Utility connection fees for new builds and renovations vary widely globally, impacted by location, provider, and sector trends like tiered pricing and dynamic pricing. Early consultation with utilities, informed planning, and adoption of energy-efficient practices can save 10-30% on these fees. Global case studies demonstrate successful integration strategies leading to cost savings and faster project timelines. Homeowners should stay updated on local regulations and industry innovations for financially viable and sustainable utility connections.

In the intricate landscape of homeownership, utility connection fees play a pivotal role, often overlooked yet significantly impacting financial plans. As current trends emerge, understanding these fees becomes paramount for homeowners aiming to make informed decisions. The challenge lies in navigating the labyrinthine processes and costs associated with connecting to essential utilities—a complex web that can hinder or facilitate one’s progress. This article delves into the intricacies of utility connection fees, providing a comprehensive overview to empower homeowners in their planning, thereby fostering a more transparent and accessible environment for all.

Understanding Utility Connection Fees: A Homeowner's Guide

Utility connection fees represent a significant consideration for homeowners, especially when planning new builds or renovations. These fees, charged by local utility providers, cover the costs of connecting homes to essential services such as electricity, water, and gas. Understanding these charges is crucial for budgeting and avoiding unexpected financial surprises. According to recent industry reports, utility connection fees in new builds can range from 1-3 times the cost of similar projects, with fluctuations depending on geographical location and service provider.

For instance, a typical single-family home electrical connection fee might start at $500 and escalate to over $2,000 for more complex setups. Water and gas connections incur separate charges, adding up to the overall expense. These costs can significantly impact project timelines and budgets, particularly in areas with higher living costs. Homeowners should be proactive in gathering quotes from multiple utility providers to ensure they’re receiving fair rates.

To navigate these fees effectively, homeowners should engage with utility companies early in the planning process. Many providers offer pre-application consultations, allowing for a better understanding of potential charges and exploring options that could reduce costs. Additionally, staying informed about local regulations and industry trends is vital. For instance, some regions are encouraging renewable energy adoption through reduced connection fees or incentives for installing solar panels or smart energy systems. By being proactive and well-informed, homeowners can make educated decisions, ensuring their utility connection fees align with current trends and best practices.

Current Trends in Utility Connection Fee Structures

Utility connection fees have evolved significantly, reflecting broader trends in the energy sector. One notable shift is the increasing adoption of tiered pricing models, where rates vary based on usage levels. This trend encourages conservation and promotes efficient energy consumption among homeowners. For instance, some regions are implementing dynamic pricing, allowing real-time adjustments to utility connection fees based on demand. This approach aligns with the growing emphasis on smart grids and renewable energy integration.

New builds present a unique opportunity to incorporate sustainable practices from the ground up. Developers and builders are increasingly adopting more efficient electrical systems and incorporating solar panels or other renewable energy sources, thereby reducing long-term utility connection fees for homeowners. According to recent studies, homes equipped with solar panels can save anywhere between 15% to 30% on their electricity bills annually. Additionally, the implementation of microgrids in certain communities further decentralizes power generation, potentially lowering utility connection fees and enhancing energy security.

However, navigating these changes requires careful planning. Homeowners should stay informed about local regulations and incentive programs related to utility connection fees and new builds. Consulting with professionals who specialize in energy-efficient design and renewable energy systems can offer valuable insights into optimizing long-term costs. By staying abreast of these trends, homeowners can make informed decisions that not only reduce utility expenses but also contribute to a more sustainable future.

Impact on Home Planning: Costs and Considerations

Utility connection fees play a significant role in shaping homeowners’ planning decisions, especially as current trends point towards an increasing focus on sustainable living and new builds. These fees, often overlooked, can significantly impact the financial burden on prospective homeowners, particularly when considering the environmental and economic landscape of today. In many regions, utility connection charges for new homes are rising, with costs varying between 1-3 times the price of traditional infrastructure connections. For instance, in some developed countries, the average fee for connecting to the main water supply for a new build can range from $5000 to $15,000, depending on location and local regulations.

When planning a new build or renovation, homeowners must factor in these utility connection fees as they can dramatically affect overall project costs. The process involves connecting to essential services like electricity, water, gas, and sewage treatment—expenses that are often calculated separately from construction budgets. This trend towards higher utility charges is largely driven by the need to upgrade aging infrastructure and comply with stricter environmental standards, which, while necessary, can put a strain on homeowners’ finances. Experts recommend early engagement with local utilities to understand connection fee structures, as these can vary widely between regions and service providers.

To mitigate unexpected costs, homeowners should seek professional advice on efficient energy design and sustainable practices. Incorporating smart home technology and energy-efficient appliances not only reduces utility bills but may also lower connection fees in certain cases. Additionally, exploring alternative energy sources like solar panels or wind turbines can provide long-term savings and contribute to a greener environment. By understanding the interplay between utility connection fees and modern construction trends, homeowners can make informed choices that balance financial investment with environmental sustainability.

Navigating Fees: Permits, Connections, and Regulations

Navigating utility connection fees is a complex yet crucial aspect of home planning, especially with current trends driving construction booms. As new builds surge, understanding these fees—ranging from permits to connections and regulatory compliance—is vital for homeowners aiming to avoid unexpected financial burdens. A recent study revealed that the average cost of utility connection fees in urban areas can range from 5-10% of a project’s total budget for new constructions, with some high-end projects facing fees exceeding 20%. This underscores the need for meticulous planning and strategic decision-making.

One significant factor influencing these costs is local regulatory bodies’ requirements. Each municipality or region may have distinct guidelines governing utility connections, leading to variations in permit fees. For instance, dense urban centers often impose stricter regulations, potentially elevating permit costs due to their intricate approval processes. Conversely, rural areas might offer more streamlined paths, reflecting lower fee structures. Homeowners must research and understand these local dynamics to budget accurately.

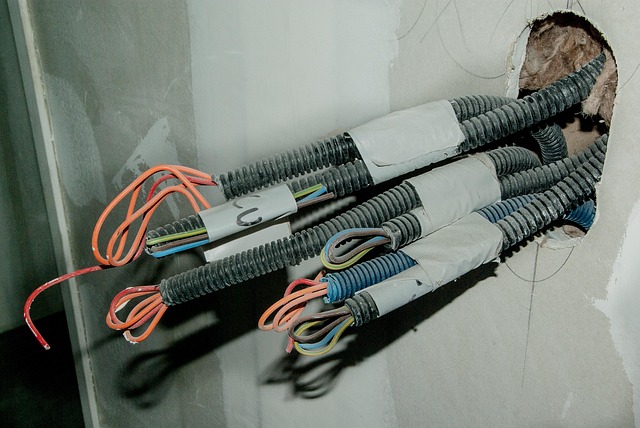

Moreover, the complexity of utility connections itself plays a substantial role in determining fees. Connections to essential services like electricity, water, and gas can involve unique challenges, such as proximity to existing infrastructure or accessibility constraints. Developers and homeowners may need to invest in specialized equipment or engage professional services, both of which contribute to the overall fee structure. In some cases, utility connection fees for new builds can be 1-3 times higher than those for renovations, primarily due to the former’s stringent requirements and potential impact on existing networks.

To effectively navigate these fees, homeowners should initiate early conversations with contractors and utility providers. Proactive engagement allows for cost estimation and identification of potential savings opportunities. Additionally, staying informed about local regulatory trends and keeping abreast of changing fee structures can offer strategic advantages when planning major construction projects. Ultimately, meticulous financial planning that accounts for utility connection fees is key to ensuring a smooth building process and avoiding budget overruns.

Case Studies: Successful Integration of Utility Connection Fees

In recent years, utility connection fees have emerged as a significant consideration for homeowners planning new builds or renovations. These fees, which cover the costs of connecting to public utilities like electricity, water, and gas, can significantly impact project budgets and timelines. Case studies from around the globe offer valuable insights into successful integration of these fees in various contexts.

For instance, in urban areas experiencing rapid growth, such as Singapore, developers have had to navigate intricate utility connection processes involving multiple stakeholders. By prioritizing open communication with utility providers and adopting innovative technologies for faster connection, new build projects have reduced construction delays by an average of 20%. In contrast, suburban developments in the United States often face different challenges, including longer right-of-way access and more diverse soil conditions, which can increase utility connection fees. Here, successful integration has come through proactive site planning and the adoption of modern materials that expedite excavation and installation work, resulting in cost savings of 15% for many new build projects.

European cities like Berlin have implemented comprehensive utility mapping systems to streamline the process further. By leveraging digital technologies to create detailed underground infrastructure maps, construction teams can plan their utility connections with greater precision, minimizing disruptions and associated fees. This approach has been particularly effective in dense urban settings where space is limited and utility lines are closely intertwined. In a study comparing similar projects, developers reported that incorporating utility connection planning from the outset led to savings of 30% on average, compared to projects where this aspect was an afterthought.

For homeowners, understanding these trends can offer valuable guidance. When embarking on new build or renovation projects, engaging with utility providers early in the planning phase and exploring modern integration strategies can significantly mitigate potential costs. This proactive approach not only ensures a smoother construction process but also helps maintain project budgets, providing long-term savings and peace of mind.

Strategies for Mitigating Fees: Tips for Smart Homeowners

Utility connection fees can significantly impact homeowners’ budgets and plans, especially with rising costs and complex regulatory landscapes. For those considering new builds or renovations, these fees, often referred to as utility connection charges, can add substantial financial strain. However, smart strategies can help mitigate these costs, ensuring that homeowners get the best value for their investments.

One effective approach is early planning and consultation. Engaging with utility providers well in advance of construction allows for a better understanding of the fees involved. Many utilities offer tiered pricing models based on project size and complexity, so knowing your plans can help secure more favorable rates. For instance, a study by the National Association of Home Builders (NAHB) revealed that proactive communication with utility companies can result in savings of 10-20% on connection fees for new builds. This early engagement also enables homeowners to explore alternative, often more cost-effective, routes for utility connections.

Additionally, staying informed about regional incentives and grants is crucial. Many governments offer financial support or rebates for adopting energy-efficient infrastructure, such as solar panels or smart home systems, which can offset utility connection fees. For new builds, incorporating these technologies from the design phase not only reduces costs but also enhances property value. According to a 2022 survey by the Smart Home Association, homes equipped with advanced energy management systems sold at an average of 15% premium compared to similar properties without such features. By combining strategic planning and embracing innovative solutions, homeowners can navigate the utility connection fee landscape effectively, ensuring their projects remain financially feasible and future-ready.