Understanding flood zone maps is vital for real estate decisions, especially in high-risk areas. These maps, issued by regulatory agencies, classify lands based on flooding risk using colors. Key terms like "Special Flood Hazard Area" (SFHA) indicate high-risk zones requiring flood insurance or protective measures. Nearly 20% of U.S. properties are in high-risk zones. Familiarity with these maps enables borrowers to make secure investments, comply with lender regulations, and protect against financial losses associated with flooding.

Understanding flood zone maps is an essential step for consumers looking to protect themselves and their investments in today’s unpredictable climate. These maps, which identify areas prone to flooding, serve as crucial tools for making informed decisions about property purchase and insurance. However, the complexity of these resources often leaves folks feeling bewildered. This article aims to demystify flood zone maps, providing a comprehensive guide tailored for consumers. We’ll break down the map’s components, explain varying risk levels, and offer practical tips for navigating this vital resource, ensuring you’re prepared and empowered in the face of potential water-related risks.

Understanding Flood Zone Maps: A Beginner's Guide

Understanding flood zone maps is a crucial step for any homeowner or prospective borrower navigating the complexities of real estate transactions, especially in areas prone to flooding. These maps, meticulously crafted by regulatory agencies, serve as a comprehensive guide to identifying areas at risk of flooding, providing essential data for informed decision-making. At their core, flood zone maps classify lands into zones based on their susceptibility to various flood events, from minor floods to catastrophic storms.

For borrowers, especially those seeking mortgages or loans, these maps play a pivotal role in the lending process. Lenders and underwriters often require borrowers to consult these maps as part of their due diligence, assessing the potential risks associated with the property’s location. Understanding the map’s terminology is key; zones like “Special Flood Hazard Area” (SFHA) indicate high-risk areas where flooding is considered both a possibility and a probability. In contrast, lower-risk zones offer borrowers peace of mind but may still require flood insurance as a protective measure.

Consider a practical example: in coastal regions, properties within 100 feet of the shoreline often fall into the SFHA due to their vulnerability to storm surges. Borrowers seeking financing for such properties must demonstrate awareness of these risks and be prepared to invest in adequate flood protection measures, which can include elevated construction or robust retention ponds. According to recent data from FEMA, nearly 20% of U.S. properties are located in high-risk flood zones, highlighting the significance of these maps in shaping borrower requirements and safety protocols.

By familiarizing themselves with flood zone maps, borrowers can make more informed choices regarding their investments. This proactive approach not only ensures compliance with lender regulations but also safeguards against potential financial losses associated with flooding, ensuring both a secure loan process and a robust investment strategy.

How to Read and Interpret Your Local Map

Understanding how to read and interpret your local flood zone map is a critical step for any borrower considering purchasing property. These maps, often provided by federal, state, or local governments, offer valuable insights into areas prone to flooding, which can significantly impact your decision-making process. The primary goal of these maps is to help buyers make informed choices regarding their future investments and safety.

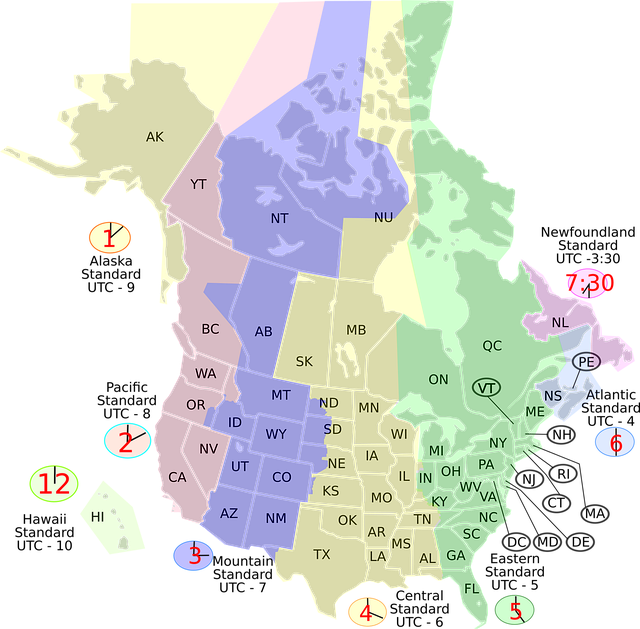

The flood zone map serves as a comprehensive visual guide, categorizing areas based on their susceptibility to various water levels during heavy rainfall or storm events. It typically uses different colors or zones to represent varying degrees of risk. For instance, the map might display light red for low-risk areas, yellow for moderate, and dark red or orange for high-risk flood zones. Each zone often comes with specific regulations and building codes designed to safeguard both structures and inhabitants. Borrowers should note these requirements as they plan their construction or renovation projects.

When reviewing the map, pay close attention to the boundaries of each flood zone. These delineations are crucial as they indicate where certain rules and restrictions apply. For example, in some areas, building within a designated flood zone might be prohibited or require special permits. Moreover, understanding the historical flooding data associated with these zones can offer valuable insights into future risks. Many maps include detailed information about past floods, helping borrowers gauge potential hazards. By combining this data with local expertise, individuals can make more prudent decisions regarding their real estate investments and ensure they meet all necessary borrower requirements.

Assessing Your Property's Risk: What the Map Tells You

When reviewing a property for purchase or refinancing, understanding your location’s flood risk is paramount. The flood zone map serves as an essential tool for assessing this risk, providing detailed information about areas prone to flooding. This map categorizes properties based on their vulnerability, allowing borrowers to make informed decisions and lenders to evaluate potential exposures.

The map typically uses zones labeled as Special Flood Hazard Areas (SFHAs), which are divided into various categories reflecting increasing levels of flood risk. Zones with higher designations indicate a higher likelihood of flooding events. For instance, Zone A represents areas within the floodplain where flooding is an annual occurrence, while Zone V encompasses areas farther from the coast with a low to moderate risk. Lenders often require borrowers in SFHAs, especially those with higher zones, to obtain flood insurance as part of their loan approval process. This requirement safeguards both the lender’s investment and the borrower’s financial security.

Assessing your property’s risk based on the flood zone map involves scrutinizing its location, topography, and historical flooding data. Properties in low-lying areas or near rivers, streams, or coastal zones are more susceptible to flooding. The map also considers elevation, distance from water bodies, and local drainage patterns. Understanding these factors empowers borrowers to inquire about potential modifications or improvements to mitigate flood risks. For example, raising the property’s elevation above the base flood level can reduce the likelihood of damage during a flood event.

Borrowers should actively engage with lenders and insurance providers when navigating flood zone map borrower requirements. Understanding the specific zoning designation and its implications is crucial for obtaining accurate flood insurance quotes and ensuring compliance with lending guidelines. By taking these proactive steps, individuals can protect their investments and prepare for potential flooding scenarios, even in areas designated as high-risk on the flood zone map.

Mitigating Hazards: Preparing for Potential Flooding

Understanding your flood zone map is a critical step in mitigating potential hazards and preparing for flooding events. As many homeowners discover, these maps are invaluable tools for assessing risk and making informed decisions about their properties. The flood zone map borrower requirements often include detailed knowledge of local water flow patterns, historical data on flooding incidents, and an understanding of your property’s elevation relative to surrounding areas. This proactive approach allows individuals to take measures that could significantly reduce the impact of a flood, from reinforcing structures to implementing effective drainage systems.

One practical example involves homeowners in low-lying coastal regions. Accessing their flood zone map, they might identify areas prone to storm surges and high water levels during hurricanes. Armed with this knowledge, they can choose appropriate building materials that withstand saltwater corrosion and implement elevated flooring systems. Such preparations not only safeguard the property but also enhance its resilience against future storms, ensuring a more secure living environment. Moreover, lenders often require borrowers in flood-prone areas to obtain insurance coverage for their properties as an additional layer of protection.

Additionally, utilizing advanced technologies like satellite imagery and GIS mapping can provide even more detailed insights. These tools enable professionals to assess the specific risks associated with various locations within a flood zone, allowing for more tailored mitigation strategies. For instance, identifying the path of recent rivers during heavy rainfall events or pinpointing areas prone to rapid water accumulation can guide homeowners in designing effective drainage solutions. Regularly updating and distributing these maps is essential for keeping communities informed, enabling better disaster preparedness, and facilitating efficient response efforts.