Zoning maps are indispensable tools for real estate investors, offering detailed insights into property uses, densities, and development potential. By analyzing zoning regulations and their evolution, investors can identify areas with revitalization potential, demographic shifts, and market trends, enabling strategic acquisitions and maximizing returns. Regular updates ensure compliance and profitable choices. Key takeaways:

1. Zoning maps link financial trends to regulations for strategic investment planning.

2. Analysis reveals suitable zones for mixed-use or industrial developments, diversifying portfolios.

3. Understanding constraints guides compliant, profitable decisions.

4. Staying updated on changes positions investors for long-term financial success.

Zoning maps play a pivotal role in shaping urban landscapes and investor strategies. Understanding their intricate relationship with financial trends is paramount for navigating today’s dynamic real estate market. This article delves into the comparative analysis of zoning maps and their profound impact on investors’ planning, utilizing financial trends as a compass. By examining various scenarios, we unveil how these maps influence investment decisions, development potential, and long-term profitability. Through this exploration, professionals can unlock insights that foster informed strategies, ultimately contributing to robust and sustainable urban growth.

Understanding Zoning Maps: Tools for Investor Strategy

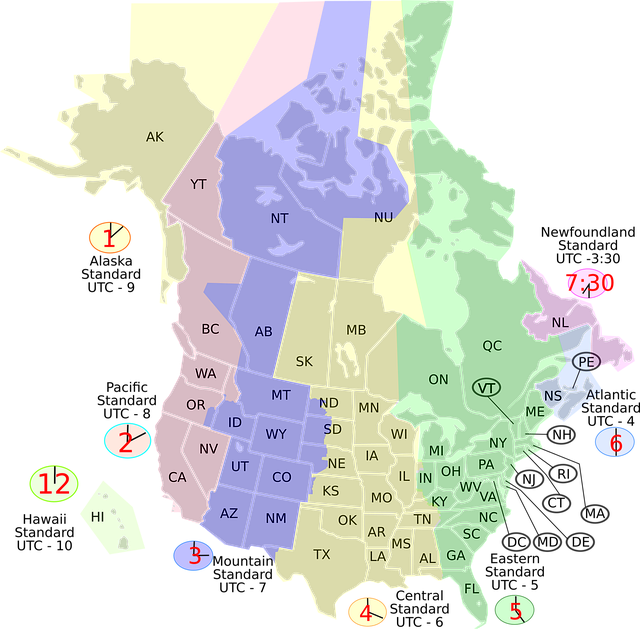

Zoning maps are indispensable tools for investors navigating the real estate landscape. These detailed plans, maintained by local governments, offer profound insights into property uses, densities, and development potential. By understanding zoning map parcel lookup and its implications, investors can make informed decisions that align with market trends and financial objectives.

For instance, a thorough examination of a zoning map reveals areas ripe for revitalization or those undergoing demographic shifts, guiding investment strategies accordingly. Consider a city experiencing an influx of young professionals; zones designated for mixed-use development with residential, commercial, and recreational spaces will likely be in high demand. Investors equipped with this knowledge can strategically acquire properties before market values escalate. Conversely, identifying declining neighborhoods through zoning map analysis allows investors to facilitate revitalization by converting underutilized industrial spaces into modern lofts or revitalizing older residential areas with thoughtful redevelopment.

Effective investment planning relies on interpreting zoning regulations and their evolution over time. Zoning map parcel lookup enables investors to assess property boundaries, accessibility, and surrounding uses. This contextual understanding is crucial for identifying opportunities that align with the area’s growth trajectory. Data-driven analysis, combined with insights from local experts, can reveal emerging trends and hidden gems. For example, a zoning change from industrial to residential in a formerly overlooked suburb could signal a growing demand for housing, attracting investors looking to capitalize on this shift. By staying abreast of such changes through regular zoning map updates, investors make informed choices that not only comply with regulations but also maximize returns.

Mapping Financial Opportunities: Trends and Zones Aligned

Zoning maps serve as a powerful tool for investors, offering a strategic advantage when identifying financial opportunities within a given area. By aligning financial trends with zoning regulations, investors can uncover specific zones that present lucrative prospects. For instance, a zoning map parcel lookup may reveal industrial areas undergoing revitalization, signaling potential for mixed-use developments. This integration of data provides a nuanced understanding of market dynamics and helps investors make informed decisions.

The mapping process involves cross-referencing financial trends with zoning classifications. Zones categorized for commercial use, for example, may exhibit higher property values and increased rental demand, indicating favorable conditions for investment. Conversely, areas designed for residential purposes could offer opportunities for buy-rent strategies or property flipping, depending on local market characteristics. Zoning maps facilitate a comprehensive analysis by visualising these patterns, enabling investors to identify emerging trends and assess their potential impact.

A practical approach is to combine financial analysis with zoning map research early in the investment planning stage. By doing so, investors can narrow down target areas and tailor their strategies accordingly. For instance, identifying zones with recent infrastructure developments or those undergoing demographic shifts provides insights into future market directions. This proactive approach leverages the interconnection between zoning regulations and financial trends, ultimately guiding investors towards profitable avenues. Moreover, staying abreast of changes in zoning maps is essential, as alterations can significantly impact investment viability.

Impact on Development: Investor Planning and Constraints

Zoning maps play a pivotal role in shaping urban landscapes and have a profound impact on investor planning strategies. When considering development projects, these maps serve as a crucial resource, delineating land use regulations and constraints. For investors, understanding the zoning map is not merely an exercise in compliance; it’s a strategic tool that guides financial decisions and influences return on investment (ROI).

A thorough analysis of the zoning map parcel lookup can reveal valuable insights into property potential. For instance, a search for specific zones within a city might disclose areas designated for mixed-use development, offering investors opportunities to capitalize on diverse revenue streams. Conversely, identifying industrial zones can attract those seeking long-term investments in established manufacturing hubs. The mapping data provides a snapshot of current trends, enabling investors to anticipate future changes and adapt their strategies accordingly.

Constraints imposed by zoning maps are significant but often overlooked. Strict zoning regulations can limit the scope of development projects, impacting potential ROI. For example, high-rise residential buildings might be prohibited in certain areas, redirecting investor focus towards more suitable low-rise developments. Understanding these constraints allows investors to make informed decisions, ensuring their projects align with local laws and maximizing profitability. By integrating zoning map analysis into their financial strategies, investors can navigate the market effectively, adapt to urban evolution, and secure lucrative opportunities.

Analyzing Market Dynamics: Financial Trends in Zoned Areas

Zoning maps play a pivotal role in shaping investors’ strategies by providing critical insights into market dynamics. When analyzing potential investment opportunities, understanding the financial trends within different zoned areas is essential. A zoning map parcel lookup becomes a powerful tool for investors, offering a granular view of local economies and property values. For instance, a commercial zone with high foot traffic might exhibit stronger rental yields over time compared to residential areas.

By studying historical data on zoning map changes and their subsequent economic impacts, investors can anticipate market shifts. This proactive approach allows them to make informed decisions about property acquisition or development. For example, recent changes in a city’s zoning regulations allowing mixed-use buildings could indicate an emerging trend towards urban densification, attracting developers seeking to capitalize on this shift. Investors who stay abreast of such trends through comprehensive zoning map analysis can position themselves strategically for long-term financial gains.

Moreover, zoning maps facilitate a nuanced understanding of local market disparities. Certain areas within a city might experience rapid gentrification due to changing zoning laws, leading to significant property value appreciation. Conversely, neglected neighborhoods with outdated zoning regulations may present opportunities for investors willing to renovate and revitalize these spaces. Effective use of zoning map data enables investors to identify undervalued assets or emerging hotspots, diversifying their portfolios and maximizing returns.

Effective Investment Strategies: Leveraging Zoning for Success

Zoning maps play a pivotal role in shaping investment strategies for savvy financial stakeholders. By meticulously studying these detailed plans, investors can uncover lucrative opportunities and navigate real estate markets with precision. A zoning map parcel lookup becomes an essential tool, allowing access to critical information about land use designations, building restrictions, and potential development rights. This data-driven approach enables investors to identify areas ripe for growth or renovation, ensuring their projects align with local regulations from the outset.

The strategic utilization of zoning maps is particularly impactful when combined with financial trends analysis. For instance, a quick lookup might reveal that a particular neighborhood is experiencing a surge in residential demand due to expanding employment opportunities nearby. This insight prompts investors to consider mixed-use developments or multi-family properties, capitalizing on the rising market dynamics. Conversely, identifying areas designated for commercial growth can signal promising sites for retail or office investments, especially when coupled with emerging consumer trends.

Expert investors recognize that zoning regulations evolve over time, reflecting changing urban landscapes. Staying abreast of these changes through regular zoning map updates is crucial to adapt investment strategies accordingly. For example, a recent shift towards mixed-use zoning in downtown areas could signal a paradigm shift from solely commercial to more diverse, vibrant communities. Investors who leverage this knowledge can pivot their portfolios, securing properties that offer both residential and retail components, thereby catering to the evolving needs of urban dwellers. By embracing the synergy between financial trends and zoning maps, investors position themselves for sustainable returns in an ever-changing market.