Tax assessors critically value properties using factors like location, economy, and trends, impacting market dynamics and buyer strategies. Their records offer historical insights into property values, helping buyers make informed decisions in competitive markets. Accessing tax assessor data allows buyers to anticipate financial commitments, identify undervalued properties, and time purchases effectively, ensuring successful navigation of today's real estate landscape.

In the dynamic real estate market, effective planning for buyers is paramount to securing their investment and ensuring a smooth transaction. One often overlooked yet pivotal player in this process is the tax assessor—a figure whose impact on buyer strategies cannot be underestimated. Understanding how tax assessment data influences market trends empowers buyers to make informed decisions. This article delves into the intricate relationship between tax assessors, market factors, and buyer planning, providing valuable insights for those navigating the complexities of real estate transactions. By exploring these dynamics, we offer a comprehensive guide for savvy buyers aiming to optimize their strategies.

Understanding Tax Assessor's Role in Property Valuation

The role of a tax assessor goes beyond simply calculating property taxes; it significantly influences buyers’ planning and market dynamics by playing a pivotal part in property valuation. Tax assessors are responsible for appraising real estate properties within their jurisdiction to determine their market value, which is crucial information for prospective buyers, sellers, and investors alike. Accurate assessments ensure fair taxation based on property values, but they also have indirect effects on the overall market.

Tax assessor property records serve as a critical resource for understanding local real estate trends. These records provide detailed insights into historical property values, assessment methods, and changes over time. Buyers can leverage this data to gauge whether a property’s listed price aligns with its true value. For instance, comparing recent assessments against historic data might reveal unexpected spikes or dips, indicating potential market distortions or areas of growth. This information empowers buyers to make informed decisions, negotiate prices effectively, and avoid overpaying.

An expert tax assessor understands the various factors that influence property values, including location, neighborhood amenities, local economy, and market trends. They consider these elements when appraising a property, ensuring a comprehensive evaluation. For example, an assessor might account for recent infrastructure developments or changes in zoning regulations that could impact a property’s desirability and value. By staying abreast of such factors, tax assessors provide a vital service to the market, enabling buyers to plan their financial strategies accordingly. This knowledge is essential for navigating competitive real estate environments and securing favorable purchases.

Market Factors: How Tax Assessments Influence Buyer Decisions

Tax assessors play a pivotal role in shaping buyer planning within market dynamics. Their primary responsibility to accurately value properties through tax assessor property records influences key decisions for prospective purchasers. This process impacts not only individual transactions but also broader market trends. Understanding how these assessments work is essential for buyers aiming to make informed choices, especially in competitive real estate environments.

Market factors, such as location, supply, and demand, are inherently linked to tax assessor data. Property values derived from assessors’ records form the basis for property taxes, which can significantly affect buyer budgets. For instance, higher assessed values often lead to increased property taxes, potentially altering a buyer’s affordability parameters. This relationship underscores the importance of assessing market conditions in conjunction with tax assessor information. By scrutinizing both, buyers can anticipate potential financial commitments and adjust their strategies accordingly.

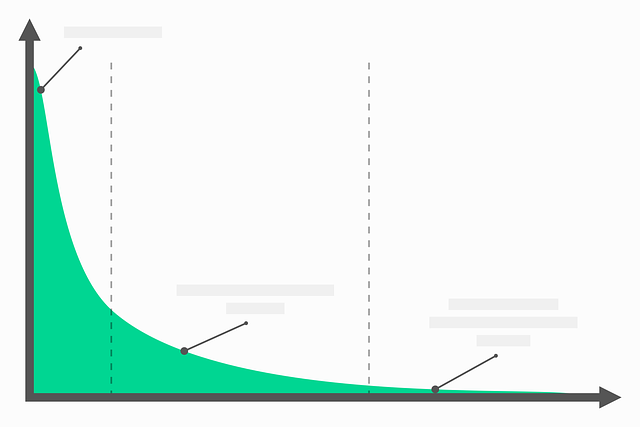

Moreover, tax assessor property records provide valuable insights into neighborhood dynamics. Consistent assessments over time indicate stable or rising property values, indicating a healthy market. Conversely, sudden fluctuations may signal emerging trends or red flags. Buyers should consider these long-term patterns when planning for future investments. Accessing and analyzing such records empowers buyers to navigate the market effectively, making informed decisions about purchase timing and strategic locations.

In today’s data-driven real estate landscape, buyers can leverage advanced tools to access tax assessor property records directly, enabling them to conduct thorough research. This proactive approach ensures that market factors, as influenced by tax assessors’ work, are factored into every decision. Ultimately, a comprehensive understanding of these interconnections allows buyers to make well-informed choices, navigate the market successfully, and secure properties that align with their long-term goals.

Effective Planning: Strategies to Navigate Tax Assessor Data

When planning a real estate purchase, buyers often overlook the significant influence of local tax assessors’ data. Tax assessor property records offer valuable insights into market trends and can be a powerful tool for strategic decision-making. Effective planning involves understanding how these records can shape your buying strategy, enabling you to make informed choices in today’s dynamic market. This is especially crucial when navigating diverse neighborhoods with varying property values.

Buyers can leverage tax assessor data to identify undervalued properties or emerging markets. By examining historical assessment records, one can track a neighborhood’s growth trajectory and potential for future appreciation. For instance, a buyer might uncover that certain areas have consistently been assessed lower than their actual market value, presenting an opportunity to secure a lucrative investment. Tax assessor property records also facilitate comprehensive market analysis by providing data on property taxes, which are tied to the assessed value of a home. This information empowers buyers and agents to negotiate more effectively, ensuring fair pricing based on current market conditions.

To implement these strategies, prospective buyers should initiate their research with local tax assessor websites, which often offer searchable databases for public access. These platforms allow users to retrieve detailed property records, including assessment history, sale prices, and ownership changes. By combining this data with professional market analysis, individuals can make informed decisions about purchasing timing, neighborhood selection, and budget allocation. Embracing these practices ensures a more transparent and successful buying journey, fostering a deeper connection between buyers and the local real estate landscape.