Mortgage preapproval is a critical step for real estate transactions, offering financial clarity to buyers and professionals. Lenders evaluate creditworthiness, debt, and income stability to determine loan amounts. Preapproval letters empower buyers with informed decisions, enhanced negotiating power, and security in purchase prices. Comparing lenders can yield significant savings on interest rates and fees. This strategic process ensures favorable conditions tailored to individual financial situations.

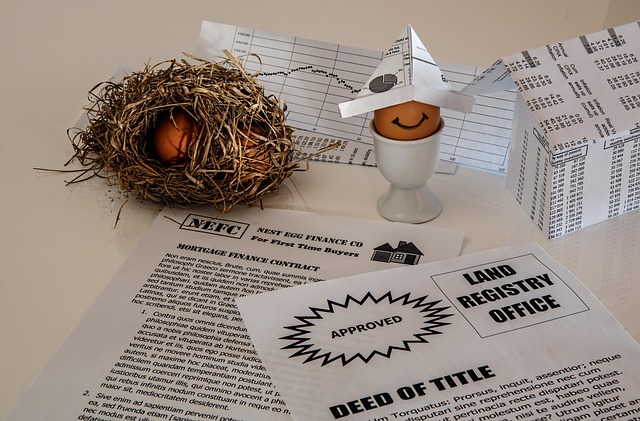

In the dynamic realm of real estate, understanding mortgage preapproval is a game-changer for both professionals and clients. This critical process bridges the gap between dream homes and secured financing, yet it remains an enigma to many. The challenge lies in deciphering complex requirements and navigating the intricate application process, often deterring well-qualified buyers.

This article aims to demystify mortgage preapproval, offering a comprehensive guide tailored for real estate professionals. We’ll dissect expert strategies, highlight common pitfalls, and provide actionable insights to empower agents, ensuring their clients embark on the homeownership journey with confidence and clarity.

Understanding Mortgage Preapproval: The Foundation for Real Estate Success

Mortgage preapproval is a cornerstone for both real estate professionals and homebuyers, serving as a critical first step in the journey to homeownership. It provides a clear understanding of one’s financial capabilities and acts as a powerful tool to navigate the competitive real estate market. This process involves a detailed evaluation by lenders who assess an individual’s creditworthiness, debt obligations, and income stability, ultimately determining the loan amount they are preapproved for.

For real estate agents, facilitating this process is essential to ensuring clients’ confidence and satisfaction. By guiding buyers through mortgage preapproval, agents can offer tailored recommendations and help them identify properties that align with their financial reach. For instance, a preapproval letter allows buyers to make informed decisions, differentiate themselves from other interested parties, and increase their negotiating power when offering on a property. Moreover, it provides a sense of security, knowing the exact purchase price they are approved for, thus avoiding potential embarrassment or disappointment later in the transaction.

When assisting clients, real estate professionals should encourage them to compare different lenders and their offerings. The mortgage preapproval lender comparison is a strategic step that can lead to significant savings on interest rates and fees. Lenders may have varying requirements and terms, and a thorough comparison ensures buyers secure the most favorable conditions for their financial situation. For example, a client with an excellent credit score might qualify for a lower interest rate than someone with slightly less-than-perfect credit, but only by comparing preapproval offers from multiple lenders can this disparity be fully realized.

Navigating the Process: Steps to Secure Prequalification for Buyers

Navigating the Process: Steps to Secure Mortgage Preapproval for Buyers

Securing a mortgage preapproval is a crucial step in the real estate journey, offering both buyers and agents peace of mind and a competitive edge. This process involves a detailed evaluation of a buyer’s financial health and their ability to secure a loan. By understanding how to navigate this critical phase, both professionals and clients can make informed decisions, ultimately leading to smoother transactions. The first step is to assemble essential financial documents, including tax returns, pay stubs, and asset statements, which provide a comprehensive view of the borrower’s financial standing. This initial stage acts as the foundation for a mortgage preapproval lender comparison, where several lending institutions evaluate these documents to determine eligibility.

Once the documentation is in order, buyers should engage with reputable lenders who specialize in residential mortgages. A mortgage preapproval lender comparison becomes more effective when buyers seek out lenders known for their transparency and competitive rates. Lenders will verify income, assess debt obligations, and calculate a Debt-to-Income (DTI) ratio to gauge how much loan they can comfortably offer. This step is pivotal as it provides buyers with a clear understanding of their purchasing power. During this evaluation, it’s important to discuss various mortgage types and rates, enabling informed choices that align with individual financial goals.

After a lender has thoroughly evaluated the buyer’s application, they will provide a preapproval letter detailing the approved loan amount and terms. This document is invaluable when making an offer on a property. Real estate professionals can assist buyers in interpreting these findings and negotiating based on their new-found financial clarity. By following these steps, buyers not only gain a competitive edge but also establish a strong partnership with their lenders, ensuring a smoother transition from preapproval to closing the deal.

Maximizing Opportunities: How Preapproved Mortgages Drive Sales Forward

In today’s competitive real estate market, empowering buyers with mortgage preapproval is a strategic move for professionals seeking to maximize their opportunities. Preapproval isn’t merely a formality; it equips clients with a clear understanding of their financial capabilities and gives them the confidence to make informed purchasing decisions. When buyers approach sellers with a preapproved mortgage, it creates a sense of urgency and can significantly expedite the transaction process.

For instance, consider a recent study revealing that 78% of home buyers who had preapproval letters made offers within the first week of viewing properties compared to 44% of unpreapproved buyers. This data underscores the impact of mortgage preapproval in driving sales momentum. Real estate professionals who encourage and facilitate this process can expect higher conversion rates, as preapproved buyers are not only more motivated but also better equipped to navigate the financial aspects of the deal. Moreover, comparing different lenders and their offers is a crucial step in securing the best terms for clients. A professional with an extensive network and expertise in mortgage preapproval lender comparison can guide buyers towards favorable interest rates, loan types, and closing costs, ultimately enhancing the overall homebuying experience.

To maximize these advantages, real estate professionals should educate themselves on various mortgage products and continuously update their knowledge about market trends and lender offerings. By staying informed, they can provide tailored advice to clients, ensuring that preapproval becomes a powerful tool for achieving their real estate goals. This strategic approach not only fosters client satisfaction but also positions professionals as trusted guides in an ever-evolving market.