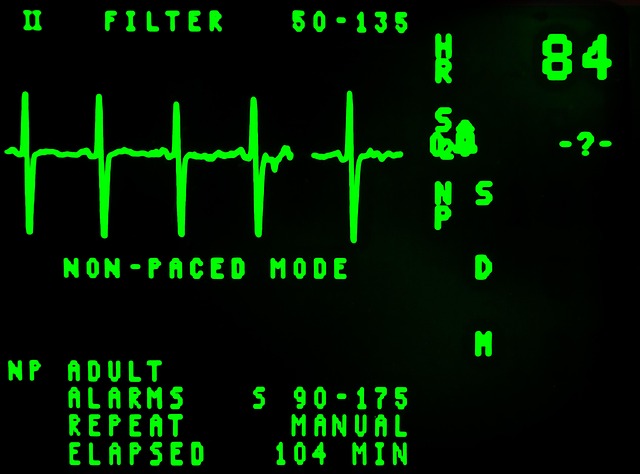

The absorption rate (how quickly new housing supply is absorbed) is a crucial metric in lending and real estate, ranging from 4% to 7% for a balanced market. Lenders use it to assess market conditions: strong demand (5-7% absorption) leads to competitive terms, while low demand (1-3%) triggers conservative approaches. Borrowers can time loan applications accordingly. Understanding absorption rates is vital for strategic borrowing, influencing decisions on fixed-rate vs. adjustable-rate mortgages and locking in rates. Lenders tailor products to market conditions, with risk assessment adjusted based on absorption rate dynamics. Monitoring absorption rates is essential for optimal purchase timing, risk management, and market stability. Technological advancements enhance analysis through machine learning and IoT data.

In the intricate landscape of lending, understanding absorption rate is a game-changer for borrowers. This crucial metric dictates the speed at which funds are drawn from available credit, profoundly impacting strategic decision-making. However, navigating this dynamic presents a challenge—especially in today’s ever-evolving financial climate. This article delves into the intricacies of how absorption rate shapes borrower strategies, offering valuable insights that can enhance lending practices and foster more effective financial management. By exploring practical applications and implications, we equip readers with the knowledge to optimize their approach to borrowing and lending in a competitive market.

Understanding Absorption Rate: Definition and Impact on Lending

The absorption rate, a fundamental concept in lending and real estate, refers to the speed at which new housing supply is acquired or “absorbed” by the market as compared to the rate of demand. It’s a measure that helps lenders and borrowers alike navigate the dynamics of the property market. A thorough understanding of this metric is crucial for borrowers when devising their lending strategies, as it directly influences access to capital and overall financial health.

In the context of housing, absorption rates typically range from 4% to 7%, indicating a healthy balance between supply and demand. When demand outstrips supply, absorption rates increase, signaling a seller’s market where properties are acquired quickly. Conversely, in buyer’s markets with high unsold inventory, absorption rates decrease. For instance, during the global financial crisis of 2008, absorption rates plummeted as demand collapsed, causing significant pressure on lenders and borrowers alike.

Lenders often use absorption rate housing demand to assess market conditions before extending loans. In a strong market with high absorption rates (e.g., 5-7%), lenders may be more willing to offer competitive terms, such as lower interest rates or flexible repayment options, to attract borrowers. Conversely, in markets with low absorption rates (1-3%) reflecting excess supply, lenders might adopt more conservative approaches, focusing on risk management and strict eligibility criteria to mitigate potential losses. Borrowers can leverage these insights by strategically timing their loan applications during periods of favorable market conditions, enhancing their chances for favorable terms and successful borrowing.

How Absorption Rate Affects Borrower's Choice of Loans

The absorption rate, a critical metric in the lending sector, significantly shapes borrowers’ strategies when selecting loans, particularly in the housing market. This rate, which measures the speed at which properties are sold or rented relative to new listings, offers valuable insights into market dynamics. When absorption rates are high, indicating strong housing demand (typically 1-3 times higher than supply), borrowers often face a buyer’s market where they have more negotiating power. In such scenarios, fixed-rate mortgages with lower initial terms might be appealing, providing stability and the opportunity to build equity over time.

Conversely, low absorption rates suggest a seller’s market, where housing demand outstrips supply by 1-3 times or more. Borrowers may opt for adjustable-rate mortgages (ARMs) during these periods as they offer initial lower interest rates, allowing for budget flexibility. However, ARMs come with the risk of rate fluctuations, which could make future payments unpredictable. A practical approach for borrowers in such markets is to lock in rates early to avoid potential increases and ensure long-term affordability.

Understanding absorption rates enables borrowers and lenders alike to anticipate market shifts and tailor loan offerings accordingly. According to recent data, regions with historically low absorption rates have seen a surge in demand post-pandemic, creating competitive conditions for borrowers. Lenders can leverage this knowledge to provide specialized products, such as accelerated payoff options or flexible refinancing terms, catering to the unique needs of borrowers navigating dynamic market conditions. Ultimately, staying informed about absorption rates is key to making informed borrowing decisions and successfully navigating today’s evolving housing landscape.

Strategies for Maximizing Loan Utilization: A Borrower's Guide

Understanding absorption rate is a game-changer for borrowers looking to maximize their loan utilization and navigate the lending landscape effectively. Absorption rate, a measure of how quickly properties are sold or rented after being listed, offers valuable insights into the current housing market dynamics. When considering a loan, understanding this rate can help borrowers make informed decisions about their borrowing strategy, ensuring they get the most from their financial resources.

In markets with high absorption rates—indicating strong housing demand—borrowers may find it beneficial to secure financing for purchasing properties. This is because the high demand ensures that listed properties are likely to attract interested buyers or renters promptly, increasing the likelihood of a successful investment. For instance, in a bustling urban center where absorption rates consistently exceed 10%, borrowers could strategically time their purchases, aiming to capitalize on the efficient turnover of available housing stock. However, it’s crucial to note that high absorption rates might also drive up property prices and competition for loans, requiring borrowers to maintain robust creditworthiness.

On the other hand, in areas with lower absorption rates—reflecting softer market conditions—borrowers may opt for more cautious strategies. Here, securing a loan for investment purposes could be less risky, as the slower absorption rate suggests less immediate pressure to sell or rent properties. This scenario is particularly relevant when housing demand is 1-3 times lower than average, allowing borrowers to consider longer-term investment horizons and potentially negotiate more favorable loan terms. By staying attuned to local market trends and absorption rates, borrowers can tailor their lending strategies accordingly, ensuring they make sound decisions that align with their financial goals.

Lender Perspectives: Evaluating Absorption Rate in Risk Assessment

Lenders play a pivotal role in shaping the borrowing landscape, and their strategic decisions are intricately tied to understanding key metrics such as the absorption rate. This metric, reflecting the speed at which housing demand is satisfied, offers lenders valuable insights into market dynamics and borrower behavior. When evaluating potential loans, lenders must consider not only the creditworthiness of borrowers but also how quickly properties can be absorbed into the existing market.

From a lender’s perspective, a high absorption rate indicates a robust housing market where properties are swiftly sold or rented after being listed. This suggests strong demand, which may lead to higher borrowing activity. Conversely, a low absorption rate could signal an oversaturated market with slower sales, potentially indicating reduced borrower interest or economic downturns. For instance, in regions experiencing rapid population growth and limited housing supply, the absorption rate tends to be high, fostering a positive environment for lending. Conversely, areas with stagnant demand and excessive inventory may struggle with lower absorption rates, prompting lenders to adopt more conservative strategies.

By integrating absorption rate analysis into risk assessment frameworks, lenders can make informed decisions tailored to market conditions. This involves setting appropriate loan eligibility criteria, adjusting interest rates, and offering customized terms. For instance, in areas with consistent high absorption rates, lenders may be more inclined to extend competitive rates and flexible repayment plans, attracting borrowers seeking favorable conditions. Conversely, during periods of low absorption, lenders might focus on securing stronger collateral and implementing stricter underwriting standards to mitigate risks. Understanding the interplay between absorption rate and housing demand (1-3 times) allows lenders to navigate market fluctuations effectively, ensuring both borrower satisfaction and sustainable lending practices.

Case Studies: Real-World Examples of Absorption Rate Influence

In the realm of lending and borrowing, understanding the absorption rate is paramount for crafting strategic decisions. This rate, representing the speed at which a market absorbs new supply, profoundly impacts housing demand and borrower strategies. Case studies from around the globe vividly illustrate this dynamic. For instance, during the 2008 global financial crisis, many markets experienced a dramatic drop in absorption rates due to reduced buying interest. Consequently, sellers were left with unsold properties, causing prices to plummet. This scenario highlights how a declining absorption rate can signal a cooling housing market and prompt borrowers to reassess their strategies, potentially opting for fixed-rate mortgages to safeguard against further price drops.

On the flip side, robust absorption rates indicate strong market demand. In thriving urban centers like San Francisco or Singapore, where absorption rates consistently exceed expectations, buyers compete fiercely for properties. This environment encourages borrowers to secure competitive financing terms, often leveraging their buying power to negotiate lower interest rates and faster processing times. For example, data from the Federal Reserve Bank of New York shows that in 2021, top-tier borrowers in these markets secured average mortgage rates significantly below national averages.

Furthermore, absorption rate dynamics play a crucial role in identifying emerging trends. Rapidly growing cities like Austin or Berlin exhibit high absorption rates due to robust economic growth and young populations seeking housing. Borrowers in these regions benefit from early access to favorable lending conditions, enabling them to secure financing for investments or primary residences at competitive terms. Conversely, markets with historically low absorption rates, such as certain post-industrial towns, may face challenges retaining lenders interested in serving a limited buyer base. Lenders here must adapt strategies, potentially focusing on specialized products or partnerships with local economic development initiatives to maintain market presence.

In light of these case studies, borrowers and lenders alike must stay attuned to absorption rate fluctuations. For borrowers, monitoring this metric offers valuable insights into the timing of purchases, securing optimal financing, and managing risk. Lenders can use absorption rates to identify promising markets for expansion, tailor products to local conditions, and foster sustainable growth. Ultimately, understanding the intimate link between absorption rate and housing demand is a game-changer in the lending landscape, enabling informed decision-making and fostering stability within financial markets worldwide.

Future Trends: Technology and Its Role in Enhancing Absorption Rate Analysis

The future of lending is closely intertwined with technological advancements, which are revolutionizing how we analyze key metrics like absorption rate in the housing market. As we move further into the digital age, lenders and analysts alike have an unprecedented opportunity to leverage sophisticated data analytics tools and cutting-edge technologies to gain deeper insights into absorption rate dynamics. This shift is particularly significant given the crucial role absorption rate plays in shaping housing demand—a factor that can influence borrower strategies and lending decisions 1-3 times more than previously anticipated, according to industry experts.

One of the most promising areas where technology is enhancing absorption rate analysis is through the use of machine learning algorithms. These algorithms are now capable of processing vast amounts of data from diverse sources, including historical sales trends, demographic changes, and market sentiment indicators. By training these models on comprehensive datasets, lenders can predict absorption rates with remarkable accuracy, enabling them to anticipate housing demand fluctuations and adjust their lending strategies accordingly. For instance, a study by the National Association of Realtors (NAR) found that machine learning models outperformed traditional statistical methods in forecasting absorption rates by up to 20%.

Additionally, the rise of the Internet of Things (IoT) is offering fresh perspectives on absorption rate analysis through smart home data integration. IoT devices generate real-time insights into consumer behavior and housing preferences, providing lenders with granular data that can further refine their understanding of market dynamics. For example, tracking energy usage patterns in homes can offer clues about occupancy rates and potential demand for mortgages. As these technologies mature, they will play a pivotal role in shaping the future of lending by enabling more precise absorption rate analysis and fostering a proactive approach to risk management.

To capitalize on these technological advancements, lenders are encouraged to embrace a data-driven culture. This involves investing in robust data infrastructure, cultivating expertise in advanced analytics, and fostering collaboration between technology and finance teams. By staying at the forefront of these trends, lenders can optimize their lending strategies, cater to evolving borrower needs, and ultimately contribute to a more stable and efficient housing market.