A well-maintained home is a safe, valuable asset. The home maintenance checklist guides responsible ownership, prevents costly repairs, and enhances property value. It includes routine and seasonal tasks like plumbing checks, electrical inspections, seasonal insulation, gutter cleaning, and critical issue testing (fire alarms, smoke detectors). Proactive upkeep extends the home's lifespan, fosters security, and improves comfort while appealing to borrowers and lenders.

In the dynamic real estate market, ensuring a property’s longevity and maximizing its value is paramount for investors and homeowners alike. A comprehensive home maintenance checklist serves as a crucial tool to navigate this landscape, addressing both routine care and potential red flags. This expert article delves into the intricacies of crafting such a checklist, empowering readers with actionable strategies to maintain and enhance their properties. By providing a structured approach, we aim to equip folks with the knowledge to tackle home maintenance effectively, ultimately fostering a thriving and sustainable living environment.

Understanding Your Home Maintenance Checklist

Understanding your home maintenance checklist is a crucial step for any homeowner or prospective borrower. A well-maintained property not only ensures a safer living environment but also significantly impacts its value. For borrowers, this checklist becomes a vital component of responsible homeownership, as it influences borrowing capabilities and financial health. According to recent studies, homes that receive regular upkeep can see up to 20% more in resale value compared to neglected properties.

A comprehensive home maintenance checklist typically includes both routine and seasonal tasks. Routine checks involve inspecting plumbing for leaks, replacing air filters, and ensuring electrical systems function optimally. Seasonal tasks, on the other hand, encompass activities like preparing for extreme weather conditions, such as sealing windows during winter or trimming trees before storm season. Borrowers should be particularly mindful of these requirements, as lenders often assess property condition when evaluating loan applications. For instance, a home with well-maintained roofing and insulation may qualify for better interest rates due to its lower maintenance risk.

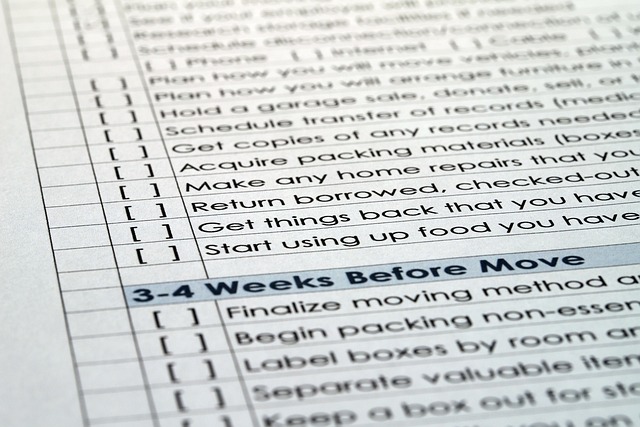

Practical insights are key to navigating this checklist effectively. Start by categorizing tasks based on urgency and frequency. Use digital tools or physical calendars to set reminders for regular inspections. Additionally, keep detailed records of all maintenance activities, including dates and costs, as these can be invaluable when applying for home loans or insurance. Regular upkeep not only extends the lifespan of your home but also provides peace of mind, ensuring that minor issues don’t escalate into costly repairs. By embracing a proactive approach to home maintenance, borrowers can demonstrate their commitment to property care, enhancing their credibility in the eyes of lenders and real estate professionals.

Regular Tasks for Optimal Home Care

Regular home maintenance is a cornerstone of preserving property value and ensuring a comfortable living environment. A well-maintained home not only retains its aesthetic appeal but also minimizes potential hazards and costly repairs. This article delves into essential tasks that comprise an effective home maintenance checklist, offering borrowers and homeowners valuable insights for optimal care.

A comprehensive home maintenance checklist should address both routine inspections and seasonal specific duties. For instance, regular checks of plumbing, electrical systems, and heating/cooling units prevent minor issues from escalating. Simple tasks like cleaning gutters in autumn or sealing windows during winter can significantly enhance energy efficiency. Borrowers particularly benefit from such practices as they mitigate potential red flags for lenders during property appraisals. A well-maintained home reflects responsible stewardship, which can positively impact borrowing capabilities and long-term investment value.

Beyond regular inspections, specific tasks target common problem areas. For example, addressing roof leaks promptly prevents water damage that could escalate into costly structural repairs. Regularly testing and replacing fire alarms and carbon monoxide detectors is crucial for safety and compliance with local regulations. These seemingly small acts of maintenance demonstrate a proactive approach to home care, fostering an environment that is both secure and enjoyable.

Developing a personalized home maintenance checklist tailored to your property’s unique needs is a powerful tool. It ensures no detail is overlooked, from minor repairs to preventive measures. Regularly reviewing and updating this list based on seasonal changes and the specific requirements of your home (e.g., age, construction) will keep your living space in top condition. Remember, proactive maintenance saves time, money, and potentially avoids catastrophic failures, making it an indispensable practice for any homeowner or borrower.

Seasonal Checks to Prevent Damage

Seasonal checks are a critical component of any comprehensive home maintenance checklist, especially for homeowners and borrowers looking to protect their investment and avoid costly repairs. As the climate shifts, so do the potential risks to your property. For instance, winter’s harsh conditions can lead to pipe bursts and frozen appliances if not adequately prepared, while summer’s extreme heat may cause power outages or damage from storms and high winds. A proactive approach involves integrating specific seasonal maintenance tasks into your routine home maintenance checklist.

A thorough home maintenance checklist borrower requirements should encompass pre-seasonal preparations. In the fall, for example, homeowners should insulate pipes, seal cracks around windows and doors, and ensure gutters are clear to prevent water damage from heavy rainfall. Similarly, in spring, inspecting and servicing air conditioning units, cleaning out chimneys, and checking for signs of pest infestation are essential. Regular seasonal assessments not only enhance energy efficiency but also safeguard against structural damage. According to recent studies, proper home maintenance can reduce repair costs by up to 30%, making these proactive measures a smart investment.

Furthermore, addressing issues early is crucial for maintaining the resale value of your property. A well-maintained home appeals to potential borrowers and can command higher market prices. Incorporating seasonal checks into your home maintenance checklist ensures that your property remains in optimal condition throughout the year. Regular inspections will also help identify potential hazards before they escalate, ensuring a safer living environment for all occupants. By prioritizing these tasks, homeowners and borrowers alike can mitigate risks, reduce long-term costs, and protect their investment in its most valuable asset—their home.

Common Issues: Quick Fixes & Prevention

In the realm of real estate, a well-maintained home not only enhances curb appeal but also significantly impacts its value. For borrowers and homeowners alike, addressing common issues promptly through a robust home maintenance checklist is paramount. Neglecting these can lead to more substantial problems, resulting in costly repairs or even reduced property value. This article delves into the critical areas of home maintenance, focusing on common issues, quick fixes, and preventive measures to ensure a seamless borrowing experience and a thriving residence.

One of the most overlooked yet essential aspects is regular inspection and upkeep of the roof. Leaks can commence from minor damages, such as missing shingles or cracked flashings, and escalate into major headaches if left unaddressed. A simple check during seasonal transitions can prevent significant water damage indoors and costly replacements later. Similarly, maintaining the exterior, including siding, windows, and doors, is crucial. These elements not only protect the internal structure but also contribute to energy efficiency. Regular cleaning and repair of gutters are vital, as clogged drains can cause water damage and even foundation issues over time.

Moreover, a comprehensive home maintenance checklist should prioritize indoor environments. Regularly changing air filters, for instance, improves air quality and reduces energy bills by enhancing HVAC system performance. Addressing plumbing issues promptly, such as leaky faucets or blocked drains, is essential to avoid mold growth and water damage. Lastly, electrical safety should never be compromised. Regularly testing smoke detectors, replacing batteries, and ensuring safe wiring practices are basic yet critical components of borrower requirements for maintaining a secure living environment. By proactively addressing these common issues through a diligent home maintenance checklist, borrowers can safeguard their investments, ensure longevity of their homes, and foster a peaceful, comfortable living space.