An adjustable rate mortgage (ARM) offers dynamic interest rates based on market conditions, with initial lower rates but potential annual adjustments. Property owners should assess financial stability, long-term plans, and interest rate risk tolerance before deciding. Proactive management, including staying informed and setting up alerts, is crucial for navigating ARM adjustments and ensuring long-term financial stability. Key strategies include monitoring rate tracker adjustments, budgeting for changes, understanding cap rates, and planning based on financial goals and market trends.

In today’s dynamic real estate market, understanding financing options is paramount for property owners seeking long-term financial stability. One such option gaining traction is the adjustable rate mortgage (ARM). However, navigating this complex instrument presents challenges, particularly as interest rates fluctuate. This article provides a comprehensive, actionable analysis of ARMs, equipping property owners with the knowledge to make informed decisions. We’ll demystify key concepts, explore potential benefits and risks, and offer practical strategies for managing an ARM effectively. By the end, readers will possess the tools necessary to confidently navigate this evolving mortgage landscape.

Understanding Adjustable Rate Mortgages: Basics Explained

An adjustable rate mortgage (ARM) offers property owners an alternative to a fixed-rate mortgage, with a key feature being that the interest rate can change over time based on market conditions. This type of mortgage is particularly appealing to borrowers who plan to sell or refinance their properties within a few years, as it allows for potential savings during the initial phase of the loan. The daily rate tracker, a component of many ARMs, adjusts the interest rate daily, reflecting current economic indicators, which can lead to significant fluctuations in monthly payments.

When considering an ARM, it’s crucial to understand that while initial rates might be lower than fixed-rate mortgages, they can rise or fall according to the chosen index, such as the London Interbank Offered Rate (LIBOR) or the Treasury Bill rate. For instance, if you secure a 5/1 ARM with an initial rate of 3% for the first five years, the rate will adjust annually after that based on market conditions. If rates rise, so do your mortgage payments, and conversely, if they fall, your payments decrease as well. As per recent data, ARMs have been particularly attractive in low-interest environments, allowing borrowers to secure substantial savings.

To make an informed decision, property owners should assess their financial stability, long-term plans, and tolerance for interest rate risk. Consulting with a mortgage expert can provide valuable insights tailored to individual circumstances. For those comfortable with potential rate fluctuations and looking to take advantage of lower initial rates, an ARM could be a strategic choice. However, it’s essential to stay informed about market trends and economic indicators to make timely decisions regarding refinancing or payment adjustments.

How Adjustable Rates Impact Your Property Loan

An adjustable rate mortgage (ARM) offers property owners a dynamic financing option where the interest rate fluctuates over time based on market conditions. This contrasts with fixed-rate mortgages, which maintain consistent payments throughout the loan term. Understanding how these adjustments impact your property loan is paramount for making informed decisions about your financial future.

Adjustable rate mortgages are often structured with initial fixed periods, after which the rate adjusts annually or at set intervals. For instance, a common ARM structure might offer a 5/1 ARM, where the rate remains fixed for the first five years and then adjusts every year thereafter. During the fixed period, property owners benefit from potentially lower interest rates compared to fixed-rate loans, leading to reduced monthly payments. However, after the initial period, the daily rate tracker can increase significantly, impacting the overall cost of the loan. This adjustment is tied to various factors, including economic indicators and the credit market. For example, if the underlying benchmark interest rates rise, so too will your ARM’s rate, resulting in higher monthly payments.

To mitigate risks associated with these adjustments, property owners should consider setting up payment buffers and regularly monitoring their loan health. Implementing a budget that accounts for potential rate increases is crucial. Moreover, staying informed about economic trends and market movements can help you anticipate rate changes. For instance, if inflationary pressures are on the rise, lenders may adjust rates upward to compensate for future cost-of-living expenses. By staying proactive and keeping abreast of these factors, homeowners with ARMs can better manage their loan obligations and ensure long-term financial stability.

Choosing an ARM: Factors and Considerations for Owners

Choosing an Adjustable Rate Mortgage (ARM) involves a careful balance between current affordability and future uncertainty. Property owners should consider ARMs as tools for managing interest rate risk while potentially enjoying lower initial payments compared to fixed-rate mortgages. One key component to watch is the daily rate tracker, which adjusts the interest rate based on market conditions. This feature can be beneficial during periods of falling interest rates, allowing homeowners to save money.

However, selecting an ARM requires a thorough understanding of market trends and personal financial flexibility. Factors such as credit score, loan-to-value ratio, and anticipated residence time significantly influence the terms offered by lenders. For instance, borrowers with strong credit and a higher down payment may qualify for more favorable ARMs with lower initial rates and fewer fees. Conversely, those with less stable finances should assess their ability to handle potential rate increases down the line.

Actionable advice for property owners includes comparing multiple ARM offers from different lenders, understanding break-even points between fixed and adjustable rates, and regularly monitoring market indicators like the Federal Reserve’s actions on interest rates. Additionally, setting up alerts for rate changes in your daily rate tracker can help you stay informed and make proactive decisions about refinancing if necessary. Remember, while ARMs offer potential savings, they also carry the risk of rising interest rates. By being well-informed and prepared, homeowners can leverage ARMs effectively to meet their financial goals.

Managing Your ARM: Strategies for Successful Borrowing

Adjustable rate mortgages (ARMs) offer a compelling alternative to fixed-rate loans for many property owners, providing potential savings on interest costs over the life of the loan. However, managing an ARM effectively requires a proactive approach and understanding of how these rates adjust over time. This section delves into practical strategies for successful borrowing with an ARM, focusing on empowering homeowners to make informed decisions and navigate rate fluctuations.

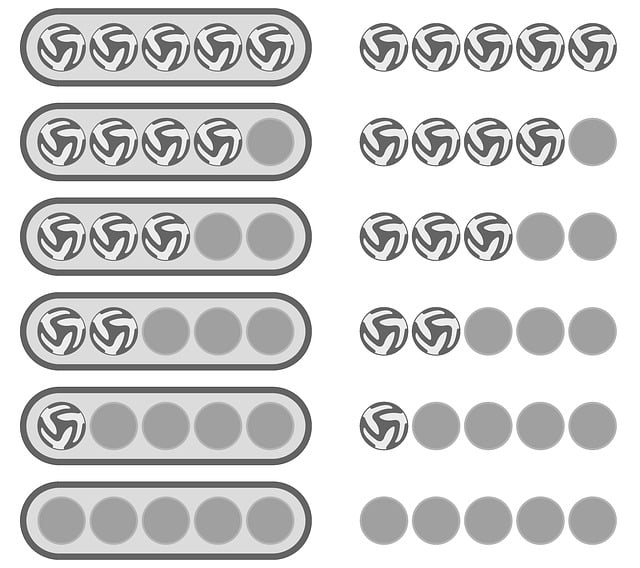

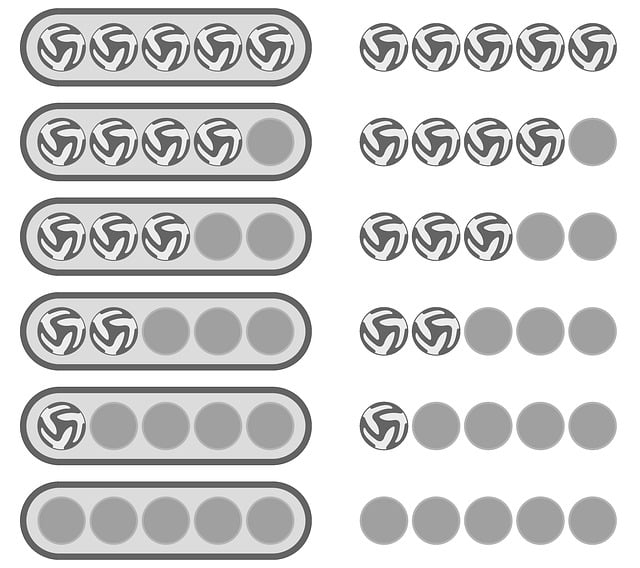

One key aspect of ARM management is staying informed about daily rate tracker adjustments. These trackers, which can change frequently, directly impact your monthly payment amounts. Regularly reviewing these updates allows you to anticipate changes and plan accordingly. For instance, if your initial interest rate was 3% and the benchmark index rises, expect a corresponding increase in your rate; conversely, falling rates could lead to lower payments. Monitoring these adjustments empowers borrowers to assess their financial position and make strategic decisions about refinancing or continuing with the ARM.

Additionally, establishing a budget that accounts for potential rate changes is crucial. Borrowers should consider not only their current income and expenses but also potential future scenarios. This includes building an emergency fund to cover unexpected costs and varying interest rates. By maintaining a disciplined budget, homeowners can ensure they remain in control of their finances even as their ARM adjusts over time. Moreover, understanding the cap rates set by your loan agreement is vital; these caps limit how much your rate can increase or decrease annually, providing stability and predictability.

Long-term planning plays a significant role in successful ARM management. Homeowners should consider their financial goals and timeline when deciding to refinance or adjust their borrowing strategy. For instance, if you plan to sell your property within the initial adjustment period, an ARM might not be the best fit due to potential rate increases. Conversely, if you intend to stay in your home for several years, an ARM could offer significant savings compared to a fixed-rate loan, especially if interest rates rise during that time. Regularly reassessing your financial situation and market trends will help guide strategic decisions regarding your ARM.