An FHA loan offers first-time homebuyers lower down payments (as low as 3.5%) and more flexible credit requirements through government-backed insurance. Key benefits include reduced mortgage insurance costs compared to conventional loans and adaptable repayment terms. Eligibility criteria include stable employment, a minimum credit score of 580, and thorough financial documentation. The process involves preapproval, home search, application, and awareness of closing costs, particularly the Mortgage Insurance Premium (MIP). Strategic loan management through consistent payments, equity building, and staying informed on real estate trends ensures long-term success with an FHA loan.

In the dynamic real estate market, understanding financing options is paramount for property owners seeking to secure their dream homes. Among these options, FHA loans stand out as a powerful tool, especially for first-time buyers navigating the complexities of homeownership. These government-backed mortgages offer unique benefits, such as lower down payment requirements and flexible credit standards, making them an attractive choice. However, demystifying the FHA loan process is crucial to ensure informed decisions. This article provides an in-depth practical explanation, guiding readers through the intricacies of FHA loans, empowering them to make confident moves in their home-buying journey.

Understanding FHA Loan Basics: An Introduction for Property Owners

An FHA loan, or Federal Housing Administration loan, is a popular choice for property owners seeking financing, especially first-time buyers. This type of loan offers several advantages, making homeownership more accessible and affordable. At its core, an FHA loan provides government-backed insurance that protects lenders in case of default, which allows them to offer more lenient credit requirements and down payment options compared to conventional loans.

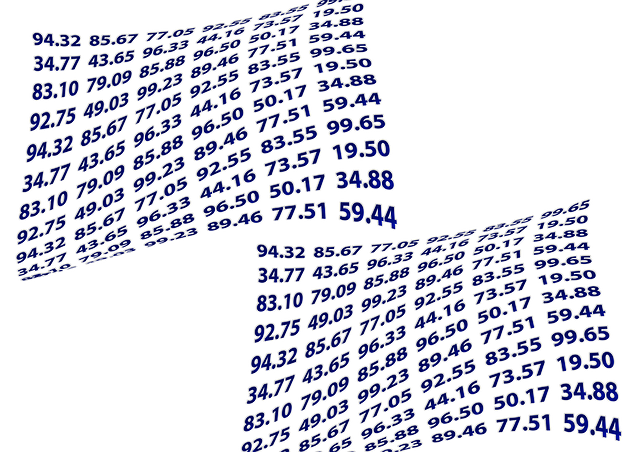

The process begins with the borrower applying for the loan through an approved lender. The FHA then assesses the property value and ensures it meets safety and quality standards. One key component is the Mortgage Insurance Premium (MIP), a cost associated with these loans. The MIP can vary, typically ranging from 1% to 2.75% of the loan amount, depending on down payment size and loan term. For instance, borrowers putting down 3.5% or more are often exempt from paying MIP annually after paying off 78% of the original loan balance. This structure encourages responsible borrowing and ensures lenders are protected while offering lower interest rates to homeowners.

Understanding these fundamentals is crucial for property owners considering an FHA loan. It’s important to weigh the benefits, such as lower down payment requirements and flexible credit standards, against potential drawbacks like higher insurance costs. For those who qualify, this option can be a game-changer in navigating the real estate market, providing a solid foundation for long-term homeownership.

Eligibility Criteria: Who Qualifies for an FHA Loan?

Understanding who qualifies for an FHA loan is crucial for prospective property owners. The Federal Housing Administration (FHA) loan program was created to encourage homeownership among eligible borrowers. To qualify, applicants must meet specific criteria related to credit history, down payment amount, and debt-to-income ratio. One key advantage of an FHA loan is that it allows for a lower down payment compared to conventional loans, as low as 3.5% of the purchase price. This accessibility has made homeownership more attainable for many first-time buyers and families with limited savings.

Eligibility for an FHA loan is determined by assessing several factors. Firstly, borrowers must have a stable employment history and demonstrate the ability to make consistent mortgage payments. The FHA requires a minimum credit score of 580 for a down payment as low as 3.5%, although higher scores can qualify for lower MIP (Mortgage Insurance Premium) costs. For instance, a borrower with an excellent credit score above 740 may only need to pay 1.75% in annual MIP, which is significantly less than the typical 2.25% for conventional loans. This cost savings can be a substantial benefit for borrowers over the life of their loan. Additionally, applicants should expect to provide detailed financial documentation and proof of income to substantiate their eligibility.

While FHA loans offer numerous advantages, they are not without requirements. Borrowers must also meet specific property criteria, such as ensuring the home meets safety, health, and zoning standards. Property appraisals are conducted to guarantee the property’s value aligns with the loan amount. Overall, understanding the eligibility criteria for an FHA loan is essential for anyone serious about purchasing a home. It enables potential owners to prepare the necessary documentation and make informed decisions regarding their financial future.

The Loan Process: Step-by-Step Guide to Applying

Applying for an FHA loan can seem like a complex process, but breaking it down step-by-step reveals a manageable path to homeownership. Here’s your guide:

1. Preapproval is Key: Begin by gathering financial documents and discussing your budget with a lender. Preapproval shows sellers you’re serious and helps you understand your purchasing power. It involves reviewing your income, assets, and credit history. This initial step ensures you meet FHA loan eligibility criteria, including minimum down payment requirements, which can be as low as 3.5% of the purchase price. Remember, preapproval isn’t a guarantee but significantly improves your chances of a successful offer.

2. Find Your Dream Home: With preapproval in hand, start house hunting. Keep in mind that an FHA loan offers flexibility with property types: single-family homes, condominiums, and townhouses are all options. During this stage, consider working with a real estate agent familiar with the process. They can guide you through the potential challenges of certain properties and help navigate any complexities. Once you find your dream home, it’s time to make an offer.

3. Application and Documentation: When submitting your offer, prepare for a detailed application process. Gather all necessary documents, including proof of income, employment history, assets, and debts. You’ll also need information about the property, such as its value and any existing loans. This step involves filling out an FHA loan application form and providing additional details about your financial situation. Be prepared to disclose any previous credit issues; the FHA requires borrowers to demonstrate good faith efforts to overcome financial setbacks.

4. Closing Cost Considerations: One important aspect of the FHA loan process is understanding the Mortgage Insurance Premium (MIP). This cost varies based on your down payment and loan amount, typically ranging from 0.80% to 1.75% of the loan balance. For example, a borrower putting 3.5% down would pay approximately 0.80% of the loan amount in MIP. It’s essential to factor this into your overall budget planning. A professional lender can help calculate and explain these costs, ensuring you’re fully informed about the financial commitment involved with an FHA loan.

Benefits and Advantages: Why Choose an FHA Loan?

An FHA loan, or Federal Housing Administration loan, offers a unique set of advantages for property owners, especially first-time buyers. Its appeal lies in several key benefits that cater to various financial situations and goals. One of the primary draws is the low down payment requirement, typically just 3.5% of the purchase price, compared to conventional loans which often demand much higher initial investments. This accessibility opens doors for prospective homeowners who may have limited savings or are new to the real estate market.

Furthermore, FHA loans provide protection through mortgage insurance, which can be a significant advantage. Unlike private mortgage insurance (PMI) on conventional loans, FHA loan insurance costs are generally lower and may even decrease over time as your equity grows. This is particularly beneficial for borrowers with less substantial down payments, ensuring they don’t face inflated monthly fees that could impact their budget. For example, according to recent data, the average annual cost of FHA loan mip is approximately 0.85% of the loan amount, which is considerably lower than PMI rates on non-FHA loans.

Additionally, these loans offer flexibility in terms of interest rates and repayment terms, catering to a wide range of borrower preferences. This adaptability allows individuals to choose a payment plan that aligns with their income and financial goals. With an FHA loan, property owners can navigate the real estate market with confidence, knowing they have access to competitive rates and terms tailored to their needs.

Managing Your FHA Loan: Repayment and Homeownership Tips

Managing your FHA loan is a crucial aspect of responsible homeownership, offering both advantages and considerations for property owners. An FHA loan, or Federal Housing Administration loan, is designed to make homeownership more accessible by providing favorable terms and low down payment requirements. However, understanding the repayment process and associated costs is essential for long-term financial stability. One key component to monitor is the Mortgage Insurance Premium (MIP), which can significantly impact your overall loan cost. The MIP for FHA loans typically ranges from 1% to 2.75% of the loan amount, with higher down payments reducing this expense.

Repayment strategies play a pivotal role in managing your FHA loan effectively. Property owners should aim to make timely monthly payments to avoid penalties and maintain favorable interest rates. Setting up automatic payments or enrolling in payment plans can ensure consistency and prevent missed deadlines. Additionally, exploring options for refinancing or modifying the loan terms can help reduce MIP costs over time, especially if market conditions change. For instance, a borrower with an FHA loan with a 3.5% down payment might be eligible for a re-evaluation of their MIP if they make on-time payments for several years and their FICO score improves.

Building equity through consistent repayment is another vital tip for managing your FHA loan responsibly. As you pay down the principal, you increase your ownership stake in the property, providing financial security and potential long-term savings. Moreover, understanding local real estate trends can help homeowners make informed decisions about when to sell or refinance, optimizing their investment in the property. By staying proactive and informed, property owners can navigate the FHA loan process successfully, ensuring a solid foundation for their homeownership journey.