Property taxes are a crucial factor for real estate investors, impacting profitability and portfolio management. Key insights include: tax rates (1-2% of assessed value) vary by location, type, and value; understanding local policies is essential; borrowers must demonstrate sufficient capital to cover costs; strategic choices in areas with stable or declining tax rates enhance ROI; calculating taxes involves multiplying assessed value by a rate; payment terms range from semi-annual to annual; tax deductions like mortgage interest and direct property tax deductions can reduce financial burden; staying informed about local laws and policy trends is vital for compliance and maximizing returns.

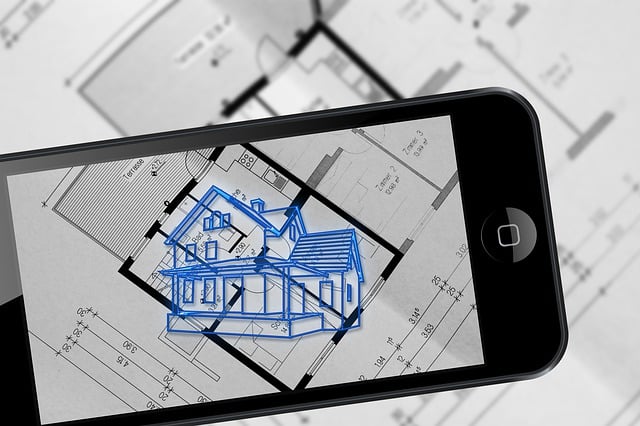

Understanding property taxes is an indispensable skill for real estate investors aiming to navigate the intricate financial landscape with confidence. These taxes, naturally, play a significant role in investment decisions, influencing profitability and long-term returns. However, navigating the complexities can be daunting. Many investors struggle to grasp the nuances of property tax assessment, appraisal methods, and available exemptions or deductions. This article provides an authoritative guide, demystifying property taxes for investors. We’ll delve into key concepts, explore practical strategies for optimization, and offer expert insights tailored to enhance your investment strategy and ensure compliance.

Understanding Property Taxes: An Essential Overview for Investors

Property taxes are a crucial aspect of real estate investing that often goes beyond basic purchase and sale transactions. Understanding property taxes is essential for investors to make informed decisions, assess profitability, and manage their portfolios effectively. These taxes, levied by local governments on ownership of property, serve as a significant revenue source but can also impact an investor’s return on investment (ROI).

For borrowers, understanding property tax requirements is vital. The amount varies widely depending on the location, type, and value of the property. For instance, in the United States, property taxes range from 1% to 2% of a property’s assessed value annually, though this can be higher in densely populated urban areas. Investors should factor these into their financial planning as they can significantly impact cash flow. A $500,000 commercial property in a major city might face property tax bills exceeding $5,000 annually, whereas a similar property in a rural area could see taxes as low as $2,000 to $3,000.

Expertise in this area involves staying informed about local tax policies and assessing their potential impact on investment strategies. Investors can optimize their tax positions by researching exemption programs or appealing assessments when warranted. Additionally, understanding property tax regulations enables investors to forecast expenses accurately, negotiate deals, and make informed decisions regarding property management and disposition. Staying ahead of these tax-related developments ensures that investors remain competitive in a dynamic market.

How Property Taxes Impact Real Estate Investment Strategies

Property taxes are a significant factor that investors must consider when delving into real estate ventures. These taxes can significantly impact investment strategies, influencing both short-term and long-term plans. Understanding how property taxes work and their implications is crucial for making informed decisions in the market. When evaluating potential properties, investors should assess not only the asset’s value but also the financial burden of property taxes, especially when considering purchasing to rent or flip properties.

The impact of property taxes on investment strategies becomes evident when analyzing borrower requirements. Lenders often consider the property tax rate as part of their assessment when extending loans for real estate investments. In many cases, lenders may require borrowers to demonstrate a sufficient financial cushion to cover these taxes, which can be 1-3 times the annual tax amount, depending on market conditions and individual lender policies. For instance, in regions with higher property tax rates, investors might need more substantial capital to navigate these costs effectively. This requirement ensures that borrowers maintain a healthy cash flow even after accounting for periodic tax payments.

Furthermore, property taxes can influence investment strategies by dictating rental rates and profit margins. Investors who opt for property flipping or long-term rentals must factor in the tax burden when setting rental prices. A thorough understanding of local tax laws and trends allows investors to anticipate these costs accurately. For example, a savvy investor might choose to acquire properties in areas with stable or declining tax rates, ensuring their investment remains profitable over time. By strategically navigating property taxes, investors can enhance their overall return on investment while adhering to borrower requirements and market dynamics.

Calculating and Paying Property Taxes: A Step-by-Step Guide

Calculating and paying property taxes is a crucial aspect of investing in real estate that requires meticulous attention to detail. Property taxes are assessed based on the value of your investment, typically calculated as a percentage of the property’s assessed value. The first step is to obtain an assessment roll or tax record from your local authority, which provides the current market value of the property. This serves as the basis for calculating your annual property tax liability.

Once you have the assessed value, apply the relevant tax rate specific to your location and investment type. Tax rates vary widely across regions and can be influenced by factors such as school districts and local services. For instance, residential properties might face a lower tax rate compared to commercial spaces. Let’s say your property is valued at $500,000 with a tax rate of 2%. Your annual property taxes would amount to $10,000 ($500,000 x 2%).

Payment terms differ across jurisdictions, but typically, borrowers are required to make semi-annual or annual payments. As a borrower, it’s essential to understand your responsibility regarding property taxes, as failure to pay can result in penalties and interest charges. Many lenders include a provision for property tax payments in the loan agreement, ensuring that taxes are covered on time. For example, if you have a mortgage, your lender may automatically deduct the tax amount from your monthly payment, streamlining the process for investors with multiple properties. Regularly reviewing and updating your budget to account for these costs is crucial for successful long-term investing.

Tax Deductions and Exemptions: Optimizing Your Property Tax Bill

Property taxes are a significant consideration for investors looking to optimize their real estate portfolios. When navigating the complex landscape of property taxes, borrowers can significantly impact their financial bottom line by understanding tax deductions and exemptions. These strategies allow investors to legally reduce their tax burden, potentially saving substantial amounts over time.

One powerful tool is the mortgage interest deduction, where taxpayers can deduct the interest paid on a property loan from their taxable income. This is particularly beneficial for real estate investors who often have substantial loans secured by their investment properties. For example, in 2022, American homeowners claimed approximately $174 billion in mortgage interest deductions, showcasing the significant impact this deduction has on taxpayers’ financial health. Property taxes borrower requirements dictate that these deductions are available as long as the property serves as a primary residence or investment property, adhering to specific criteria set by tax authorities.

Another lesser-known benefit is the ability to deduct property taxes directly from taxable income. Many states and local governments allow taxpayers to take off certain local taxes, including property taxes, when calculating their federal tax liability. This deduction can vary widely depending on the jurisdiction and the borrower’s individual circumstances. Property taxes borrower requirements for this exemption often involve submitting the necessary forms to claim these deductions accurately. For instance, in New York State, eligible taxpayers can deduct up to $10,000 in combined state and local property taxes annually.

By leveraging these tax advantages, investors can minimize their tax exposure while maximizing returns on their real estate investments. It’s crucial to consult with tax professionals who can guide borrowers through the ever-changing tax codes and ensure they take full advantage of legal deductions and exemptions available to them.

Navigating Local Laws: Ensuring Compliance in Property Taxation

Navigating local laws is a critical aspect of property taxation for investors, ensuring compliance with borrower requirements and avoiding potential penalties. Each jurisdiction has its own set of rules and regulations governing property taxes, which can be complex and vary widely from one region to another. Understanding these nuances is essential for investors looking to minimize their tax burden and maximize returns. For instance, in some areas, property taxes are assessed based on the fair market value of a property, while others use a flat rate or a combination of factors. Investors must stay informed about local assessment practices and any changes in legislation that could impact their investments.

Compliance with borrower requirements is paramount to avoid legal issues and penalties. Property tax laws often involve stringent deadlines for payments, detailed record-keeping, and specific reporting mechanisms. Borrowers are responsible for ensuring they meet these obligations, which can include providing proof of payment, maintaining accurate financial records, and notifying the appropriate authorities of any changes that might affect their tax liability. For example, failure to pay property taxes on time can result in interest charges, late fees, or even foreclosure. To ensure compliance, investors should develop robust internal processes for tracking payments and stay current with industry best practices.

Furthermore, staying abreast of recent trends in property tax policies is vital. Governments frequently update regulations to reflect changing economic conditions and public demands. These changes can include adjustments to assessment methods, exemptions for specific groups or types of properties, or modifications to appeal processes. Investors who proactively monitor these developments can anticipate potential impacts on their portfolio and make informed decisions. For instance, some jurisdictions offer incentives for energy-efficient improvements or provide tax breaks for revitalizing underserved areas. By being proactive, investors can strategically position their properties to take advantage of these opportunities.