Real estate investors must meticulously assess and manage moving costs, which include direct expenses (legal fees, commissions) and indirect (relocation services, storage). Key strategies involve evaluating borrower requirements, conducting thorough market research, budgeting 1-3% for moving costs, negotiating rates, and regularly reviewing budgets. Effective cost management ensures successful relocation and maximizes investment returns.

In the dynamic world of investment, navigating moving costs is a complex yet critical aspect that can significantly impact financial strategies. As investors delve into new opportunities, understanding and managing these expenses are essential to achieving long-term success. The challenge lies in the multifaceted nature of moving costs, which encompass various elements, from transaction fees to market volatility’s influence. This authoritative guide aims to demystify this landscape, offering a comprehensive breakdown for investors seeking to optimize their moves. By providing practical insights and expert analysis, we empower readers to make informed decisions, ensuring they harness opportunities while minimizing the financial burden associated with moving costs.

Assessing Common Moving Costs for Investors

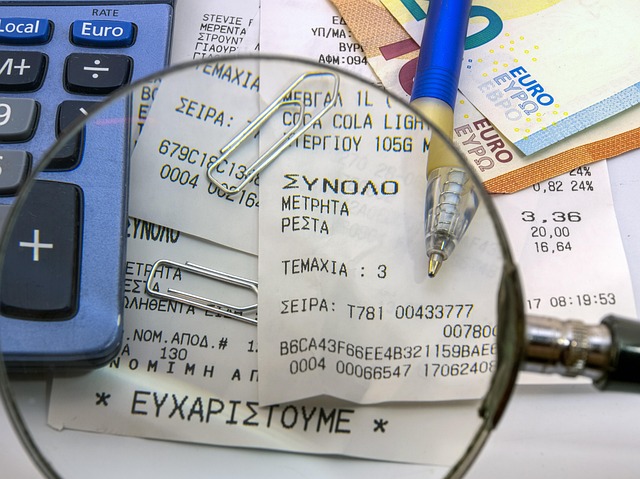

Assessing Common Moving Costs for Investors involves a nuanced understanding of various expenses that can significantly impact financial strategies. These moving costs go beyond the immediate price of relocation, encompassing a wide range of factors that investors must consider to make informed decisions. A thorough evaluation of these costs is crucial for managing expectations and avoiding unforeseen financial burdens.

One key area to scrutinize are borrower requirements associated with moving costs. Lenders often mandate specific cost structures, including appraisals, inspection fees, and legal documentation, which can vary widely depending on the market and loan type. For instance, a study by the National Association of Realtors (NAR) revealed that average closing costs for homebuyers in 2022 were around 3% to 5% of the purchase price, with some markets showing higher variations. Investors should also factor in potential penalties for early repayment or additional fees for specialized loan programs.

Additionally, investors should budget for various indirect moving costs, such as relocation assistance services, storage units, and insurance adjustments. Professional movers can offer valuable expertise but come at a cost—typically based on distance, weight, and the complexity of the move. Storage expenses, meanwhile, can vary by location, duration, and unit size. It’s essential to anticipate these variables and compare quotes from multiple service providers. For instance, self-storage facilities in urban areas might charge 15% to 20% more than their suburban counterparts.

To effectively manage moving costs, investors should adopt a proactive approach. Conducting thorough market research to understand local dynamics can help in negotiating favorable terms with lenders and service providers. Keeping detailed records of expenses and seeking professional advice tailored to individual circumstances can further mitigate surprises. By systematically assessing these common moving costs, investors can ensure smoother transitions, optimize their financial resources, and ultimately enhance the overall investment experience.

Strategizing Cost Management During Relocation

Strategizing Cost Management During Relocation

Relocating for investment purposes can be a complex process, with numerous variables influencing the overall financial burden. Effective cost management is paramount to ensuring a successful transition and maximizing returns. This section delves into the critical aspects of navigating moving costs, offering investors a strategic framework to make informed decisions. By understanding and planning for these expenses, borrowers can avoid surprises and make their investments more robust from the outset.

One of the primary areas to focus on is the direct association between moving costs and borrower requirements. According to recent industry data, the average relocation expense ranges from 1% to 3% of the total property cost, depending on distance and complexity. This means that for every $100,000 investment, investors should anticipate spending between $1,000 and $3,000 on moving costs alone. A strategic approach involves evaluating the necessity of each expense, especially when compared to the potential savings or increased rental income from the new location. For instance, a borrower considering a property in a major metropolitan area with high demand might justify higher moving costs based on the expected rent premium.

Expert advice emphasizes the importance of detailed budgeting and flexibility. Investors should create a comprehensive budget that accounts for not only direct expenses like packing materials and transportation but also indirect costs such as utilities and temporary accommodation during the transition period. A buffer within the budget allows for unexpected moving costs borrower requirements, ensuring the process remains stress-free. Additionally, staying informed about local market trends can help investors negotiate better deals and time their relocations to align with more favorable conditions, further optimizing their financial outcomes.

Optimizing Budgeting for Smooth Moves Ahead

Optimizing budgeting for smooth moves ahead is a crucial aspect often overlooked by investors when navigating the complexities of real estate transactions. Moving costs can significantly impact the financial health of both individual borrowers and investment portfolios. A comprehensive understanding of these expenses is essential to ensuring a seamless transition during property transfers, whether for renovation purposes or relocation.

The moving process involves numerous variables that contribute to its overall cost, from initial assessments and surveys to legal fees and transportation charges. For investors, managing these costs effectively means factoring in not just the direct expenses but also indirect costs such as time spent coordinating moves, potential rental income loss during transitions, and the impact on tenant relationships. According to a recent survey, the average move for an investor property can incur direct moving costs ranging from 1% to 3% of the property value, with legal fees and real estate agent commissions adding another 2-4%. This underscores the importance of meticulous budgeting and strategic planning.

To optimize budgeting, investors should begin by thoroughly evaluating their borrower requirements and considering the flexibility of loan terms. A 1-3 times analysis of expected moving costs can help in structuring loans that accommodate these expenses without straining cash flow. Additionally, exploring alternative financing options or negotiating with service providers can lead to substantial savings. For instance, coordinating multiple services bundled together might result in better rates than securing individual quotes for each aspect of the move. Expert advice suggests regularly reviewing and adjusting moving budgets throughout the investment lifecycle to account for changing market conditions and property-specific variables.