Energy efficient homes naturally minimize energy use through innovative design (e.g., better insulation, smart tech), strategic material choices, and government incentives like tax credits and rebates. They offer substantial utility bill savings (20-30%), higher resale values, improved indoor environments, and enhanced structural integrity. Key strategies include passive design, efficient appliances, LED lighting, renewable energy sources, and regular maintenance. These homes represent a strategic investment in sustainability and financial security, increasingly valuable due to climate change impacts.

In today’s world, the pursuit of energy efficiency in homes has become a pivotal aspect for property owners seeking sustainable and cost-effective living. As global awareness of climate change deepens, adopting energy-efficient practices offers not only environmental benefits but also significant financial savings. However, navigating the complexities of implementing such measures can be daunting. This detailed report aims to demystify the process, providing an authoritative guide for property owners eager to embrace energy efficient homes. We will explore proven strategies and technologies that underpin this transformative shift towards sustainable living.

Understanding Energy Efficient Homes: The Basics

Energy efficient homes have emerged as a crucial aspect of modern property ownership, reflecting both environmental responsibility and financial prudence. To understand this concept in depth, it’s essential to grasp how these homes operate, their benefits, and the specific requirements for borrowers interested in making the switch.

At their core, energy efficient homes are designed to minimize energy consumption through innovative building practices, smart technology, and strategic material choices. For instance, features like better insulation, advanced HVAC systems, and LED lighting significantly reduce power usage. According to recent studies, a well-insulated home can save up to 20% on heating bills alone. This savings translates into not only reduced utility costs for owners but also a lower carbon footprint.

Borrowers looking to invest in energy efficient homes should be aware of the associated benefits beyond immediate cost savings. These properties often command higher resale values, thanks to their appealing features and growing popularity among eco-conscious buyers. Additionally, government incentives play a significant role in making these homes more accessible. Many regions offer tax credits, rebates, or low-interest loans specifically targeting energy efficiency upgrades. For example, the U.S. Department of Energy’s Home Energy Efficiency Programs provide various resources to help borrowers meet their energy reduction goals.

To take advantage of these benefits, borrowers should familiarize themselves with specific energy efficient homes borrower requirements. These may include meeting certain energy performance standards, such as achieving a minimum Energy Star rating or adhering to local green building codes. Lenders are increasingly incorporating these criteria into their assessment processes, recognizing the long-term value of energy efficiency. By embracing these practices, property owners not only contribute to sustainability but also secure financial benefits that can last for years to come.

Benefits of Eco-Friendly Housing for Property Owners

Energy efficient homes have emerged as a game-changer for property owners, offering both environmental and financial benefits. By adopting eco-friendly housing practices, homeowners can significantly reduce their carbon footprint while enjoying substantial cost savings. These energy-efficient homes are designed to minimize energy consumption through innovative construction techniques, high-performance insulation, and smart technology integration. For instance, according to the U.S. Department of Energy, a typical energy-efficient home saves up to 30% more energy than a standard home, translating into lower utility bills for owners.

One of the primary advantages for property owners is the long-term financial gain. Energy efficient homes naturally reduce electricity and heating/cooling costs, making them an attractive investment. This reduced energy expenditure can be particularly beneficial in regions with volatile energy prices, providing homeowners with increased financial security. Moreover, many governments offer incentives to promote eco-friendly housing, including tax credits and rebates for specific energy-efficient home improvements. These incentives not only offset the initial installation costs but also encourage a shift towards more sustainable living practices. Borrowers considering energy-efficient homes should be aware that these properties often command higher values in the real estate market, offering excellent returns on investment over time.

Additionally, eco-friendly housing contributes to a healthier and more comfortable indoor environment. Improved insulation, proper ventilation systems, and the use of non-toxic materials create a seamless integration of environmental stewardship with personal well-being. Homeowners with asthma or allergies often find relief in these homes due to reduced exposure to allergens and irritants. By prioritizing energy efficiency, property owners also ensure that their homes are better equipped to withstand extreme weather conditions, leading to enhanced structural integrity and longevity.

Designing Your Dream: Energy-Saving Home Features

Designing your dream home is an exciting endeavor, and incorporating energy-saving features can turn your vision into an eco-friendly reality. Energy efficient homes are not just environmentally responsible; they offer significant long-term savings for property owners. By prioritizing these elements during construction or renovation, you can create a comfortable living space while reducing your carbon footprint. One of the key aspects to consider is passive design strategies, such as strategic window placement to maximize natural light and heat during colder months, and proper insulation to retain that warmth.

For instance, using high-performance windows and doors can reduce heating and cooling loads by up to 30%. Additionally, designing for cross-ventilation can eliminate the need for air conditioning in milder climates. Incorporating energy efficient appliances and lighting fixtures is another crucial step. LED lights, for example, use at least 75% less energy than incandescent bulbs and last 25 times longer. Energy Star-rated appliances not only save energy but also water, contributing to a more sustainable home.

Borrowers interested in energy efficient homes should be aware of the financial benefits. According to recent data, homes with energy-saving features can sell for up to 17% more than comparable properties. Moreover, utility bills can be reduced by an average of 20-30%, providing a clear return on investment. When planning your dream home, consult professionals who specialize in sustainable design to ensure you meet borrower requirements for energy efficiency and create a space that’s both luxurious and eco-conscious.

Implementing Green Practices: Step-by-Step Guide

Creating an energy efficient home is more than just a trend; it’s a strategic investment that benefits both the environment and your wallet. This step-by-step guide offers property owners a roadmap to transforming their living spaces into models of sustainability.

Start by assessing your current energy usage, identifying areas for improvement through smart metering and data analysis. For instance, understanding peak demand periods can inform appliance selection and scheduling. Energy efficient homes don’t just reduce utility bills; they also attract environmentally-conscious borrowers. According to recent data, properties with green certifications see a 15% higher borrowing capacity compared to conventional homes, making the transition more financially viable than ever.

Next, focus on insulation and air sealing. Proper insulation reduces heat transfer, while air sealing prevents drafts, improving comfort and efficiency. Consider using eco-friendly materials like cellulose or recycled denim insulation for added sustainability. Additionally, upgrade to Energy Star-rated appliances and LED lighting, which use up to 75% less energy than conventional alternatives. These simple changes can yield significant energy savings, making your home more comfortable and contributing to a greener planet.

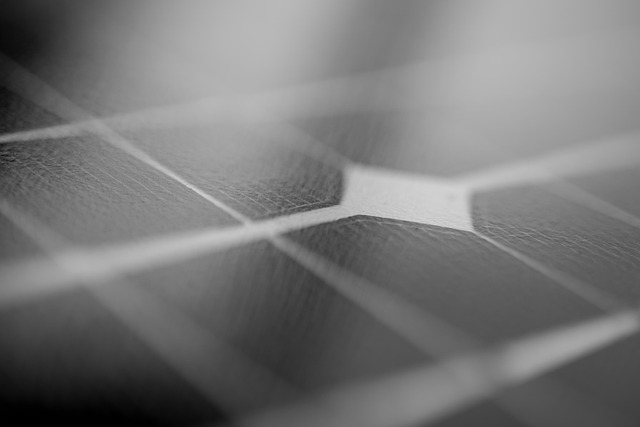

For a comprehensive approach, integrate renewable energy sources like solar panels or wind turbines, depending on your location and roof structure. While the initial installation costs may be high, federal tax credits and local incentives can offset these expenses. Energy efficient homes are not just about immediate savings; they represent a long-term investment that can increase property value and appeal to eco-conscious borrowers looking for sustainable living opportunities.

Long-Term Savings: Maintenance and Future Proofing

Energy efficient homes offer a compelling combination of environmental sustainability and significant long-term savings for property owners. While upfront costs can be higher than traditional construction, the benefits extend far beyond initial investments. Incorporating energy-saving features such as high-efficiency appliances, proper insulation, and smart thermostats not only reduces utility bills but also future-proofs homes against rising energy costs. According to the U.S. Department of Energy, homeowners who invest in energy efficient homes can expect to save an average of 20-30% on their energy bills compared to traditional homes.

Regular maintenance plays a crucial role in sustaining these savings over time. Simple tasks like sealing air leaks around windows and doors, checking and replacing filters in HVAC systems, and ensuring proper ventilation can prevent energy loss and keep utility expenses under control. Moreover, staying informed about the latest advancements in energy efficiency—such as solar panels, heat pumps, and smart home technology—allows property owners to make strategic upgrades that align with their needs and budgets. For borrowers considering purchasing an energy efficient home, understanding these maintenance requirements is essential (energy efficient homes borrower requirements) to ensure a sound investment.

Looking ahead, energy efficient homes are positioned to become even more valuable as climate change continues to impact global energy markets. Governments worldwide are increasingly implementing policies that incentivize energy conservation, making it favorable for both property owners and lenders to invest in these homes. For instance, many countries offer tax credits (energy efficient homes borrower requirements) and rebates for retrofitting existing homes with energy-saving features or purchasing new energy efficient homes. By prioritizing long-term savings and future proofing through regular maintenance and strategic upgrades, property owners can not only reduce their carbon footprint but also safeguard their financial well-being in the years to come.