An adjustable rate mortgage (ARM) offers dynamic interest rates linked to market conditions, initially lower than fixed-rate mortgages. After a fixed period, rates adjust periodically based on indices like LIBOR. Regular monitoring of credit profile and index trends is crucial for informed refinancing decisions. Effective ARM management involves tracking daily rate adjustments, setting alerts, reviewing loan statements, and diversifying investments to mitigate risks. ARMs are suitable for short-term borrowers but require proactive financial planning as rates rise over time.

In the dynamic landscape of property ownership, understanding financing options is paramount for making informed decisions. One such option gaining traction is the Adjustable Rate Mortgage (ARM). As property markets fluctuate, ARMs offer a flexible alternative to fixed-rate mortgages, potentially saving borrowers significant funds over time. However, navigating this complex instrument presents challenges. This article provides an in-depth analysis, breaking down the intricacies of ARMs and offering actionable insights for property owners. We’ll explore key factors, benefits, risks, and strategies for successful ARM management, empowering readers to make informed choices that align with their financial goals.

Understanding Adjustable Rate Mortgages: Basics Explained

An adjustable rate mortgage (ARM) offers a dynamic approach to home financing, allowing property owners to navigate shifting interest rates over time. Unlike fixed-rate mortgages, ARMs feature a variable interest rate that adjusts periodically based on market conditions. This structure can be advantageous during periods of declining rates, potentially saving homeowners significant amounts in the long run.

At its core, an ARM typically consists of an initial fixed-rate period followed by periodic adjustments linked to a specific index. For instance, a common scenario involves a 5/1 ARM, where the borrower enjoys a fixed rate for the first five years, after which the rate adjusts annually based on the performance of a benchmark index like the London Interbank Offered Rate (LIBOR). This daily rate tracker ensures that as market rates fluctuate, so does the mortgage’s interest rate.

While ARMs present potential savings, they also carry risks. Interest rate increases during the adjustable period can substantially elevate monthly payments. Homeowners must be prepared for these fluctuations and have a robust financial plan in place. Regularly reviewing and understanding the terms of one’s ARM, including the frequency of rate adjustments and the cap limits on rate increases, is crucial for effective management. By staying informed and being proactive, property owners can leverage the benefits of ARMs while mitigating their potential drawbacks.

How ARMs Work: Factors Influencing Interest Rates

Adjustable rate mortgages (ARMs) offer property owners an alternative to fixed-rate loans, with interest rates that can change over time. This flexibility is driven by market conditions and is typically tied to an index, such as the London Interbank Offered Rate (LIBOR) or the U.S. Treasury yield curve. Understanding how ARMs work involves delving into the factors that influence these interest rates.

One key factor is the daily rate tracker, which is often tied to a specific benchmark index. For instance, a common ARM might be structured with an initial fixed period (e.g., 5 years) followed by adjustments based on the daily change in the LIBOR index plus a margin. If LIBOR rates rise, so does the interest rate on the mortgage, and vice versa. This mechanism allows borrowers to benefit from falling interest rates but exposes them to potential risks when rates increase. Another influencing factor is creditworthiness; lenders typically adjust rates based on changes in the borrower’s credit score or debt-to-income ratio, as these indicators reflect an individual’s ability to repay the loan.

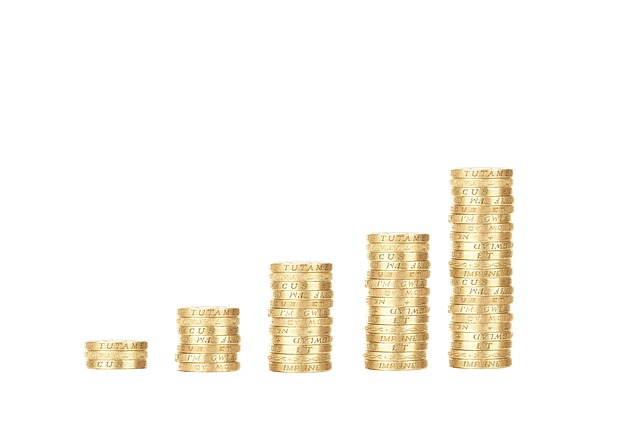

To illustrate, consider a $300,000 ARM with a 5/1 rate structure (5 years fixed followed by daily adjustments). During the initial period, the interest rate might be 4% annually, resulting in monthly payments of approximately $1,276. However, if market conditions change and LIBOR rises to 5%, the new adjustable rate could be 5.5% plus a margin, increasing the monthly payment to around $1,389. While ARMs can offer lower initial rates than fixed-rate mortgages, borrowers should carefully monitor their credit profile and the chosen index to make informed decisions about refinancing or extending the loan term when appropriate.

Benefits and Risks: Weighing Your Options with ARMs

An adjustable rate mortgage (ARM) offers property owners an alternative to traditional fixed-rate mortgages. While ARMs can be attractive due to their initial lower interest rates, understanding the benefits and risks is crucial for making an informed decision. The daily rate tracker, a key component of many ARMs, adjusts the interest rate on a regular basis based on market conditions, which can lead to significant fluctuations in monthly payments.

One of the primary advantages of an ARM is the potential for lower initial monthly payments compared to a fixed-rate mortgage. This can be particularly beneficial for borrowers who plan to sell their property or refinance within a few years, as they may not be exposed to higher rates for the entire loan term. For instance, an ARM with a 5/1 daily rate tracker starts with a fixed rate for the first five years before adjusting annually. If market rates drop during this period, borrowers can enjoy lower payments without refinancing.

However, ARMs come with substantial risks. The most significant concern is the potential for substantial increases in monthly payments over time as interest rates rise. A borrower who takes out an ARM expecting stable or decreasing rates could face unexpected higher payments, straining their budget. Data shows that during periods of rising interest rates, ARM borrowers often find themselves unable to afford their mortgage payments, leading to defaults. For example, a 30-year fixed-rate mortgage has consistent monthly payments throughout the loan term, whereas an ARM with a 1-year adjustment period could see rates increase by 2% or more in subsequent years.

To weigh your options wisely, consider consulting with a financial advisor who can provide expert insights tailored to your situation. Examining historical interest rate trends and understanding your personal financial goals are essential steps before deciding on an ARM. Additionally, evaluating the specific terms of the ARM, such as the frequency of rate adjustments and any caps on rate increases, will help you make a well-informed choice between the potential benefits and risks of an adjustable rate mortgage.

Strategies for Adjusting: Managing an ARM Effectively

Adjusting your adjustable rate mortgage (ARM) effectively is a crucial strategy for property owners to manage their financial obligations successfully. ARM daily rate trackers can help you stay ahead of potential interest rate fluctuations by providing real-time data on your loan’s variable component. This proactive approach allows homeowners to make informed decisions and adjust their budgets accordingly.

One effective strategy involves setting up alerts based on specific triggers, such as when the daily rate tracker reaches a certain threshold. For instance, if your ARM is tied to a benchmark interest rate like LIBOR or SOFR, monitoring these rates daily can give you an early warning of impending changes. Additionally, reviewing your loan statements regularly enables you to track the impact of interest rate adjustments on your monthly payments and overall debt.

Another valuable technique is comparing your ARM with fixed-rate mortgages. While ARMs offer lower initial rates, fixed-rate loans provide stability throughout the loan term. Data from recent studies shows that over a 15-year period, ARMs can be more cost-effective for borrowers who expect to sell their homes or refinance before significant rate adjustments kick in. However, for those planning to stay in their properties long-term, a fixed-rate mortgage might offer better predictability and peace of mind.

Lastly, consider diversifying your investments to mitigate ARM-related risks. Allocating a portion of your portfolio to low-risk assets can provide a financial cushion during periods of elevated interest rates. This balanced approach ensures that even if your ARM adjusts upward, your overall financial health remains stable. By combining these strategies with regular monitoring and informed decision-making, property owners can effectively manage their adjustable rate mortgages and navigate the ever-changing financial landscape.