A mortgage payment calculator is a vital tool for first-time homebuyers. It breaks down payments into principal and interest, enabling comparisons between lenders and understanding long-term financial implications. By inputting loan details, buyers can estimate monthly payments, assess different scenarios, negotiate offers, make informed decisions, and save money by securing an affordable mortgage aligned with their budget and goals.

In the intricate journey of purchasing a home, understanding mortgage payments stands as a cornerstone for first-time buyers. Navigating complex financial landscapes can be daunting, but with the right tools, clarity emerges. This trusted article delves into the heart of the matter by offering an in-depth explanation of a mortgage payment calculator—a versatile instrument designed to simplify one’s path to homeownership. By demystifying this calculator’s functionality, we empower buyers to make informed decisions, ensuring financial confidence and peace of mind throughout their real estate endeavors.

Understanding Mortgage Payments: Basics for First-Time Buyers

Understanding mortgage payments is a critical aspect of homeownership for first-time buyers. It’s not just about knowing how much you’ll pay each month; it involves grasping the underlying components that make up your mortgage payment. This includes principal repayment, interest accrual, and other fees. Utilizing a mortgage payment calculator can significantly aid in this process by providing an accurate estimate of your monthly payments based on various factors like loan amount, interest rate, term length, and down payment.

One of the key advantages of these calculators is their ability to offer comparisons between different lenders. A mortgage payment calculator lender comparison allows you to evaluate not only the overall cost of borrowing but also the differences in monthly payments across various lenders. For instance, a 30-year fixed-rate mortgage might appear more appealing initially due to lower monthly payments compared to a 15-year fixed rate. However, the total interest paid over the life of the loan can vary significantly, making it crucial to consider the long-term implications using such calculators.

Practical insights gleaned from these tools can empower first-time buyers to make informed decisions. For example, increasing your down payment from 5% to 20% can drastically reduce the total interest paid over the life of a 30-year mortgage. Conversely, extending the term from 15 to 30 years will lower your monthly payments but result in paying more interest overall. By understanding these dynamics, buyers can tailor their financial plans accordingly, ensuring they secure not just an affordable home but one that aligns with their long-term financial goals.

Using a Mortgage Payment Calculator: Step-by-Step Guide

Using a mortgage payment calculator is a crucial step for first-time buyers navigating the complex world of homeownership. This tool, accessible online or through various financial apps, allows you to estimate your monthly mortgage payments based on key factors like loan amount, interest rate, and term. By inputting these details, borrowers can gain valuable insights into their financial obligations before committing to a specific mortgage offer.

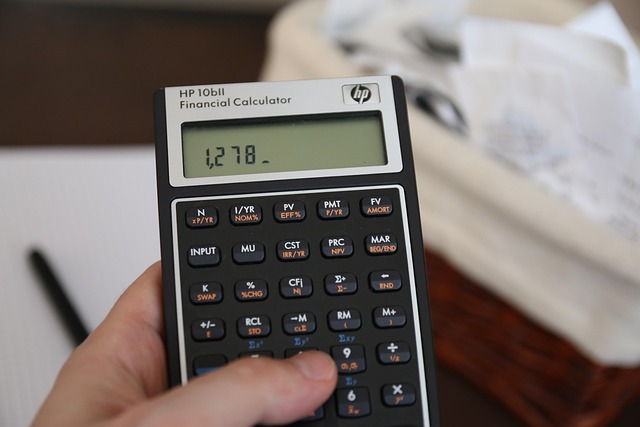

For instance, consider two individuals seeking a $300,000 30-year fixed-rate mortgage at 4% interest. Using a mortgage payment calculator, they discover that their estimated monthly principal and interest payment is approximately $1,279. This early calculation enables them to compare different lenders’ offerings effectively. A side-by-side lender comparison using such calculators can reveal variations in monthly payments, even with similar loan terms, underscoring the importance of shopping around for the best rates.

Beyond calculating the basic payment, advanced mortgage payment calculators often factor in property taxes and homeowners insurance premiums, providing a more comprehensive view. This is essential as these additional costs can significantly impact overall housing expenses. For example, in areas with higher property tax rates, borrowers might find that their total monthly housing budget increases compared to regions with lower taxes. Understanding these dynamics empowers first-time buyers to make informed decisions and budget accordingly.

Deciphering Loan Terms: Key Factors in Your Calculations

When considering a mortgage for the first time, understanding loan terms is essential to making informed decisions. A mortgage payment calculator is a valuable tool that helps demystify these terms, allowing you to project your future financial obligations accurately. Key factors like interest rates, loan term, and principal amount significantly impact your monthly payments. For instance, a $200,000 mortgage at 4% interest over 30 years will result in substantially higher overall costs compared to the same loan at 3% interest, even if the monthly payment remains constant.

Lender comparison is another crucial aspect that a mortgage payment calculator aids in. By inputting identical loan parameters across multiple lenders, you can identify potential savings or hidden fees. According to recent data, average interest rates vary among lenders, with some offering rates as low as 2.75% compared to others at 3.5%. This discrepancy can translate into savings of thousands over the life of your loan. Utilizing a mortgage payment calculator lender comparison feature enables you to objectively evaluate offers and select the most favorable terms for your situation.

Moreover, these calculators often include scenarios that factor in property taxes, homeowners insurance, and property maintenance costs. Incorporating such details ensures a more comprehensive view of your financial responsibilities as a homeowner. As a first-time buyer, it’s essential to remember that while a mortgage payment calculator provides valuable insights, it doesn’t replace professional financial advice. Consulting with a lender or financial advisor can offer personalized guidance based on your unique circumstances.

Creating a Budget: Managing Mortgage Payments with Ease

Creating a budget is an essential step for first-time homebuyers, as it allows them to understand their financial capabilities and make informed decisions regarding their mortgage payments. A mortgage payment calculator is a powerful tool that can significantly aid in this process. By inputting relevant data such as loan amount, interest rate, and loan term, potential homeowners can instantly see estimated monthly payments, breaking down complex financial concepts into manageable components.

For instance, consider a first-time buyer considering a $300,000 mortgage at 4% over 30 years. Using a mortgage payment calculator, they can quickly discover that their monthly payments would average around $1,278—a crucial piece of information for budgeting purposes. This tool enables buyers to assess different loan scenarios, compare various lenders’ offers, and make strategic choices based on their financial comfort zones. In today’s market, where interest rates fluctuate, having a mortgage payment calculator at your disposal facilitates proactive financial management.

Lender comparison is another vital aspect streamlined by these calculators. By entering identical figures for different lenders, buyers can see variations in monthly payments, which often reflect differences in loan terms and interest rates. This practice empowers them to negotiate more effectively with lenders, shop around for the best deals, and ultimately secure a mortgage that aligns with their budget and long-term financial goals. A simple lender comparison exercise using a mortgage payment calculator can save first-time buyers significant amounts over the life of their loan.