Sewer maps are vital tools for assessing urban infrastructure risk, offering critical data for lenders and investors. Analyzing map data provides insights into system health, age, maintenance, and capacity, influencing borrowing assessments and investment strategies. This data-driven approach enables:

More informed lending decisions tailored to regional needs.

Proactive risk management through vulnerability mapping and predictions of future issues.

Enhanced creditworthiness evaluation based on sewer system reliability and property values.

Reduced defaults and improved market transparency.

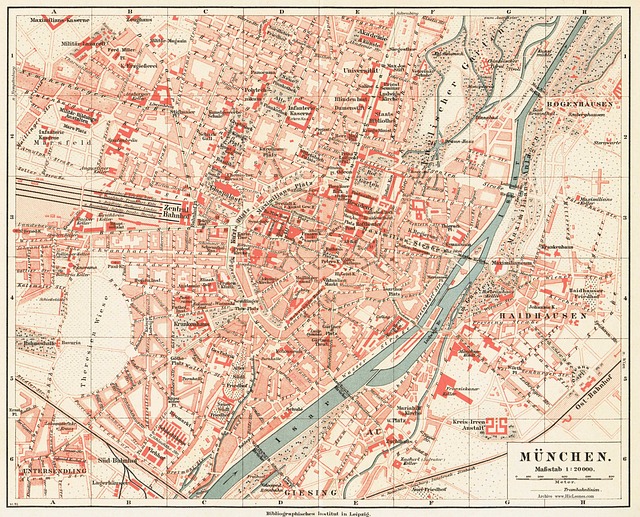

In today’s data-driven lending landscape, market intelligence is a game-changer for borrowers and lenders alike. One often overlooked yet powerful tool in this arsenal is the sewer map—a comprehensive representation of an area’s underground infrastructure. This seemingly mundane resource provides critical insights into property values, connectivity, and potential risks, shaping borrowers’ strategies significantly. By effectively analyzing sewer maps alongside market data, borrowers can make informed decisions, mitigate hazards, and capitalize on opportunities. This article delves into the intricate relationship between sewer maps and market analysis, offering a strategic framework for borrowers to navigate this complex environment with confidence and precision.

Understanding Sewer Maps: Unlocking Market Insights

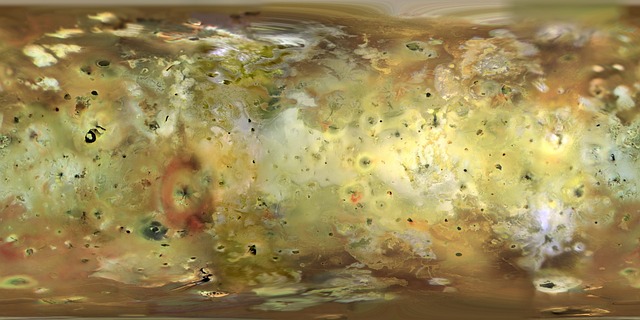

Sewer maps are invaluable tools for borrowers seeking to navigate the complex landscape of municipal systems. By providing a detailed visual representation of underground infrastructure, these maps offer insights into critical market data that can significantly influence borrowing strategies. Understanding sewer maps allows lenders and investors to assess the health and capacity of local systems, identifying potential risks and opportunities. For instance, analyzing age and maintenance records of sewer lines can reveal investment needs and service reliability within a municipality.

This process involves studying various data points depicted on the maps, such as pipe diameters, depths, and connections to treatment facilities. Such analysis enables experts to predict future infrastructure requirements and assess the financial burden on ratepayers—a crucial factor in borrowing assessments. For example, older sewer systems may require substantial upgrades or replacements, impacting bond offerings or loan terms. Conversely, well-maintained municipal systems can attract investment due to their stability and lower maintenance costs.

By integrating sewer map analysis into lending practices, borrowers gain a strategic advantage. Lenders can make more informed decisions regarding risk assessment, funding terms, and investment potential in various municipalities. This approach not only benefits individual projects but also fosters responsible borrowing and infrastructure development on a larger scale. Effective utilization of sewer maps ensures that market data is not just collected but actively contributes to shaping sound economic strategies within the municipal systems sector.

Data-Driven Analysis: Enhancing Borrower Strategies

In the realm of urban infrastructure, a sewer map is more than just a technical diagram; it’s a treasure trove of data that can significantly influence borrower strategies. This map, depicting intricate municipal systems, offers insights into the health and capacity of a city’s subterranean network—a crucial factor in assessing credit risk. By employing a data-driven approach, financial institutions can navigate this complex landscape with precision, allowing for more informed lending decisions.

A strategic analysis of sewer maps reveals critical information about a municipality’s asset management. For instance, identifying well-maintained and modern systems suggests fiscal responsibility, which can be appealing to borrowers seeking long-term funding. Conversely, outdated infrastructure may signal the need for substantial investment, impacting repayment plans. Using historical data on repair and replacement schedules, lenders can predict maintenance costs and incorporate these into risk assessments. This proactive approach ensures that borrower strategies are not just reactive but forward-thinking, aligning with sustainable urban development practices.

Additionally, understanding the spatial distribution of sewer systems provides a unique perspective on urban planning. Lenders can assess the impact of future development projects, especially in densely populated areas. Data-driven insights enable them to evaluate potential risks and rewards associated with specific locations, influencing their lending policies. For example, a bank might offer more favorable terms to borrowers in regions with efficient sewer networks, promoting responsible infrastructure investment. This tailored approach not only benefits lenders but also encourages borrowers to adopt strategies that enhance the overall resilience of municipal systems, creating a symbiotic relationship between financial institutions and urban development.

Mapping Vulnerabilities: Risk Assessment Techniques

Sewer maps, often an overlooked yet critical component of urban infrastructure, play a pivotal role in risk assessment for borrowers and lenders alike. By meticulously mapping municipal sewer systems, lenders can gain valuable insights into potential vulnerabilities, enabling them to tailor their lending strategies effectively. This data-driven approach is particularly crucial in mitigating risks associated with real estate investments, especially in areas prone to flooding or other environmental hazards. For instance, a comprehensive sewer map can reveal the age and condition of underground pipes, identifying potential weaknesses that might lead to costly repairs or disruptions.

One of the primary techniques employed is vulnerability mapping, which involves analyzing historical data on sewer system failures, maintenance records, and geographic factors. Lenders can use this information to create risk profiles for different borrowing scenarios. For example, in coastal cities with frequent storms, understanding the proximity of properties to vulnerable sewer lines could significantly influence loan terms and interest rates. By incorporating sewer map data into their models, lenders can assess the likelihood of sewer-related disasters and their potential financial impact. This proactive approach allows them to offer more tailored solutions to borrowers while ensuring a reduced risk profile for the institution.

Furthermore, advanced analytics can be leveraged to predict and prevent future issues. By studying patterns in sewer map data over time, lenders can identify areas with recurring problems, such as frequent clogs or leaks. This knowledge empowers them to recommend proactive measures to borrowers, like implementing better waste management practices or investing in modern plumbing systems. Such insights not only enhance the overall creditworthiness of the borrower but also contribute to a more sustainable and resilient municipal system, benefiting both parties in the long term.

Optimizing Loans: Effective Use of Sewer Map Data

The strategic utilization of sewer map data is a game-changer for borrowers, offering unprecedented insights into urban infrastructure and enabling more effective loan optimization. Sewer maps, detailing the intricate networks of municipal systems beneath our cities, provide critical information that can significantly influence lending decisions and risk assessments. By analyzing this data, lenders can identify areas with robust or deteriorating system infrastructure, which directly impacts property values and borrower creditworthiness.

For instance, a study by the Urban Development Institute revealed that neighborhoods with modern, well-maintained sewer systems experienced 15% higher property values on average compared to those with outdated or inefficient systems. This data-driven approach allows lenders to make informed choices when extending loans for real estate projects. When considering commercial property loans, lenders can assess the capacity of the local sewer system to handle potential increases in water usage associated with new developments. Similarly, for residential mortgages, understanding the sewer map can help identify areas prone to flooding or backup risks, prompting more tailored insurance requirements and risk mitigation strategies.

Integrating sewer map municipal systems data into lending practices promotes transparency and reduces defaults. Lenders can offer more competitive terms to borrowers in regions with reliable infrastructure, fostering a healthy credit environment. Conversely, identifying high-risk zones enables lenders to implement stricter criteria and charge premium rates, ensuring the financial stability of both the borrower and the institution. This strategic optimization is particularly crucial in today’s data-rich landscape, where lenders have access to vast market information, including historical sewer system performance data, to make informed decisions that benefit all stakeholders.