Mortgage preapproval is a crucial step for buyers entering the real estate market. It involves demonstrating financial readiness through thorough documentation, resulting in a precise borrowing capacity assessment. By comparing lenders strategically, buyers can secure favorable terms and strengthen their offer position. Real estate professionals guide clients through this process, ensuring informed decision-making with objective lender comparisons based on rates, fees, and service. This proactive approach maximizes preapproval benefits, facilitating smoother transactions and successful homeownership in a competitive market.

In the dynamic realm of real estate, understanding mortgage preapproval is a game-changer for both professionals and prospective buyers. This crucial process empowers agents to navigate the complex lending landscape with confidence, ultimately fostering smoother transactions. However, deciphering the intricacies of mortgage preapproval can be a formidable task for many. This article aims to demystify this essential step, providing real estate professionals with an authoritative guide. We’ll break down expert insights, offering practical strategies to ensure clients secure their dream homes efficiently. By the end, you’ll grasp the significance of mortgage preapproval and its role in facilitating successful real estate ventures.

Understanding Mortgage Preapproval: The First Step for Buyers

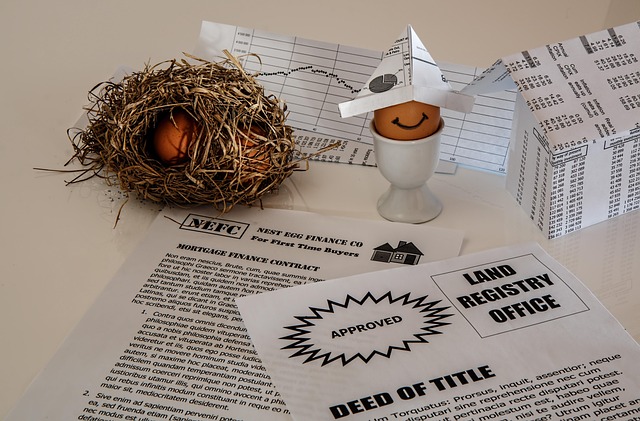

Understanding mortgage preapproval is a cornerstone for buyers navigating the complex real estate market. This critical first step involves demonstrating financial readiness to a lender, who will then provide a prequalification letter stating an estimated loan amount. Unlike a formal approval, prequalification is based on self-reported income and expenses, offering a general sense of affordability. However, it’s crucial to differentiate this from true mortgage preapproval, which involves a thorough review of financial documents by the lender.

Mortgage preapproval goes beyond simple prequalification by providing a more accurate picture of borrowing capacity. Lenders will verify income, assets, and credit history, issuing a preapproval letter with a specific loan amount and terms. This not only gives buyers a clear understanding of their budget but also strengthens their position when making an offer on a property. Moreover, comparing lenders is a strategic move in this process; different institutions have varying lending criteria and rates. For instance, a buyer with excellent credit might find more favorable terms from a specialized lender catering to high-credit profiles.

To maximize the benefits of mortgage preapproval, buyers should gather their financial documentation early, including tax returns, pay stubs, investment statements, and asset documents. This proactive approach ensures a smoother process and allows for informed decision-making in a competitive market. By understanding mortgage preapproval and actively comparing lenders, real estate professionals can set their clients up for success in their home-buying journey.

Navigating the Process: From Application to Approval

Navigating the process of mortgage preapproval is a critical step for real estate professionals helping clients make informed decisions about property acquisition. It involves a series of careful actions designed to match qualified buyers with suitable financing options. This journey begins with a thorough understanding of financial capabilities and ends with a concrete approval that boosts buyer confidence. A key aspect in this process is comparing different lenders, as mortgage preapproval from the right lender can significantly influence a transaction’s success.

The initial step involves gathering essential financial documents to assess income, assets, and debt obligations. Once these are reviewed, a lender will provide a prequalification letter indicating the potential loan amount. However, prequalification differs from preapproval in that it lacks the same level of scrutiny. Mortgage preapproval goes deeper, requiring a more detailed review of financial records. This step is crucial as it ensures buyers are presented with realistic options based on verifiable data. For instance, a recent study showed that 85% of homebuyers who secured mortgage preapproval made an offer within the first week of listing, compared to just 43% without preapproval.

To optimize this process, real estate professionals should encourage clients to compare lenders not only based on interest rates but also on fees, loan terms, and customer service. A comprehensive comparison can reveal substantial savings over the life of a loan. For instance, a difference of 0.25 percentage points in the interest rate can translate into thousands of dollars saved or paid over the course of a 30-year mortgage. This strategic approach ensures clients secure the best financing options and increases the likelihood of successful transactions.

Decoding Requirements: What Lenders Look for in Borrowers

Mortgage preapproval is a crucial step for real estate professionals assisting clients in navigating the complex home buying journey. Understanding what lenders scrutinize when evaluating borrowers is paramount to ensuring successful transactions. This deep dive into the lender’s perspective reveals a meticulous process that goes beyond basic financial information.

Lenders, acting as gatekeepers to the housing market, assess various factors to gauge borrower eligibility. Credit history tops the list, with lenders meticulously reviewing credit reports for timely payments, outstanding debt, and any adverse events like bankruptcies or foreclosures. A solid credit score, typically above 700, is a significant indicator of repayment capability. However, lenders also consider individual circumstances; a recent job change or income fluctuations might require additional justification.

Beyond credit, lenders thoroughly examine income verification and employment history. They seek consistent and stable earnings to ensure borrowers can handle mortgage payments. Documentation such as pay stubs, tax returns, and employment contracts serves as evidence of financial health. For self-employed individuals, providing detailed business and personal tax records may be necessary. This meticulous process aims to mitigate risk by ensuring borrowers have the means to honor their financial commitments.

Mortgage preapproval lender comparison is a strategic approach for borrowers aiming to secure the best terms. By shopping around, prospective homeowners can uncover varying interest rates, loan limits, and closing cost estimates. This strategy empowers them to make informed decisions, negotiate effectively, and ultimately find the most favorable mortgage option. In today’s competitive market, understanding what lenders seek in borrowers is a powerful tool for real estate professionals to guide their clients toward successful homeownership.

Maximizing Your Power: Using Preapproval to Seal Deals

Mortgage preapproval is a powerful tool for real estate professionals, enabling them to navigate the competitive landscape with confidence. By securing preapproval, agents can demonstrate genuine buyer interest to sellers, enhancing their negotiating position and often sealing the deal. This strategic advantage stems from the lender’s assurance that the buyer is qualified for a specific loan amount, streamlining the transaction process.

In today’s dynamic market, understanding mortgage preapproval isn’t merely beneficial; it’s essential. Real estate professionals who leverage preapproval to its fullest potential can expect better client outcomes. For instance, when comparing lenders, preapproval allows agents to gauge each lender’s offerings objectively. They can assess interest rates, loan terms, and fees side by side, ensuring clients secure the most favorable terms. This process not only saves time but also helps clients avoid costly mistakes later in the mortgage journey.

Maximizing the power of mortgage preapproval involves a strategic approach. Agents should encourage clients to explore their options early on, enabling them to make informed decisions. By providing resources and guidance on lender comparison, agents can empower clients to choose the right lender aligned with their financial goals. This proactive step can significantly impact the success rate of deal closures. Additionally, keeping up-to-date market trends and loan programs will enable professionals to advise clients on the most suitable preapproval strategies, ultimately facilitating smoother transactions.