A comprehensive plan is pivotal for successful investment strategies. It involves defining goals aligned with individual needs—from capital preservation for retirees to high growth for entrepreneurs. This plan integrates borrower requirements, assessing creditworthiness and market trends for dynamic adaptation. Key components include detailed project specifics, risk assessment via analytics and scenario modeling, asset allocation diversification, performance analysis, and proactive monitoring. By combining data insights with expert feedback, investors create adaptable strategies that navigate market volatility, foster collaboration, and ultimately achieve long-term growth.

In today’s dynamic investment landscape, making informed decisions requires a robust strategic framework. This article presents a comprehensive plan for investors seeking to navigate the complexities with confidence and expertise. Understanding the intricate interplay between market trends, economic indicators, and individual risk tolerances is crucial. However, many investors struggle to articulate a coherent strategy that aligns with their goals. We address this gap by offering a step-by-step guide, providing a clear roadmap for constructing a robust investment portfolio. Our approach ensures investors can make calculated moves, adapt to market shifts, and ultimately achieve long-term success in their financial endeavors.

Define Your Investment Goals: Setting the Foundation

Defining your investment goals is a critical step in crafting a comprehensive plan for investors aiming for informed decision-making. This process serves as the foundation upon which all subsequent strategies and analyses are built. The first order of business is to understand what constitutes a successful investment, whether it’s generating substantial returns, preserving capital, or achieving specific financial milestones. For instance, a retiree might prioritize low-risk investments focusing on capital preservation, while a young entrepreneur could be seeking high-growth opportunities with potential for significant returns.

Once goals are established, the comprehensive plan should delineate borrower requirements and constraints. This includes assessing creditworthiness, understanding down payment capabilities, and evaluating the borrower’s capacity to repay loans. A thorough analysis of these factors is essential in ensuring that investments align with both the borrower’s objectives and their financial health. For example, a borrower with excellent credit history and substantial savings may be eligible for more favorable loan terms compared to someone with limited credit experience. The comprehensive plan should incorporate these requirements naturally throughout its framework, guiding investors on how to navigate the complexities of the market while adhering to borrower-centric considerations.

Moreover, factoring in economic trends, industry insights, and market volatility is integral to crafting a robust comprehensive plan. Investors must remain agile, ready to adapt strategies based on changing circumstances. Regularly reviewing and reassessing investment goals allows for course correction when necessary. By combining a clear understanding of borrower requirements with a dynamic approach to market dynamics, investors can make informed choices, ultimately contributing to the success of their investment endeavors.

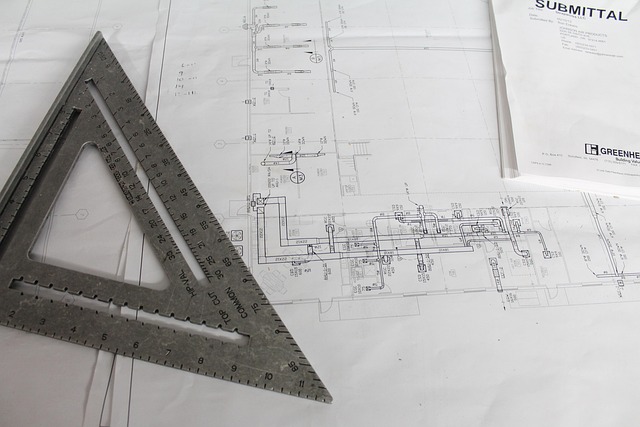

Market Research: Understanding the Landscape

Risk Assessment: Navigating Potential Challenges

Risk assessment is a cornerstone of any robust comprehensive plan for investors seeking informed decision-making. Navigating potential challenges requires a strategic approach that accounts for market volatility, operational risks, and unforeseen circumstances. A thorough risk analysis involves identifying, quantifying, and prioritizing potential threats, enabling investors to mitigate their impact. For instance, historical data can reveal recurring trends or sudden spikes in interest rates, which may jeopardize investment strategies if unaddressed. By employing advanced analytics and scenario modeling, investors gain insights into the likelihood and magnitude of various risks, facilitating more precise borrower requirement definitions.

The comprehensive plan should incorporate specific risk management frameworks tailored to different asset classes and market segments. Diversification, for example, is a powerful tool against concentrated risk; spreading investments across various sectors or geographies reduces exposure to any single source of volatility. Furthermore, setting clear risk tolerance levels and stop-loss mechanisms helps confine potential losses. Comprehensive plan borrower requirements must account for these risk management strategies, ensuring that lending criteria align with the investor’s risk profile and objectives. Regular review and adjustment of risk parameters are essential as market conditions evolve, ensuring adaptability to changing landscapes.

Beyond data-driven analysis, expert insights play a pivotal role in refining risk assessment processes. Engaging industry professionals brings diverse perspectives, enabling investors to anticipate risks that may be overlooked by quantitative models alone. Incorporating real-world knowledge and experience can illuminate complex interdependencies among economic factors, enhancing the comprehensiveness of the plan. By integrating robust risk assessments into their comprehensive strategies, investors not only protect their capital but also position themselves for sustainable long-term growth in the face of inherent market uncertainties.

Asset Allocation: Building a Balanced Portfolio

Asset allocation is a cornerstone of any comprehensive plan for investors aiming for informed decision-making. A balanced portfolio, meticulously crafted, allows for diversification across various asset classes—equities, bonds, real estate, commodities—reducing risk while maximizing potential returns. This strategic approach mirrors the age-old adage: don’t put all your eggs in one basket.

Consider a conservative investor seeking stability. Their comprehensive plan might allocate 60% to low-risk bonds and money market instruments, offering a steady stream of income with minimal volatility. The remaining 40% could be invested in blue-chip equities known for their reliability and dividend payments. This diversification is key to navigating market fluctuations. For instance, during economic downturns, bonds often retain value while equities may suffer temporary drops.

Yet, asset allocation isn’t one-size-fits-all. Aggressive borrowers might opt for a 70/30 split in favor of equities, capitalizing on higher growth potential. The comprehensive plan borrower requirements demand a thorough understanding of risk tolerance and time horizons. Risk assessment tools can aid in determining the optimal asset mix. Data from recent studies show that well-diversified portfolios consistently outperform those concentrated in single sectors over the long term.

Actionable advice dictates regular rebalancing to maintain the desired asset allocation. Market shifts can alter the risk/return profile, necessitating adjustments. Say a portfolio heavily weighted in bonds sees bond yields rise; rebalancing might involve selling some bonds and buying equities to return to the targeted allocation. This proactive approach ensures investors remain aligned with their comprehensive plan objectives, benefiting from both market upswings and downswings.

Dive into Strategies: Exploring Effective Techniques

Investing is a complex art, and for those seeking to navigate the financial landscape, a comprehensive plan is non-negotiable. This deep dive into strategies reveals effective techniques that serve as a roadmap for investors aiming for informed decision-making. The process begins with a thorough understanding of market dynamics and one’s risk tolerance, followed by a meticulous analysis of potential investments. Herein lies the essence of our approach: identifying trends, evaluating historical data, and assessing company financials. For instance, a study of tech startups over the past decade reveals that those with robust growth rates and innovative products consistently outperformed their peers.

In crafting a comprehensive plan, borrower requirements play a pivotal role. Lenders and investors alike must consider not only the creditworthiness of borrowers but also their ability to execute the proposed business strategies. This involves delving into operational details, market positioning, and competitive advantages. A case in point is the renewable energy sector, where companies with strong government support and a clear path to scalability have proven to be more resilient during economic downturns. By integrating these insights, investors can construct portfolios that not only diversify risk but also capitalize on emerging trends.

Practical steps include setting clear investment goals, diversifying across sectors, and regularly reviewing performance metrics. Additionally, staying abreast of regulatory changes and industry disruptions is paramount. For example, the rise of artificial intelligence has transformed numerous industries, creating both opportunities and challenges for investors. A comprehensive plan borrower requirements should also encompass a robust risk management framework, enabling investors to navigate market volatility while adhering to their strategic objectives.

Monitor and Adjust: Continuous Refinement

In the realm of investment strategy, a comprehensive plan is not a set-in-stone document but a living, breathing framework that adapts to market dynamics and borrower needs. Monitoring and adjusting are critical components of this continuous refinement process, ensuring investors stay ahead of the curve. Regularly evaluating performance data, industry trends, and borrower feedback allows for informed decisions on strategy shifts or pivots. For instance, analyzing loan repayment rates can reveal potential risks associated with certain demographics or sectors, prompting a more nuanced approach to future lending practices.

A robust comprehensive plan borrower requirements section is integral to this process. It should be detailed enough to capture essential risk factors and flexible enough to accommodate evolving market conditions. Investors must remain vigilant in monitoring not only traditional financial metrics but also qualitative data such as borrower satisfaction surveys and feedback on loan terms. This dual approach enables a more holistic understanding of borrower health, facilitating proactive adjustments to the comprehensive plan. For example, if survey results indicate growing concerns about loan terms, an investor might consider introducing more flexible repayment options or enhancing customer support services to mitigate potential defaults.

Actionable advice includes integrating sophisticated analytics tools and hiring experienced analysts who can interpret complex data sets. Regular meetings with industry experts and peers can also provide valuable insights into emerging trends and best practices. By fostering a culture of continuous learning, investors can adapt their comprehensive plan borrower requirements more effectively, ensuring long-term success in a dynamic market environment. Ultimately, successful monitoring and adjustment strategies transform an investment plan from reactive to proactive, enhancing its ability to navigate uncertainties and capitalize on new opportunities.