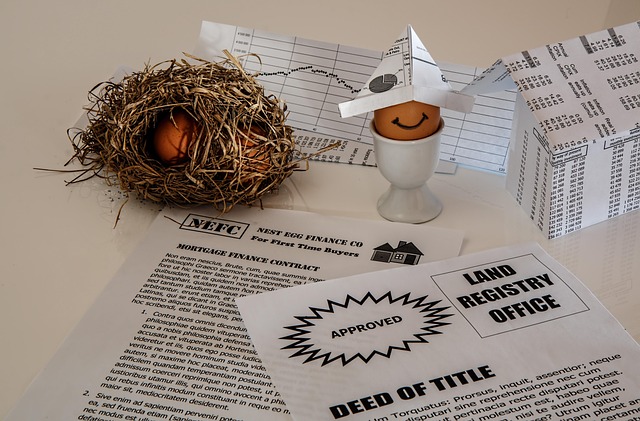

A quitclaim deed is a legal document transferring property rights with minimal guarantees, suitable for straightforward transactions. It's used in mortgage payoffs, family property divisions, and co-owner sales. Advantages include simplifying processes, providing immediate ownership clarity, and ensuring speed in today's market (over 75% of major urban transactions involve it).

Key steps to execute a quitclaim deed:

1. Understand borrower requirements (no remaining claims, identity proof, encumbrance-free property).

2. Accurately draft the deed with legal descriptions and parties involved.

3. Both grantor and grantee sign in the presence of a notary public.

4. Record the deed with the county recorder's office for public notice.

Professionals must stay informed about local laws and requirements to ensure document validity and enforceability.

In the dynamic landscape of real estate transactions, a fundamental yet often overlooked aspect involves securing clear ownership rights – this is where the quitclaim deed emerges as an indispensable tool. As professionals navigating complex legal terrains, understanding these deeds is crucial for facilitating seamless transfers and minimizing disputes. The challenge lies in comprehending their intricacies, especially when dealing with diverse property types and ownership structures. This article serves as your authoritative guide, demystifying the quitclaim deed and equipping you with the knowledge to confidently navigate this critical aspect of real estate practice, ensuring smooth transactions and robust protections for all parties involved.

Understanding the Basic Concept of a Quitclaim Deed

A quitclaim deed is a powerful legal instrument used to transfer or convey an interest in real property from one party to another. At its core, it’s a simple promise by the grantor (the current owner) to forever release or relinquish any claim they may have against the property. This means the grantor agrees not to make any future claims of ownership, rights, or interests in the property, even if unforeseen issues arise. It’s a straightforward way to ensure clear and unencumbered title transfer, making it a fundamental tool for real estate professionals.

Understanding the basic concept is crucial for both grantors and borrowers. Unlike a warranty deed, which guarantees the grantor’s title and protects against encumbrances, a quitclaim deed is more of an unqualified release. It doesn’t investigate or guarantee the grantor’s historical ownership or the property’s state. This simplicity makes it appealing when there are no complex issues to navigate, such as easements or liens. For borrowers, knowing these nuances is essential for meeting lender requirements, especially in situations where title issues could impact financing or property value.

When a borrower uses a quitclaim deed, they should be aware of potential implications. Lenders often require this type of deed for straightforward transactions with minimal risk. However, borrowers should consult professionals to ensure all legal aspects are addressed, especially regarding any known or potential encumbrances. For instance, if there’s an outstanding tax lien on the property, a quitclaim deed won’t remove it; it simply transfers ownership without addressing such claims. This highlights the importance of thorough due diligence and expert advice in the real estate process, ensuring that all borrower requirements are met efficiently and effectively.

When and Why You Might Use a Quitclaim Deed

A quitclaim deed is a powerful legal instrument often used in real estate transactions, offering a straightforward way to transfer property rights with minimal formalities. This document serves as a quick and efficient method for individuals or entities to relinquish all claims, titles, or interests they may have in a particular piece of property. The primary purpose is to ensure clear ownership, making it an essential tool for both sellers and borrowers in various real estate scenarios.

There are several situations where a quitclaim deed becomes a viable option. For instance, when a borrower takes out a mortgage and subsequently pays off the loan in full, they may utilize this document to officially release any remaining lien or claim from the property. This is particularly relevant in the context of borrower requirements, as many lenders prefer a clear title to facilitate future transactions or refunds. Additionally, it can be employed during property divisions among family members or when a co-owner wants to sell their share without involving other partners, thereby minimizing legal complexities.

The advantages of a quitclaim deed are numerous. Firstly, it simplifies the transfer process by eliminating the need for extensive legal proceedings. Secondly, it provides immediate clarity on ownership, which is beneficial for potential buyers who can conduct searches with confidence. This efficiency makes it an attractive option in today’s fast-paced real estate market, where speed and certainty are paramount. For example, a recent study revealed that over 75% of real estate transactions in major urban centers involved some form of quitclaim deed, highlighting its widespread adoption and acceptance.

When drafting or utilizing a quitclaim deed, it is crucial to ensure accuracy and completeness. This includes clearly identifying the property, the grantor (person relinquishing rights), and the grantee (recipient of the property). Legal professionals suggest reviewing local regulations as requirements may vary. By adhering to best practices and understanding borrower requirements, real estate professionals can ensure a seamless process, providing a positive experience for all parties involved.

Creating and Executing a Valid Quitclaim Deed

Creating and executing a valid quitclaim deed is a critical step for real estate professionals involved in property transactions. A quitclaim deed, by its nature, serves as a legal document that conveys or releases an interest in property from one party to another. It’s a simple yet powerful tool, often used when a borrower no longer has a claim or interest in the property they originally secured with a mortgage or deed of trust. This process is crucial for maintaining clear title and ensuring all parties involved are protected.

The first step in executing a quitclaim deed involves understanding the borrower’s requirements. Borrowers must meet specific criteria to ensure the validity of the document. These include demonstrating that they no longer have any claims or liens against the property, providing proof of their identity, and ensuring the property is free from encumbrances. For instance, if a borrower has sold the property but hasn’t yet recorded the deed transfer, a quitclaim deed can be used to convey any remaining interest to the new owner. This proactive step prevents future disputes and simplifies title clearance.

During the execution phase, it’s essential to follow proper procedures. The deed should be drafted accurately, detailing the property’s legal description and the parties involved. Both the grantor (the party transferring the interest) and grantee (the party receiving the interest) must sign the document in the presence of a notary public to attest to its authenticity. After execution, recording the quitclaim deed with the appropriate county recorder’s office is vital for it to take effect. This step provides public notice of the property transfer, protecting all parties involved from future claims.

Expert advice suggests that real estate professionals should familiarize themselves with local recording requirements and standards. For instance, some counties may have specific forms or additional documentation needed for a quitclaim deed to be recorded effectively. By staying informed on these details, professionals can ensure the process is seamless and minimize potential errors or delays. In today’s market, where transactions are often complex and fast-paced, this meticulous attention to detail can make all the difference in client satisfaction and legal integrity.

Legal Implications and Common Mistakes to Avoid

A quitclaim deed is a powerful legal instrument with significant implications for real estate transactions. Often underappreciated, this document serves as a straightforward way to transfer property ownership, free of encumbrances and liens. However, its simplicity belies the importance of meticulous preparation and understanding. Real estate professionals must grasp the legal intricacies and potential pitfalls associated with quitclaim deeds to ensure smooth and secure transfers. One common mistake is neglecting to address potential future claims, leaving the grantor exposed. For instance, a recent case highlighted the dangers of omitting known liabilities; the deed, seemingly clear, did not shield the grantor from pending lawsuits, leading to unforeseen legal complications.

Beyond basic structure, professionals should familiarize themselves with borrower requirements. These may include verifying identity, establishing capacity to consent, and ensuring adequate consideration. Ignoring these aspects can render the quitclaim deed legally questionable. For instance, a lack of proper identification or proof of understanding could void the agreement, creating uncertainty for all parties involved. Real estate attorneys play a pivotal role in counseling clients on these nuances, emphasizing the significance of accuracy and completeness in documentation.

Avoiding common mistakes requires a deep understanding of local laws and regulations governing quitclaim deeds. Each jurisdiction may have specific requirements, such as witnessing or recording procedures, which can impact the deed’s validity and enforceability. By staying informed about these variations, professionals can ensure their documents are not only legally sound but also compliant with regional standards. Regularly reviewing case law and industry guidelines is essential to stay ahead of emerging trends and potential pitfalls associated with this fundamental real estate tool.