Understanding local flood zone maps is crucial for first-time homebuyers to assess flooding risks, budget effectively, and make informed mortgage decisions. These maps categorize areas as low, moderate, or high risk, influencing insurance requirements, construction standards, and loan approvals. High-risk zones may have stricter lending criteria and higher flood insurance costs. Consulting professionals and examining the latest FEMA maps are essential steps for proactive risk management and long-term financial stability.

In the real estate landscape, understanding your property’s risk of flooding is a crucial step for any first-time buyer. With climate change and increasing extreme weather events, accessing accurate and up-to-date flood zone maps has become essential for informed decision-making. Many buyers are unaware of the potential risks lurking beneath the surface, leading to costly surprises. This comprehensive report aims to demystify the process, providing an in-depth guide to deciphering flood zone maps. By the end, readers will possess the knowledge needed to navigate this aspect of home ownership with confidence and make informed choices.

Understanding Flood Zones: A First-Time Buyer's Guide

Understanding Flood Zones is a crucial step for any first-time buyer navigating the complexities of purchasing a home. A flood zone map serves as a vital tool in this process, providing a detailed overview of areas prone to flooding based on historical data and environmental factors. These maps are not just decorative; they’re regulatory documents that influence insurance requirements, construction standards, and mortgage approvals for borrowers.

For instance, the Federal Emergency Management Agency (FEMA) publishes flood zone maps that categorize properties as being in a Special Flood Hazard Area (SFHA), which indicates high risk of flooding. Borrowers looking to finance real estate in these areas may face stricter lending criteria from lenders and insurance providers. Understanding these zones is essential for budgeting, planning, and ensuring long-term financial stability.

When purchasing a home, borrowers should request and thoroughly review the latest flood zone map available from their local government or FEMA. This map will indicate whether the property is in a low, moderate, or high-risk zone, guiding both the buyer’s decision-making process and subsequent loan application. For instance, properties in higher risk zones may require more substantial flood insurance, impacting the overall cost of homeownership. Additionally, lenders often mandate inspections to verify the risk assessment, further emphasizing the importance of a comprehensive understanding of local flood zones.

By being proactive in researching and comprehending flood zone maps, first-time buyers can make informed decisions, avoid unexpected financial burdens, and ensure their homes are protected against potential flooding risks. This knowledge equips borrowers with valuable insights during the home buying journey, fostering confidence and peace of mind as they establish their new living spaces.

Interpreting Your Local Flood Zone Map

Understanding your local flood zone map is a crucial step for first-time homebuyers, as it can significantly impact their loan options and property insurance costs. This in-depth report aims to demystify these maps and offer practical insights for borrowers. The flood zone map acts as a critical tool for lenders and insurance providers, helping them assess the risk of flooding on a particular property.

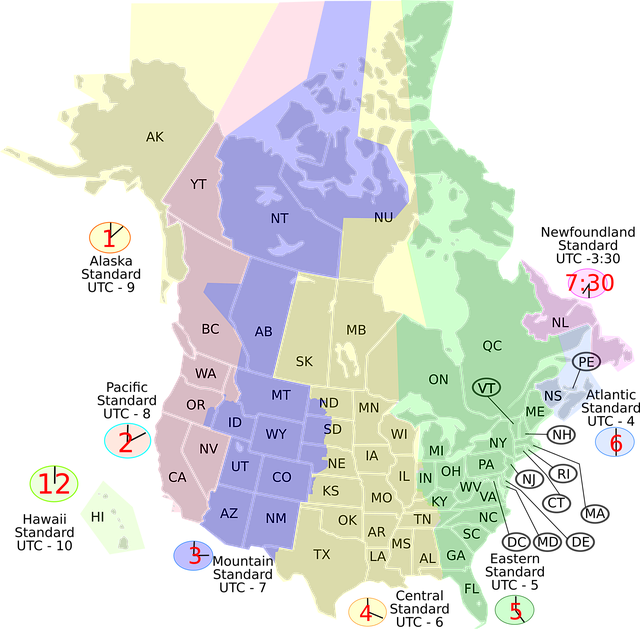

When interpreting your local flood zone map, familiarize yourself with the different zones designated by regulatory bodies like the Federal Emergency Management Agency (FEMA). These zones are typically color-coded, indicating various levels of flood risk. Zone A, for instance, represents the 1% annual chance of flooding, while lower-risk areas may be labeled as Zone X. Lenders often require borrowers in high-risk zones to obtain flood insurance, which can affect the overall cost of borrowing.

A key consideration for flood zone map borrower requirements is that properties in special flood hazard areas (SFHAs) usually face stricter lending standards. Lenders may demand more extensive documentation and higher down payments from buyers in these areas. For example, a study by the Federal Reserve Bank found that borrowers in SFHAs often received loans with higher interest rates and shorter maturities compared to those in lower-risk zones. Therefore, understanding your flood zone map is not just about insurance; it’s also a financial decision point that can influence your loan terms.

Before proceeding with a purchase, consult with a mortgage professional or real estate agent who can offer expert guidance based on local maps and regulations. They can help you navigate the unique challenges of high-risk areas and ensure you’re making informed decisions. Remember, being proactive in understanding flood zone map borrower requirements can save you from unexpected financial surprises down the line.

Assessing Risk: What the Map Reveals

When considering a property purchase, especially for the first time, understanding the intricacies of a flood zone map is paramount. This tool, meticulously designed by urban planners and environmental experts, offers a comprehensive view of areas prone to flooding, providing critical insights into potential risks. The map serves as a powerful guide for borrowers, enabling them to make informed decisions in a market where water-related hazards can significantly impact property values and safety.

A flood zone map borrower requirements should not be taken lightly. It reveals various zones classified according to their susceptibility to flooding events, ranging from high-risk areas prone to frequent inundations to low-risk sectors with minimal historical occurrence of such disasters. For instance, in coastal regions, these maps often color-code beaches and nearby residential areas based on tidal patterns and storm surges, revealing potential for sea-level rise impacts over time. Such detailed visualizations empower borrowers to assess not just immediate risks but also long-term sustainability.

Data from historical events can offer concrete evidence of a property’s vulnerability. Consider an area hit by repeated flash floods due to its location near rapid river currents; the flood zone map will likely highlight this, prompting borrowers to consider measures like improved drainage systems or elevated construction. Understanding these nuances is essential for securing mortgages, as lenders often assess risk based on these maps, influencing loan terms and interest rates. By comprehending the insights a flood zone map provides, first-time buyers can navigate the market with confidence, ensuring they invest in properties aligned with their safety and financial goals.

Impact on Property Value and Insurance

For first-time homebuyers, understanding the impact of a flood zone map on property value and insurance is crucial. These maps, maintained by federal agencies like FEMA, delineate areas prone to flooding based on historical and predictive data. Properties located in these zones face unique challenges that significantly affect both their financial value and insurability.

When a home falls within a designated flood zone, it typically experiences lower property values compared to comparable properties outside the zone. Insurance companies view flood-prone areas as higher risk, leading to elevated insurance premiums for borrowers. For instance, homes in coastal regions or low-lying areas near rivers are often subject to these effects. According to recent studies, properties in high-risk flood zones can see their value reduced by 15-30% compared to neighboring properties not affected by flooding. Furthermore, the cost of flood insurance, mandated for borrowers in most flood zones, adds several hundred dollars annually to mortgage payments, significantly impacting affordability.

Borrowers should also be aware that lenders require a detailed understanding of these maps as part of their loan approval process. Lenders use them to assess risk and ensure compliance with federal guidelines. A borrower’s failure to disclose or misrepresent flood zone information can lead to denial of financing or even legal repercussions later. As such, it’s essential for buyers to have a comprehensive grasp of the flood zone map associated with any prospective property and factor in both potential value loss and increased insurance costs in their financial planning. Consulting with real estate professionals and insurance brokers who specialize in flood zones can provide valuable insights for making informed decisions.

Mitigating Risks: Precautions for New Owners

For first-time homebuyers, navigating the complexities of property acquisition, especially in areas prone to flooding, can be a significant challenge. A crucial step in this process involves understanding and interpreting flood zone maps—essential tools designed to mitigate risks for prospective owners. These maps, mandated by federal agencies like FEMA (Federal Emergency Management Agency), categorize lands based on their susceptibility to flooding, providing vital information for borrowers and lenders alike.

One of the primary considerations for new homeowners is recognizing that a property located in or near a flood zone doesn’t necessarily equate to inevitable disaster. Instead, it offers an opportunity to be proactive about safety and financial protection. Borrowers should familiarize themselves with the specific flood zone map borrower requirements relevant to their region. This may include obtaining flood insurance, which is often mandatory for properties in high-risk areas as per federal regulations. For instance, data from FEMA indicates that nearly 10 million residential structures are located in special flood hazard areas across the United States. Understanding these zones can empower buyers to make informed decisions and take necessary precautions.

Additionally, prospective owners should consult with local experts and professionals who have experience dealing with flood zone maps. Real estate agents, surveyors, and mortgage lenders can offer valuable insights into the specific challenges and opportunities associated with buying in these areas. They can guide borrowers through the process of obtaining accurate flood zone maps, assessing potential risks, and exploring appropriate coverage options to mitigate financial losses. By taking these proactive steps, first-time homebuyers can avoid costly surprises and ensure a smoother transition into homeownership.

Community Preparedness: Beyond Individual Action

Community Preparedness: A Crucial Aspect for First-Time Buyers Navigating Flood Zone Maps

While individual preparedness is essential in flood-prone areas, it’s the collective efforts of the community that can significantly enhance resilience. For first-time buyers considering a home in these regions, understanding not just your own property but the broader neighborhood context is vital. This involves delving into local flood zone maps and appreciating how they influence not only individual homes but also entire communities. A flood zone map borrower requirement often overlooked is the need to examine community infrastructure and neighbor engagement strategies.

Data shows that well-prepared neighborhoods can mitigate damage, speed recovery, and foster a sense of unity during challenging times. For instance, in areas where neighbors collaborate on early warning systems, evacuation routes, and post-flood cleanup efforts, resilience increases exponentially. Community preparedness initiatives might include shared emergency generators, community shelters, or even locally funded flood-resistant infrastructure projects. These collective actions not only protect individual homes but also ensure that the entire neighborhood emerges stronger from potential flooding events.

First-time buyers should actively engage with their prospective communities to gauge preparedness levels. This could involve attending local meetings, joining neighborhood watch programs, or discussing plans for future resilience projects with neighbors. By embracing community preparedness as a core aspect of their homeownership journey, borrowers can make more informed decisions when navigating flood zone maps and ensuring they choose a location that not only suits their lifestyle but also aligns with robust, resilient communities.