easements, or other hidden issues that might affect their rights as a seller and the buyer’s ability to use the property. For instance, a previous owner’s neglect to obtain necessary permits for an addition could leave the new owner responsible for costly remediation.

Additionally, some sellers underestimate the importance of thorough research regarding potential buyers’ financial stability. A quitclaim deed borrower requirements encompass more than just creditworthiness; it involves understanding the buyer’s ability to fulfill their obligations, maintain property taxes, and ensure insurance coverage. Conducting a background check or obtaining a title search can prevent future disputes and protect the seller from unforeseen financial risks. By being proactive in these areas, sellers can safeguard their interests and foster a reliable transaction environment.

Expert Insights: Best Practices for Seamless Conveyance

When considering a smooth conveyance process with a quitclaim deed, it’s essential to understand best practices from experts in the field. A quitclaim deed is a powerful legal tool that transfers ownership of property from one party to another, and its proper utilization can significantly impact the efficiency of real estate transactions. Sellers often seek expert guidance to ensure they meet all borrower requirements associated with this document.

According to renowned real estate attorneys, seamless conveyance starts with meticulous preparation. This includes a thorough review of the property’s title history to identify any liens or encumbrances that may affect ownership transfer. By addressing these matters proactively, sellers can minimize potential delays and complications during the closing process. Additionally, experts recommend clear communication between all parties involved, especially regarding borrower expectations and responsibilities. For instance, borrowers are typically required to provide specific information, such as their full legal name and current mailing address, to ensure accurate documentation.

Another critical aspect is ensuring the deed’s language aligns with local laws and regulations. This precision prevents potential disputes and facilitates a faster transfer of ownership. Experts suggest consulting with a legal professional familiar with quitclaim deed borrower requirements in your jurisdiction. They can offer tailored advice on crafting clear, unambiguous language to protect all parties’ interests. For example, specifying the property’s exact boundaries and describing any existing easements or restrictions can prevent future misunderstandings. By adhering to these practices, sellers can ensure their quitclaim deeds are not only legally sound but also contribute to a stress-free conveyance experience for all involved.