Understanding flood zone maps is crucial for homebuyers. These maps categorize areas based on flooding risk, influencing insurance requirements and mortgage terms. High-risk zones necessitate flood insurance and stricter loan criteria. Detailed maps consider historical events, future projections, and Base Flood Elevation. Analyzing historical data helps anticipate climate change impacts. Lenders offer specialized programs, and borrowers should conduct due diligence for informed decisions. Adhering to regulations and storm-resistant practices increases safety and property value.

For first-time homebuyers, navigating the complexities of real estate can be an overwhelming process, especially when considering potential risks like flood zones. A detailed flood zone map serves as a crucial tool, offering insights into areas prone to flooding, thus enabling informed decisions. This comprehensive report aims to demystify the concept and guide buyers through the intricacies of these maps, ensuring they make well-informed choices in safe, secure neighborhoods. By delving into the significance of flood zone mapping, we empower homebuyers with essential knowledge, fostering a smoother transition into homeownership while mitigating potential risks.

Understanding Flood Zones: A Primer for Homebuyers

Understanding Flood Zones: A Primer for Homebuyers

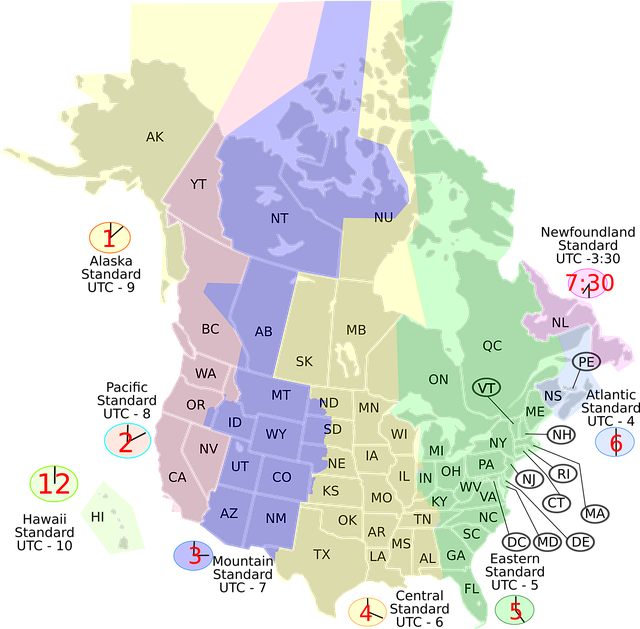

When considering a purchase, especially a first-time acquisition, one of the most critical tools at your disposal is the flood zone map. This detailed geographic representation illustrates areas prone to flooding based on historical data and regulatory criteria. Navigating these zones requires meticulous planning and awareness since properties located within them often face unique challenges and borrower requirements. According to FEMA, over 13 million properties are at risk of flooding in the United States, highlighting the paramount importance of this knowledge for any prospective homeowner.

Flood zone maps, typically provided by local, state, or federal agencies, categorize areas into different zones based on their vulnerability. These zones range from low-risk to high-risk, with Zone A representing the most susceptible areas. Properties in these zones may be subject to specific insurance mandates and lending guidelines. Lenders often require borrowers in flood zones to purchase flood insurance as a condition of their loan, underscoring the importance of understanding these maps ahead of time. Failure to account for potential flooding risks can lead to significant financial burdens, including higher insurance premiums and reduced property values.

For instance, let’s consider a borrower looking to buy a home in a coastal area historically prone to storm surges. The flood zone map will clearly indicate this region as a high-risk zone (Zone A or Zone V). Before proceeding with the purchase, the borrower should consult with a lender who specializes in flood zone financing. These professionals can guide them through the process of obtaining appropriate insurance and understanding any additional costs associated with purchasing in a flood-prone area. By being proactive and well-informed, borrowers can secure their loans and protect their investments, even in these challenging zones.

Assessing Your Property's Risk: Analyzing Local Maps

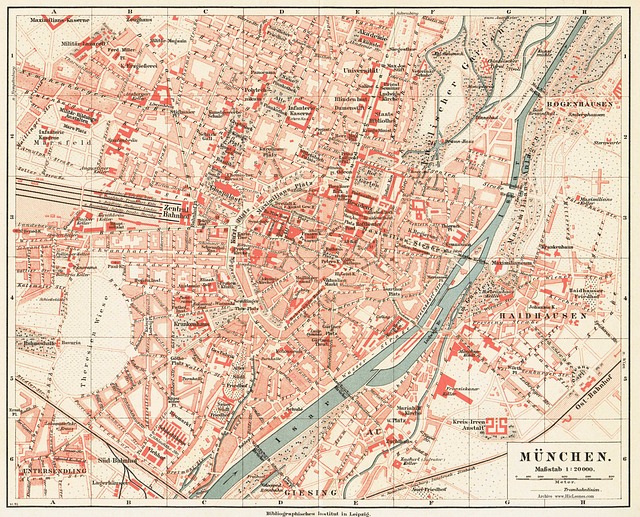

When considering a property purchase, especially for first-time buyers, assessing flood risk is a crucial step. One of the key tools for this evaluation is the flood zone map – a detailed geographic representation that identifies areas prone to flooding based on historical data and hydrological analysis. Understanding your property’s position relative to these maps is essential as it directly influences borrower requirements for mortgage financing.

Flood zone maps, maintained by federal, state, and local agencies, classify lands into zones based on their susceptibility to different levels of flooding. These zones are determined by examining past flood events, studying river flows, and analyzing terrain features. For instance, in coastal areas, high-risk zones might include low-lying coastal plains near rivers or directly on the shore, while inland regions could see elevated risk due to heavy rainfall and rapid runoff from nearby mountains. According to FEMA data, approximately 10% of the U.S. population lives in high-risk flood zones.

When a borrower applies for a mortgage, lenders will assess the property’s flood zone designation as part of their underwriting process. Properties located in Special Flood Hazard Zones (SFHAs), identified on these maps, often require additional measures to mitigate risk and protect both the borrower and the lender. These provisions may include purchasing flood insurance, ensuring structural modifications for better flooding resilience, or even avoiding construction in high-risk areas altogether. Lenders use the flood zone map borrower requirements to evaluate the loan’s safety and determine interest rates and terms accordingly. For example, a property in a moderate-risk zone might have more favorable financing options compared to one in a high-risk area.

Navigating Flood Zone Map Layers: What to Look For

Navigating a flood zone map is a critical step for first-time homebuyers, as it provides invaluable insights into their potential property’s risk of flooding. These maps, developed by various governmental and environmental agencies, offer layers of information that go beyond simple water levels. Understanding these layers—from historical flood events to future projections—is essential for making informed decisions. Borrowers should delve into the specifics, such as flood plain zones, special flood hazard areas, and base flood elevation data, as these directly impact insurance requirements and property value assessments.

For instance, a borrower purchasing a home in a 100-year flood zone, as defined by the Federal Emergency Management Agency (FEMA), is mandated to obtain flood insurance, unlike those in lower risk areas. Additionally, lenders often require borrowers in high-risk zones to provide proof of adequate flood coverage before finalizing loans. According to FEMA data, over 9 million properties are located in these high-risk areas, underscoring the significance of this map layer for borrowers.

Another critical aspect to scrutinize is the Base Flood Elevation (BFE). This layer indicates the minimum elevation at which flooding would occur during a specific return period, typically 100 years. Properties within lower elevation zones are at higher risk and will face stricter borrower requirements for flood insurance and potential adjustments in loan eligibility criteria. Homebuyers should consult with lenders and insurance providers to understand these requirements, ensuring they meet the necessary standards before committing to a purchase.

By thoroughly analyzing these map layers, first-time buyers can avoid unexpected challenges related to flooding. It empowers them to make more calculated decisions, consider potential risks, and plan accordingly for the future. This proactive approach not only protects borrowers from financial losses but also ensures they obtain the best possible terms when securing loans in areas prone to flooding.

Interpreting Risks: High, Moderate, Low Flood Areas

When reviewing a flood zone map for the first time, understanding the risk levels associated with different areas is paramount. The map categorizes zones based on their susceptibility to flooding, typically classified as High, Moderate, or Low flood areas. This classification system is a crucial tool for both prospective homeowners and lenders, providing essential insights into potential risks and guiding informed decisions.

High flood areas are those most vulnerable to frequent and severe flooding events. These zones are typically near large bodies of water like rivers or coastal regions, where historical data indicates recurring inundation. Borrowers considering property in these areas face a higher risk and should be prepared for potential damage and insurance implications. Lenders often require additional measures, such as elevated homes or robust flood protection systems, to mitigate risks before approving loans for these properties.

Moderate zones represent an intermediate level of flood risk. While less susceptible than high-risk areas, they still experience occasional flooding, usually during extreme weather events. Properties in these zones may have varying degrees of elevation and proximity to water bodies. Borrowers here should thoroughly research local flood history and understand the potential for future inundation. Lenders typically assess each case individually, considering factors like infrastructure improvements and effective drainage systems before approving financing.

Low flood areas are generally considered safer from regular flooding. These zones are elevated and farther removed from significant water sources. However, it’s essential to remember that even in these areas, occasional flash floods or localized events can occur. Borrowers and lenders alike should maintain a cautious approach, particularly when purchasing older properties where flood protections might be outdated or lacking. Regular maintenance and staying informed about local flood mitigation efforts are wise practices for homeowners in low-risk zones.

Historical Data and Trends: Predicting Future Flood Events

Understanding historical data and trends is essential when interpreting a flood zone map for the first time as a buyer or investor. Flooding events are complex phenomena influenced by various factors, including climate change, urban development, and natural variability. By examining past occurrences, we can gain valuable insights into potential future risks. According to a study by the National Oceanic and Atmospheric Administration (NOAA), coastal areas worldwide have experienced an increase in severe storm surges and heavy rainfall intensity over the past few decades. This trend highlights the growing necessity for borrowers considering property in flood-prone regions to engage with detailed flood zone maps.

These historical data sets allow experts to identify recurring patterns and develop predictive models. For instance, cities like Miami and New Orleans have long been designated as high-risk due to their low elevation and proximity to major water bodies. The U.S. Army Corps of Engineers’ maps for these areas show consistent flooding events every few years, with some neighborhoods affected more frequently. Borrowers purchasing properties in such locations must adhere to strict building codes and may be required by lenders to obtain flood insurance, as outlined in the flood zone map borrower requirements. This proactive approach ensures that construction meets safety standards and protects both investors and their assets.

Furthermore, analyzing historical data can help mitigate risks associated with climate change. Rising sea levels and changing weather patterns will likely increase the frequency and severity of flooding events. As such, buyers should be vigilant when considering properties in areas prone to these dynamics. Utilizing advanced models and consulting with environmental experts can provide a more nuanced understanding of potential flood zones, enabling borrowers to make informed decisions and mitigate future financial losses.

Mitigating Risks: Building a Safe Haven in Flood Zones

Navigating flood zones is a critical consideration for first-time homebuyers, as these areas present unique challenges and risks. A comprehensive understanding of local flood zone maps is essential to make informed decisions and mitigate potential losses. This guide aims to provide an in-depth look at managing risks in flood-prone regions, empowering borrowers with knowledge to build their safe haven.

Flood zone maps, produced by regulatory bodies, offer detailed insights into areas susceptible to flooding events. These maps categorize zones based on their likelihood of inundation, from low to high risk. For instance, in the United States, the Federal Emergency Management Agency (FEMA) maintains precise digital flood hazard maps, which have become indispensable tools for borrowers and lenders alike. By studying these maps, potential buyers can identify areas where flooding has historically occurred or is predicted to happen in the future. This proactive approach allows individuals to make educated choices regarding their property investments.

One of the primary risks for borrowers in flood zones is the potential for substantial financial losses due to water damage. According to a 2021 study, homes located in high-risk flood areas face an average of 40% higher repair costs post-disaster compared to those outside these zones. To mitigate this risk, lenders and borrowers should collaborate closely. Lenders can offer specialized loan programs designed for flood-prone properties, often with enhanced safety features. These may include elevated construction methods, improved drainage systems, or specific insurance requirements. Borrowers, in turn, should engage in thorough due diligence by consulting local experts, assessing potential mitigation measures, and evaluating the availability of disaster relief funds.

Building a safe haven in a flood zone requires a multi-faceted approach. It involves understanding regulatory guidelines, adopting resilient building practices, and securing adequate insurance coverage. For instance, in coastal regions, homeowners may consider implementing storm-resistant windows or doors to protect against powerful winds and flying debris. Additionally, raising essential appliances and electrical systems off the ground can significantly reduce water damage. By integrating these measures into their property, borrowers not only enhance their home’s safety but also increase its resale value, ensuring a more secure future for both the homeowner and the investment.