Understanding the roles of listing and selling agents is crucial for successful real estate transactions. Listing agents maximize property value through strategic pricing, marketing, and negotiations, while selling agents facilitate buyer purchases at a fixed fee. Realtor closing costs, varying based on property value and location, are key considerations. Transparency in pricing structures from agents like West USA Realty ensures clients understand associated costs before closing. Both buyers and sellers can save money by choosing experienced agents who negotiate fees and ensure competitive prices.

In the realm of real estate transactions, understanding the roles of listing agents and selling agents is paramount for both buyers and sellers. This nuanced distinction often impacts realtor closing costs and overall deal terms. Many overlook the strategic differences these roles entail, potentially leading to misunderstandings and unwelcome surprises during the process. Our article delves into this critical aspect, elucidating how each agent’s mandate shapes the buyer-seller dynamic and financial obligations. By exploring these nuances, we empower informed decision-making, ensuring you’re equipped to navigate real estate with confidence and optimize your investment.

- Understanding Roles: Listing vs Selling Agent Responsibilities

- The Listing Process: Steps & Strategies for Success

- Seller's Perspective: Maximizing Sales with a Listing Agent

- Buying vs Selling: Agent Costs & Closing Expenses

- Choosing Wisely: Selecting the Right Real Estate Professional

Understanding Roles: Listing vs Selling Agent Responsibilities

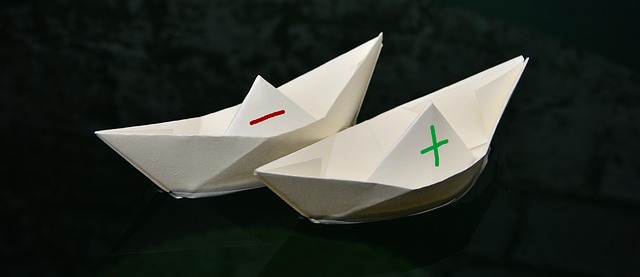

When it comes to buying or selling a home, understanding the distinct roles of listing agents and selling agents is crucial for a successful transaction. While both professionals play vital parts in real estate deals, their responsibilities differ significantly. A listing agent, primarily tasked with marketing your property, acts as your advocate to secure the best possible price. They prepare the home for showing, negotiate offers, and guide you through the process up until the sale is finalized. On the other hand, a selling agent, engaged by a buyer or sometimes represented by a seller’s agent, focuses on finding suitable properties for clients and facilitating the purchase.

The key difference lies in their incentives and approaches. Listing agents are typically compensated through realtor closing costs, which can include various fees and commissions. These costs often depend on the sale price and are negotiable. For instance, a listing agent might charge 3% to 6% of the sale price as commission, with additional expenses like marketing and administrative fees. In contrast, selling agents’ compensation is usually structured around real estate agent fees at closing, which can be 1% to 3% of the purchase price, depending on local market conditions and their specific arrangement with the buyer’s agent.

When engaging a realtor for either listing or buying, it’s essential to communicate expectations and budget. West USA Realty, for instance, offers transparent pricing structures to ensure clients understand their costs. Sellers should inquire about potential realtor closing costs and how they can optimize their home’s value to maximize returns. Buyers, likewise, need to be aware of the associated real estate agent fees at closing to factor these into their overall budget. Understanding these dynamics is fundamental to navigating the complex world of real estate transactions successfully.

The Listing Process: Steps & Strategies for Success

The listing process is a critical phase for any real estate transaction, where the relationship between a seller and their chosen agent truly takes center stage. A successful listing involves a strategic approach that extends far beyond merely putting a price tag on a property. It’s an art that requires meticulous planning, powerful marketing, and a deep understanding of the local market dynamics. Sellers often turn to dedicated listing agents who act as their advocates, navigators, and experts in the complex real estate landscape.

A listing agent’s primary responsibility is to maximize the selling price while ensuring the property attracts qualified buyers. This involves a detailed analysis of comparable sales data, market trends, and an understanding of the unique features and benefits the home offers. They then craft a compelling marketing strategy that includes professional photography, virtual tours, and strategic pricing. West USA Realty agents, for instance, utilize advanced marketing tools and techniques to showcase listings, ensuring sellers receive top dollar.

During the listing period, agents manage multiple tasks, from preparing legal documents and disclosures to coordinating showings and handling negotiations. They work closely with their clients to address any concerns or adjustments needed to make the property more marketable. As the process unfolds, they keep a pulse on the market, quickly adapting strategies if conditions shift. This proactive approach is key to achieving a successful sale, minimizing realtor closing costs, and ensuring a positive outcome for both parties.

The real estate agent fees at closing, or realtor closing costs, are a significant consideration for sellers. These costs can vary widely depending on the property’s value, location, and the level of service provided. Understanding these fees in advance is crucial. Sellers should discuss the expected breakdown with their listing agent to make informed decisions. For example, West USA Realty offers transparent pricing structures, providing peace of mind and ensuring clients are aware of all associated costs well before the closing process begins.

Seller's Perspective: Maximizing Sales with a Listing Agent

When selling a home, one of the most crucial decisions you’ll make is choosing between a listing agent and a selling agent. While both play vital roles in the real estate transaction process, their primary objectives diverge significantly—a factor that can profoundly impact your bottom line as a seller. From marketing prowess to negotiating skills, understanding these distinctions is essential to maximizing sales and navigating the complex world of realtor closing costs.

From the seller’s perspective, a listing agent acts as your advocate in the market. Their primary responsibility is to list your property at an optimal price, attract qualified buyers, and ultimately secure the best possible sale terms. A key advantage lies in their expertise in setting competitive listing prices, which can lead to higher sales values. This strategic pricing, coupled with effective marketing strategies, ensures your home gains maximum exposure to potential buyers. Moreover, these professionals are adept at navigating complex negotiations, allowing you to achieve favorable terms without incurring excessive realtor closing costs or real estate agent fees at closing.

West USA Realty, for instance, boasts a team of seasoned listing agents who understand the nuances of the local market. They employ advanced marketing tools and strategies, including high-quality photography, virtual tours, and targeted online advertising, to showcase your property in its best light. By leveraging their network and expertise, you can expect a quicker sale at a price that aligns with or exceeds your expectations, while minimizing associated realtor closing costs.

However, it’s crucial to note that the choice between agents should also consider your personal preferences and goals. Some sellers may prefer a more hands-on approach and direct involvement in the sales process, which a selling agent can provide. Selling agents are responsible for marketing their own services and attracting buyers, often at a fixed fee or percentage of the final sale price. This model offers transparency regarding real estate agent fees at closing but requires a higher level of engagement from the seller. Ultimately, understanding these roles and their implications is key to making an informed decision that aligns with your unique circumstances.

Buying vs Selling: Agent Costs & Closing Expenses

When buying or selling a home, understanding the roles of a listing agent versus a selling agent is crucial, particularly when it comes to costs. Many homeowners are unaware that these professionals have distinct fee structures and can significantly impact their overall real estate experience and budget. Let’s delve into the financial implications for buyers and sellers alike.

For sellers, the primary focus is on marketing and negotiating to secure the best possible price. A listing agent, working with West USA Realty or any reputable brokerage, will charge a commission—typically around 2-3% of the final sale price—as their main source of income. This fee covers various services including property valuation, marketing strategies, open houses, and negotiations. While this might seem like a substantial cost, it’s important to remember that a skilled agent can expedite the selling process and command a higher sale amount. For instance, a well-priced and effectively marketed home in a desirable location could attract multiple offers, ultimately increasing the seller’s returns.

On the buying side, a real estate agent fees at closing plays a different role. Buyers typically pay their agent a flat fee or a percentage of the purchase price (usually 1-2%) as a thank you for their services. Unlike sellers’ commissions, these fees are negotiable and can vary based on market conditions and the agent’s experience. A buying agent’s primary goal is to secure the best deal for their client, negotiating with the seller’s agent on their behalf. They also assist with paperwork and ensure a smooth transaction process, helping buyers navigate realtor closing costs effectively.

When considering these dynamics, buyers and sellers should approach real estate transactions pragmatically. For sellers, choosing an experienced listing agent who understands market trends can lead to significant savings through faster sales and competitive pricing. Similarly, informed buyers working with dedicated agents can reduce their own realtor closing costs by negotiating fees, understanding local market values, and ensuring they receive the best possible value for their investment.

Choosing Wisely: Selecting the Right Real Estate Professional

Choosing the right real estate professional is a crucial step in any property transaction, but it’s an area where many buyers and sellers make a hasty decision, often focusing solely on commission rates. While the cost of services is a significant factor, it’s equally important to understand the roles and responsibilities of listing agents versus selling agents—and how this impacts your bottom line, including realtor closing costs and real estate agent fees at closing.

A listing agent, as the name suggests, specializes in marketing properties for sale and attracting potential buyers. They are responsible for preparing the home for listing, setting a competitive price, creating effective advertising strategies, and managing open houses. On the other hand, a selling agent is primarily focused on facilitating the purchase process—negotiating offers, coordinating inspections, and guiding clients through the legal aspects of closing the deal. Understanding these distinct roles can help you make an informed choice, ensuring you’re not only satisfied with the service but also aware of associated costs like realtor closing costs and real estate agent fees at closing.

When selecting a realtor, consider their expertise in your specific market. For instance, West USA Realty agents are well-versed in local trends, which can significantly impact property values and negotiation strategies. Look for an agent who has successfully navigated similar transactions, as this experience translates to better outcomes and potentially lower costs. Additionally, ask about their fee structure—do they charge a flat rate or a percentage? Are there any hidden fees or additional charges for services like marketing or paperwork processing? Understanding these details beforehand helps in budgeting and avoids surprises during the closing process, where real estate agent fees at closing can vary significantly.