Home loan rates, expressed as APR, are influenced by borrower credit history, debt-to-income ratio, property value, and mortgage type. Excellent credit secures lower rates. Understanding fixed and adjustable mortgages is key for informed decision-making. Maintaining good credit standing and shopping around for offers can significantly impact rates. Locking in rates, especially with fixed terms, protects against market fluctuations. Experts recommend securing rates 6-12 months ahead to optimize savings.

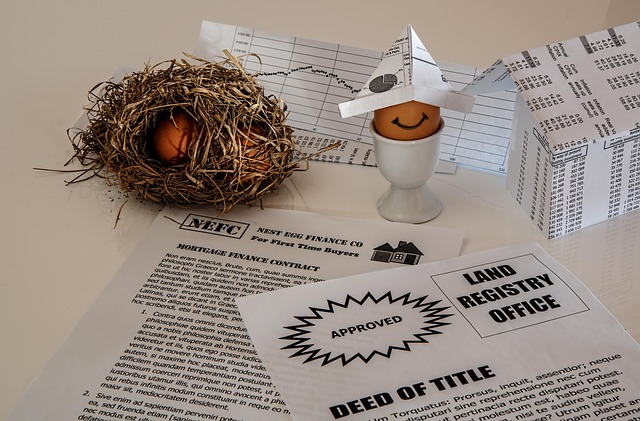

Home ownership is a cornerstone of financial stability for many individuals, but navigating the complex landscape of home loan rates can be daunting. In today’s dynamic market, understanding these rates is paramount for prospective homeowners to make informed decisions. This article provides a clear, comprehensive guide to unraveling the intricacies of home loan rates, equipping readers with the knowledge to confidently pursue their ownership goals. We delve into factors influencing these rates, demystify common terminology, and offer practical insights to help homeowners optimize their financing options in today’s competitive real estate environment.

Understanding Home Loan Rates: Basics Explained

Home loan rates are a fundamental aspect of homeownership, influencing the financial journey of borrowers significantly. Understanding these rates is crucial for any prospective homeowner, as they determine the cost of borrowing to purchase or refinance a property. The key to navigating this process lies in comprehending how these rates work and what factors contribute to them.

Put simply, a home loan rate is the annual percentage rate (APR) charged by lenders for the privilege of borrowing money to buy a house. It reflects both the base interest rate offered by the lender and any additional fees or charges associated with the loan. These rates are typically expressed as a decimal, such as 4.75%, and represent the cost of borrowing on a yearly basis. For instance, a $200,000 mortgage at 4.75% means you’d pay an additional $950 in interest each year compared to a rate of 3.5%.

Borrower requirements play a pivotal role in determining home loan rates. Lenders assess various factors before setting rates, including credit history, debt-to-income ratio, property value, and the type of mortgage sought. A strong credit profile typically secures lower rates, as it indicates responsible borrowing behavior. Conversely, borrowers with less-than-perfect credit may face higher rates to compensate for perceived risks. For example, a borrower with excellent credit might secure a 30-year fixed-rate mortgage at 3%, while a borrower with a lower credit score could expect a rate closer to 4.5% or more. It’s essential to maintain a good credit standing to access the best home loan rates available in the market.

Furthermore, understanding the terms and conditions of your home loan is vital. Fixed-rate mortgages offer consistent payments over the loan term, providing borrowers with predictability. Adjustables, on the other hand, allow for periodic rate adjustments, reflecting market fluctuations. Borrowers should consider their financial stability and long-term plans when choosing between these options. By delving into these fundamentals, homeowners can make informed decisions, negotiate better terms, and ultimately manage their home loan rates effectively.

Factors Influencing Your Mortgage Interest Rate

The home loan rates you’re offered by lenders are influenced by a multitude of factors, each playing a significant role in shaping your borrowing costs. Understanding these variables is crucial for borrowers aiming to secure the best terms on their mortgages. One of the primary determinants is your credit score; a strong credit history generally translates to more favorable home loan rates. Lenders view higher scores as an indication of responsible borrowing, which carries over into your mortgage obligations.

Another key factor is the type of loan you’re seeking. Different mortgage products cater to various borrower requirements—whether it’s a fixed-rate or adjustable-rate mortgage (ARM), each has its own set of interest rate considerations. For instance, ARMs often offer lower initial rates that can adjust over time, appealing to borrowers who anticipate potential rate fluctuations. Conversely, fixed-rate mortgages provide consistent payments throughout the loan term, offering stability and protection against rising interest rates.

The amount you put down as a down payment also impacts your home loan rates. Traditionally, larger down payments have been associated with lower interest rates as it demonstrates financial strength to lenders. However, recent trends show that even smaller down payments can result in competitive rates, especially when combined with strong creditworthiness and stable employment history. Additionally, borrower requirements for mortgage insurance or private mortgage insurance (PMI) can affect rates; loans with lower down payments often require PMI, which adds a cost that’s reflected in your home loan rate.

Types of Home Loan Rates: Fixed vs. Variable

Home loan rates are a crucial aspect of homeownership, impacting borrowers’ financial journeys significantly. When navigating the mortgage market, understanding the distinction between fixed and variable home loan rates is essential for any prospective homeowner. This fundamental choice influences the borrower’s experience over the life of their loan, affecting both monthly payments and overall interest expenditure.

Fixed home loan rates remain constant throughout the term of the loan, providing borrowers with predictable and stable repayments. For instance, a 30-year fixed-rate mortgage offers consistent monthly payments, enabling homeowners to budget effectively. This type is ideal for those seeking long-term financial security and avoiding potential interest rate fluctuations. On the other hand, variable rates are subject to change over time, typically tied to an underlying benchmark index. These loans may offer lower initial rates but carry the risk of increased payments in future periods. A common example is an adjustable-rate mortgage (ARM), where rates can adjust periodically based on market conditions. Borrowers should carefully consider their financial goals and tolerance for risk when selecting a variable rate option.

The choice between fixed and variable home loan rates depends on individual circumstances. For borrowers planning to stay in their homes for an extended period, fixed rates offer stability and protection against rising interest rates. In contrast, those who anticipate potential moves or prefer the flexibility of lower initial payments might opt for variable rates, acknowledging the associated risks. Understanding these differences is vital for borrowers to make informed decisions tailored to their specific requirements (e.g., 1-3 times the loan amount) and financial landscapes.

How to Get the Best Home Loan Rate: Strategies

Securing the best home loan rate is a strategic process that requires an understanding of the market, your financial health, and the specific requirements of lenders. As a homeowner or prospective buyer, navigating these factors can significantly impact your long-term financial obligations. Here’s a deep dive into the strategies to optimize your chances of securing favorable home loan rates.

One of the primary determinants of home loan rates is your credit score. Lenders view this as an indicator of your ability to repay the loan. A higher credit score generally translates to better interest rates and more favorable terms. Regularly checking your credit report and taking steps to improve your score, such as paying bills on time and reducing debt, can make a substantial difference. According to recent studies, borrowers with excellent credit scores often secure home loans at rates 0.5% to 1% lower than those with fair or poor credit.

Another crucial aspect is the type of loan program you choose. Conventional loans, backed by private financial institutions, typically offer better rates for borrowers with strong credit histories and substantial down payments. In contrast, government-backed loans like FHA or VA mortgages may be more accessible but often come with higher interest rates. Shop around to compare offers from different lenders, keeping in mind that even a small variation in home loan rates can lead to significant savings over the life of your loan. For instance, a reduction of 0.25% in your interest rate for a $300,000 loan over 30 years would save you approximately $10,000 in interest expenses.

Borrower requirements also play a substantial role. Lenders assess your income-to-debt ratio, employment history, and overall financial stability. Demonstrating robust financial health through consistent employment and low debt levels significantly improves your chances of securing the best home loan rates. Providing detailed financial documentation during the application process can help lenders gauge your eligibility accurately. Additionally, being pre-approved for a mortgage before shopping for a home gives you a competitive edge, as it shows sellers that you are a serious buyer ready to act quickly.

Comparing Lenders: Shopping for Competitive Rates

When considering a home loan, shopping around for competitive home loan rates is paramount to securing the best deal for your financial future. This process involves comparing lenders and understanding the unique offerings they bring to the table. It’s not merely about finding the lowest rate; it’s about aligning your loan with your specific borrower requirements. For instance, a fixed-rate mortgage might appeal to borrowers seeking stability over the long term, while an adjustable-rate loan could be more attractive to those looking for initial cost savings.

Lenders typically offer a range of products catering to various risk profiles and financial goals. They assess your creditworthiness, income stability, and debt obligations to determine eligibility and set home loan rates. This assessment is crucial as it dictates the interest you’ll pay throughout the loan term. A borrower with excellent credit and minimal debts may qualify for lower rates compared to someone with a less-than-perfect credit history. For instance, according to recent data, borrowers with high credit scores often secure rates around 3% or lower, while those with fair credit might face rates in the mid-4% range.

To maximize savings and ensure you’re getting the best home loan rates for your needs, borrowers should take an active approach. This involves gathering quotes from multiple lenders, comparing not just rates but also fees and terms. It’s wise to consider not only the current market conditions but also predicting future trends. As interest rates fluctuate, locking in a rate now could protect you from potential increases down the line. Additionally, understanding borrower requirements—such as your desired loan amount and repayment period—will enable lenders to tailor their offers more effectively.

Locking in Your Rate: Protecting Your Investment

Locking in your home loan rate is a strategic move to protect your investment and ensure long-term financial stability. In today’s dynamic market, where home loan rates fluctuate regularly, this step becomes even more critical for borrowers. When you secure a fixed rate, it offers several advantages, especially for those planning their financial future. For instance, consider a borrower who locks in a 30-year, 4% fixed rate mortgage. This guarantees that their monthly payments remain consistent throughout the loan term, providing budget predictability and protection against potential rate hikes.

The process involves careful evaluation of your financial position and the current market trends. Lenders offer various rate options tailored to different borrower profiles and requirements—be it a first-time buyer or someone refinancing. It’s crucial to assess your creditworthiness, as lenders will consider factors like credit score, debt-to-income ratio, and down payment when determining eligibility for lower home loan rates. For instance, borrowers with excellent credit and a substantial down payment might qualify for competitive rates in the 3% range. Staying informed about these borrower requirements is essential to accessing the best available home loan rates.

Experts suggest that locking in your rate at least six months to a year ahead of time can offer significant benefits. This strategy allows borrowers to take advantage of lower rates while avoiding the uncertainty of future market changes. For instance, data from recent years indicates that early rate-locking can save homeowners thousands of dollars over the life of their loan. It’s a proactive approach that demonstrates financial foresight and ensures peace of mind as you navigate the intricate world of home loan rates and borrower requirements.