The absorption rate, measuring properties sold vs. new listings, is a critical real estate metric. High rates indicate strong demand, driving prices up and offering higher appreciation; low rates suggest cooler markets with opportunities for stable values through strategic resales. Homeowners use historical data to analyze market dynamics, guiding purchase timing, pricing, and investment decisions. Regular monitoring of absorption rates, along with economic indicators, empowers informed choices in a competitive landscape. Understanding this metric is key to navigating the real estate market effectively.

Homeowners often find themselves at a crossroads when considering renovation projects, burdened by the desire to enhance property value and the financial constraints that come with it. A critical factor in this decision-making process is the absorption rate—the speed at which market trends and investments pay off. Understanding how this rate influences financial strategies is paramount for both savvy investors and those seeking to maximize their home’s potential. This article delves into the intricate relationship between absorption rates and homeowners’ choices, providing clear-cut financial insights to guide informed decisions.

Understanding Absorption Rate: Definition and Impact

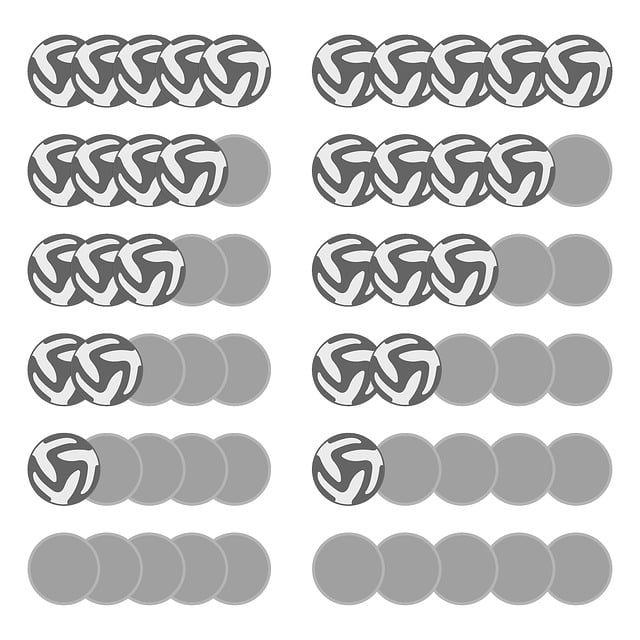

The absorption rate, a critical metric in real estate, refers to the speed at which properties are sold or rented relative to new listings. It’s a leading indicator of housing market health and significantly influences homeowners’ financial decisions. Understanding absorption rate is crucial for navigating the housing demand landscape, as it reveals whether markets are seller- or buyer-favorable. In regions with high absorption rates—meaning many homes sell quickly—sellers often command premium prices due to strong local demand. Conversely, low absorption rates suggest a potential oversupply of properties, which may lead to price negotiations and longer selling times.

Homeowners weigh these dynamics when considering sales or rentals. In markets with high absorption rates, homeowners might choose to sell at a favorable time, anticipating swift re-entry into the market as buyers. Conversely, low absorption rate environments could prompt strategic rent increases or property improvements to attract tenants quickly, ensuring consistent cash flow. For instance, a 2021 study found that areas with strong absorption rates experienced higher home price appreciation, underscoring its impact on homeowners’ financial outlooks. Tracking absorption rate becomes an essential tool for making informed decisions about the timing and terms of real estate transactions.

Experts advise homeowners to monitor local market trends, including absorption rates, to anticipate shifts in demand. This proactive approach allows them to adapt their strategies, whether selling or renting, to capitalize on favorable conditions or mitigate risks during periods of reduced absorption. By staying abreast of these metrics, homeowners can ensure their financial decisions align with the evolving dynamics of the housing market, ultimately enhancing their investment and rental strategies.

Homeowners' Financial Perspective on Absorption Rate

Homeowners’ financial decisions are intricately tied to the concept of absorption rate—a key indicator of housing market health. When considering a purchase or investment, understanding the absorption rate provides valuable insights into the demand dynamics of the local real estate market. This metric represents the number of properties sold relative to the total inventory, offering a clear picture of buyer activity and market balance. A high absorption rate signifies a robust market where buyers actively seek properties, often driving up prices and creating a seller’s market. Conversely, a low absorption rate indicates a cooler market with fewer active buyers, potentially allowing homeowners more negotiating power.

The financial perspective of homeowners is significantly influenced by the absorption rate as it directly impacts property values and resale prospects. In markets with high absorption rates—where housing demand outstrips supply—homeowners benefit from increased property appreciation. However, they may also face higher selling costs due to competitive bidding. On the other hand, owners in areas with low absorption rates can anticipate more stable property values but might need to be strategic in their resales to achieve desired outcomes. For instance, a study conducted by the National Association of Realtors revealed that homeowners in markets with balanced absorption rates (ideally around 1-3 times) tend to experience more predictable and healthy returns on their investments over time.

When making financial decisions, homeowners should consider the absorption rate housing demand plays in their desired location. Analyzing historical data on property listings, sales, and market trends can provide a realistic understanding of the current and future state of the local market. This proactive approach allows for informed choices regarding purchase timing, pricing strategies, and potential investment opportunities. By staying abreast of absorption rates, homeowners can navigate the real estate landscape with confidence, ensuring their financial decisions align with long-term goals and market realities.

Analyzing Market Trends: The Role of Absorption Rate

Homeowners and investors alike closely scrutinize various factors when navigating the real estate market, with a significant influence often stemming from the absorption rate—a critical metric that reflects housing demand dynamics. Understanding how this rate impacts their decisions is essential for making informed choices in today’s competitive landscape. The absorption rate, essentially, measures the balance between homes for sale and potential buyers, providing insights into market trends and future forecasts.

When absorption rates are high, indicating a strong supply relative to demand, homeowners may face challenges in selling their properties quickly or achieving premium prices. This scenario often prompts strategic adjustments, such as considering more competitive listing prices or exploring home upgrades to enhance appeal. For instance, in regions where new construction outpaces buyer interest, sellers might opt for renovation projects that increase the marketability of their homes. Conversely, low absorption rates signal a buyer’s market, encouraging homeowners to stay informed about market shifts and be prepared to negotiate or offer incentives to attract buyers.

Financial data plays a pivotal role in this analysis, as it helps identify trends and patterns. Historical absorption rate data, when combined with demographic insights and economic indicators, can provide valuable predictions. Homeowners and investors should monitor these rates regularly, as they are influenced by various factors including interest rates, population growth, migration patterns, and housing affordability. For example, a prolonged period of low absorption rates could indicate a growing demand for housing, potentially signaling an opportune time to invest or sell, depending on individual goals. By staying attuned to these market forces, homeowners can navigate the real estate environment with greater confidence and strategic advantage.

Strategies for Maximizing Investment Returns: Absorption Rate Considerations

Homeowners seeking to maximize investment returns in the real estate market often turn their focus to absorption rates—a critical factor influencing property values and demand. Understanding absorption rate housing demand is key to making informed decisions. This metric represents the speed at which new homes sell in a given area, offering insights into market dynamics. A high absorption rate indicates a competitive market with strong buyer interest, while a low rate suggests fewer sales and potentially more opportunities for investors.

When considering strategies for maximizing returns, homeowners should analyze historical absorption rates to identify trends. For instance, a consistent low absorption rate over several quarters may indicate an undervalued market, presenting an attractive entry point. Conversely, rapid increases in absorption rates can signal rising demand and potential price appreciation. Experts advise tracking these rates regularly using reliable data sources to anticipate market shifts. By staying ahead of the curve, investors can make timely decisions, whether it’s purchasing properties for renovation or buying undervalued assets for future resale.

Implementing effective strategies requires a nuanced understanding of local absorption rates and their impact on housing demand. For example, in regions with a historically low absorption rate, well-timed investments could yield significant returns. Conversely, markets experiencing high demand due to strong absorption rates may require careful consideration, as competition for properties can drive up prices. Homeowners should also factor in economic indicators and demographic trends that influence absorption rates. Staying informed about employment rates, migration patterns, and local infrastructure developments helps investors make data-driven choices, ensuring their strategies align with market realities.

Ultimately, maximizing investment returns involves a delicate balance between recognizing market signals through absorption rate housing demand analysis and acting swiftly to capitalize on emerging trends. By embracing this approach, homeowners can navigate the real estate landscape with confidence, leveraging their knowledge of absorption rates to secure lucrative opportunities.