The loan-to-value (LTV) ratio is a critical metric for real estate finance, influencing borrowing costs and terms. Lower LTV ratios (e.g., below 80%) offer advantages like reduced interest rates and fees, while higher ratios face stricter criteria. Calculated as outstanding loan / property value (e.g., 66.7%), maintaining a healthy LTV (e.g., 50%) enhances refinancing terms and long-term savings. Strategies to optimize LTV include substantial down payments, improving credit scores, and exploring government loans with lower LTV requirements. Regularly reviewing mortgage strategies is vital for financial stability.

In the intricate landscape of real estate financing, understanding the delicate balance between loan and value is paramount for investors, borrowers, and lenders alike. The loan-to-value (LTV) ratio, a pivotal metric, holds the key to unlocking sound financial decisions, yet its complexities often leave many bewildered. This authoritative guide aims to demystify the LTV ratio, providing an in-depth exploration of its significance, calculations, and practical applications. By unraveling this essential concept, we empower readers with the knowledge to navigate the credit market confidently, ensuring informed choices that resonate with their financial objectives.

Understanding Loan to Value Ratio (LTV): Basics Explained

The loan-to-value (LTV) ratio is a critical metric in real estate finance, reflecting the relationship between the amount of a loan and the value of the property securing it. It’s a key factor lenders consider when evaluating loan applications, influencing funding decisions and terms. Understanding LTV ratios is essential for both borrowers and lenders, enabling informed decision-making throughout the lending process.

An LTV ratio is calculated by dividing the outstanding loan balance by the estimated property value. For example, if you take out a $200,000 mortgage on a home valued at $300,000, your LTV ratio would be 66.7% ($200,000 / $300,000). Lenders typically aim to keep this ratio below 80%, considering anything above as higher risk. A lower LTV ratio demonstrates stronger equity in the property and can result in more favorable loan terms, including lower interest rates and reduced funding fees. These fees, often a percentage of the loan amount (e.g., 1-3% for conventional mortgages), can significantly impact overall borrowing costs.

Borrowers with higher LTV ratios may face stricter lending criteria, potentially requiring larger down payments to mitigate risk. Conversely, maintaining a healthy LTV ratio can provide opportunities for future refinancing or home equity loans at competitive rates. For example, a borrower with an LTV of 50% might qualify for a lower-interest rate and save thousands over the life of their mortgage compared to someone with an LTV of 80%. Understanding and managing your LTV ratio is therefore a strategic component of responsible borrowing and long-term financial planning.

Why LTV Matters in Real Estate Financing

The loan-to-value (LTV) ratio is a critical metric in real estate financing, reflecting the amount of a borrower’s loan compared to the property’s value. It plays a pivotal role in determining an individual’s ability to secure funding and significantly impacts overall borrowing costs. An understanding of LTV is essential for borrowers, lenders, and real estate professionals alike, as it dictates terms, interest rates, and access to capital. For instance, a lower LTV ratio often leads to more favorable loan conditions, including lower funding fees, which can range from 1% to 3% of the loan amount.

In the competitive real estate market, lenders carefully assess LTV ratios before extending loans. A high LTV ratio may indicate excessive risk, prompting lenders to charge higher interest rates or decline the loan application altogether. Conversely, a lower LTV ratio presents a more secure investment opportunity for lenders and can result in better terms for borrowers. According to recent industry data, borrowers with an LTV below 80% typically enjoy reduced borrowing costs and have access to a broader range of financing options compared to those with higher LTV ratios.

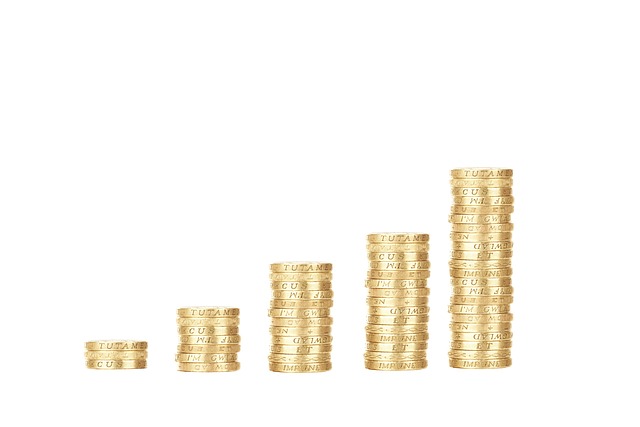

To optimize their financial position, borrowers should strive to maintain healthy LTV ratios. This can be achieved through responsible borrowing practices, such as making larger down payments and paying off existing debts. For instance, reducing your LTV ratio from 90% to 75% can result in significant savings over the life of a mortgage, thanks to lower interest rates and potential fee reductions. By keeping LTV ratios in check, borrowers not only enhance their chances of securing desirable loan terms but also lay the groundwork for long-term financial stability in the real estate market.

Calculating Your Loan to Value: Step-by-Step Guide

Calculating your loan-to-value (LTV) ratio is a crucial step in understanding how much funding you can secure for your real estate venture. This simple yet powerful metric compares the amount of your loan to the value of the property you’re purchasing, offering lenders and investors critical insight into risk levels and potential returns. A lower LTV ratio generally indicates a safer investment for lenders, potentially leading to more favorable terms and rates.

To calculate your LTV ratio, divide the loan amount by the property’s estimated value. For instance, if you’re seeking a $200,000 mortgage to purchase a home valued at $500,000, your LTV would be 40%. This means you’re contributing 60% of the property’s value toward the purchase, with the remainder funded by the loan. It’s important to note that lenders may also consider additional factors, such as your credit history and down payment, when assessing your overall risk profile.

A key consideration in managing LTV ratios is understanding funding fee structures. Many lenders charge fees based on a percentage of the loan amount, often ranging from 1% to 3% for conventional mortgages. These fees can significantly impact the overall cost of your financing, especially with larger loans and lower down payments. For example, a $300,000 mortgage with a 2% funding fee would result in additional costs of $6,000—a factor to keep in mind when negotiating loan terms.

To optimize your LTV ratio and funding fees, aim for a substantial down payment if possible. Increasing your equity position reduces the need for a large loan, lowering both the LTV ratio and associated financing costs. Additionally, maintaining or improving your credit score can yield better interest rates, further minimizing long-term expenses. Remember, a well-planned LTV strategy is not just about securing funding; it’s about ensuring financial health and stability in the real estate journey.

Impact of LTV on Mortgage Approval and Rates

The loan to value ratio (LTV) is a critical metric for both lenders and borrowers when securing a mortgage. It represents the percentage of a property’s value that is financed by the loan. Understanding its impact on mortgage approval and rates is essential, as it plays a significant role in assessing risk and determining loan terms. In general, a lower LTV ratio is favorable, indicating a smaller portion of the property’s value is borrowed and thus reducing potential financial exposure for lenders.

When applying for a mortgage, an LTV above 80% may face stricter scrutiny. Lenders often impose funding fees or higher interest rates for loans with such high LTV ratios to compensate for increased risk. For instance, in some markets, borrowers with a 95% LTV might be charged a loan to value ratio funding fee of 2-3% of the loan amount at closing. These additional costs can significantly impact the overall cost of homeownership. According to recent studies, the average mortgage rate for loans with an LTV below 70% is approximately 3% lower than those above 85%. This gap underscores the influence of LTV on securing more favorable funding terms.

Practical advice for borrowers aiming to minimize loan to value ratio funding fees and secure better rates includes improving their credit score, increasing the down payment percentage, and exploring government-backed loans that may offer competitive rates with higher borrowing limits. Maintaining a low LTV not only improves mortgage terms but also demonstrates financial responsibility, potentially paving the way for future borrowing opportunities. Borrowers should aim to keep their LTV below 80%, if possible, to ensure the best chances of approval and access to cost-saving rates in today’s competitive lending landscape.

Optimal LTV Ranges for Different Financial Scenarios

The optimal loan to value (LTV) ratio varies significantly across different financial scenarios, from first-time homebuyers to experienced investors. A prudent LTV range is crucial for both lenders and borrowers, balancing risk and access to funding. For instance, a borrower seeking a mortgage might aim for an LTV of 80% or less, ensuring a substantial equity buffer against potential market downturns. In contrast, real estate investors might target higher LTV ratios, such as 90%, to maximize purchasing power, especially in growing markets where property values are rising quickly.

Lenders typically charge a loan to value ratio funding fee for loans above certain thresholds, usually between 80% and 90%. This fee compensates for the increased risk associated with higher LTV ratios. For example, an LTV ratio of 95% might incur a funding fee of 1-3 percentage points compared to a loan at 80% LTV. Borrowers should weigh these fees against the potential savings from borrowing more equity. A strategic approach involves balancing the benefits of increased funding with the risk of higher interest expenses and potential penalties.

Practical insights suggest that maintaining an LTV ratio below 75% offers a safe haven for borrowers, minimizing the impact of market fluctuations. However, in robust economic conditions, exploring slightly higher LTV ratios can be beneficial, provided borrowers have a solid financial foundation. Expert advice emphasizes the importance of comprehensive risk assessment, including personal financial health, property location, and market trends, before committing to an LTV range. Ultimately, understanding and navigating optimal LTV ranges empower both lenders and borrowers to make informed decisions in today’s dynamic real estate landscape.

Strategies to Improve Your Loan to Value Ratio

Improving your loan-to-value (LTV) ratio is a strategic move that can significantly enhance your financial standing when seeking real estate funding. An LTV ratio refers to the percentage of a property’s purchase price financed by the loan compared to its total value, and it plays a critical role in accessing favorable borrowing terms. A lower LTV ratio generally indicates a more secure investment for lenders, which can translate into better interest rates and loan conditions for borrowers.

One effective strategy is to increase your down payment. By committing a larger portion of the property’s value upfront, you reduce the amount borrowed, thereby lowering the LTV ratio. For instance, if you’re purchasing a $500,000 home and are able to save a 20% down payment ($100,000), your loan amount becomes $400,000. This reduces the LTV ratio from 95% (if you only put down 5%) to 80%, which is more appealing to lenders. Additionally, consider paying off existing debts to free up cash and improve your debt-to-income ratio, another crucial factor in loan eligibility.

Another approach involves exploring government-backed or conventional loans with lower LTV requirements. Some programs, like FHA loans, allow borrowers to obtain a mortgage with as little as 3.5% down, which is ideal for first-time homebuyers. Even more, certain lenders offer flexible funding fee structures that can help manage the costs associated with borrowing. These fees are often tied to your loan amount and LTV ratio—a higher LTV may result in a funding fee of 1%-3%, but with a lower ratio, these fees become less pronounced, providing some financial relief for borrowers. Regularly reviewing and adjusting your mortgage strategy can help you maintain or improve your LTV ratio over time, ensuring long-term financial stability.