A comprehensive plan for investors involves setting clear goals (short-term & long-term), aligning risk tolerance with investment strategy, and conducting thorough market research to identify trends and opportunities. Diversification, dynamic asset allocation, and regular risk assessment ensure adaptability in a complex market. Execution includes continuous monitoring using advanced analytics to reassess KPIs and make informed decisions based on changing conditions and borrower needs.

In today’s dynamic investment landscape, crafting a robust and informed strategy is paramount for both novice and seasoned investors. The intricate nature of financial markets demands a comprehensive plan that navigates risk, opportunities, and ever-changing regulatory environments. This article delves into the critical components of such a plan, offering an authoritative guide for investors seeking to demystify their investment journey. By examining market trends, risk assessment techniques, and proven strategies, we empower readers with the knowledge to make informed decisions, ultimately fostering financial success.

Define Investment Goals: Setting Clear Objectives

Setting clear investment goals is a foundational step in crafting a comprehensive plan for investors seeking informed decision-making. This process involves defining both short-term objectives and long-term visions to guide their financial journey effectively. A well-defined goal provides a sense of direction, enabling investors to navigate market fluctuations with confidence. For instance, an investor might aim to generate substantial capital growth over a decade while ensuring regular income streams to fund retirement.

A comprehensive plan should align investment goals with the borrower’s risk tolerance and time horizon. This involves assessing their willingness to accept volatility in exchange for higher potential returns or preferring more stable options with lower risks. The comprehensive plan borrower requirements dictate that investors clearly articulate these preferences, especially when considering various asset classes. For example, a conservative investor might focus on high-quality bonds and dividend-paying stocks, while a more aggressive investor could target growth equities and real estate investments.

Data from recent market trends can offer valuable insights into setting realistic goals. According to industry reports, investors who set specific and measurable goals, such as “achieving a 10% annual return on equity investments,” tend to outperform their peers. This data-driven approach ensures that the comprehensive plan is not only strategic but also adaptable to changing economic conditions. By regularly reviewing and adjusting goals, investors can stay on track, making informed decisions based on current market dynamics and their evolving needs.

Market Research: Understanding Industry Trends

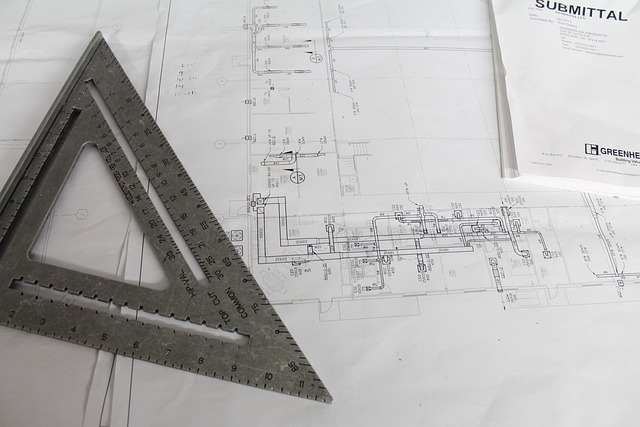

Market research is a cornerstone of any successful investment strategy, providing critical insights into industry trends that inform decisions across sectors. A comprehensive plan for investors begins with an in-depth analysis of market dynamics, enabling them to identify emerging patterns and shifts in consumer behavior. This involves scrutinizing historical data, tracking key performance indicators (KPIs), and monitoring regulatory changes. For instance, a review of the renewable energy sector over the past decade reveals a substantial shift towards sustainable practices, underscoring the importance of clean energy investments.

Understanding industry trends is not merely about identifying popular fads; it requires a nuanced perspective that considers macroeconomic factors, technological advancements, and societal shifts. Investors should assess market size, growth potential, and competitive landscapes to gauge viability. For example, the rise of e-commerce has transformed retail, creating new opportunities for digital platforms while challenging traditional brick-and-mortar stores. This trend highlights the need for comprehensive plan borrower requirements that account for evolving market conditions and consumer preferences.

Practical insights derived from market research empower investors to make informed choices. It allows them to identify undervalued assets, predict potential risks, and capitalize on emerging opportunities. For instance, recognizing the growing demand for cybersecurity solutions due to digital transformation can lead to strategic investments in innovative startups or established companies at the forefront of this sector. By staying abreast of industry trends, investors can align their comprehensive plan borrower requirements with market realities, ensuring both short-term profitability and long-term sustainability.

Comprehensive Plan: Strategies for Diversification

In today’s dynamic investment landscape, a comprehensive plan for investors is an indispensable tool for navigating market complexities and achieving robust returns. Diversification stands as a cornerstone of this strategy, enabling investors to mitigate risk while unlocking growth opportunities across various asset classes. A well-designed diversification approach involves meticulously analyzing the borrower requirements and selecting investments that correlate low or negatively with one another. For instance, combining stocks, bonds, real estate, and commodities can help insulate a portfolio from volatility in any single sector.

Expert analysts emphasize the importance of understanding not just the composition of the comprehensive plan but also its execution. Investors must carefully consider the liquidity and trading costs associated with diverse assets to ensure they can enter or exit positions efficiently without disrupting market equilibrium. Data suggests that investors who successfully implement diversification strategies typically experience lower overall portfolio volatility and improved risk-adjusted returns over the long term. This is particularly evident in historical studies of diversified investment portfolios, which have shown a reduced impact from economic downturns compared to concentrated holdings.

To operationalize this comprehensive plan, investors should employ dynamic asset allocation models that allow for regular rebalancing based on market conditions. This involves periodically reassessing the portfolio’s correlation matrix and making adjustments to maintain the desired diversification levels. By adhering to such a strategy, investors not only enhance their risk management but also position themselves to capitalize on emerging market trends. A comprehensive plan borrower requirements should incorporate flexibility and adaptability, reflecting the dynamic nature of financial markets and ensuring that investments remain aligned with individual risk tolerances and financial goals.

Risk Assessment: Identifying Potential Challenges

Risk assessment is a cornerstone of any successful comprehensive plan for investors seeking informed decision-making. It involves meticulously identifying and analyzing potential challenges, enabling proactive strategies to mitigate adverse effects. This process necessitates a thorough understanding of market dynamics, industry trends, and individual borrower requirements. For instance, a real estate investor might assess the risk of default by examining historical property values, occupancy rates, and the borrower’s financial history—a comprehensive plan that incorporates these factors ensures a nuanced view of potential risks.

Data plays a pivotal role in refining this assessment. Recent studies indicate that comprehensive plan borrower requirements, such as credit scores and debt-to-income ratios, can significantly predict investment outcomes. Investors should leverage robust data analytics to identify patterns and correlations, enabling them to make more accurate risk appraisals. For example, a study covering the past decade could reveal that borrowers with higher credit ratings consistently demonstrate lower default rates, underscoring the importance of creditworthiness in the comprehensive plan process.

Moreover, a comprehensive plan should account for macro-environmental factors and industry-specific risks. This includes geopolitical events, regulatory changes, and technological advancements that might impact investment sectors. For instance, investors in renewable energy may consider the potential effects of government subsidies or shifting environmental policies on their projects. By integrating these diverse risk factors into the comprehensive plan, investors gain a holistic perspective, enabling them to navigate challenges more effectively and capitalize on emerging opportunities.

Execution and Monitoring: Regular Review & Adjustments

A key component of any successful investment strategy is a robust execution and monitoring process, which involves regular review and adjustments to ensure alignment with the comprehensive plan. This dynamic approach recognizes that market conditions, economic indicators, and borrower needs are ever-evolving, necessitating flexibility in the lending framework. Lenders who adopt this practice not only mitigate risk but also enhance their ability to adapt to changing circumstances, ultimately fostering a more responsive and effective investment strategy.

Regular review sessions provide an opportunity to reassess borrower requirements, ensuring they remain in line with the initial comprehensive plan objectives. This may involve analyzing repayment trends, assessing creditworthiness updates, and gauging the impact of macroeconomic shifts on both borrowers and the broader market. For instance, a comprehensive plan for a commercial real estate investment might include specific debt-to-income ratios and occupancy rates as key performance indicators (KPIs). Through periodic monitoring, lenders can identify when these metrics deviate from the target ranges, signaling the need for adjustments in loan terms or strategies to steer borrowers back on track.

Data-driven insights play a pivotal role in this process. Lenders should employ advanced analytics and reporting tools to track performance indicators across their portfolio. By setting up automated alerts for significant deviations, they can proactively address potential issues before they escalate. This proactive monitoring approach allows lenders to make informed decisions, whether it’s offering revised loan structures or providing additional support to borrowers facing temporary challenges. Ultimately, this agility in execution and monitoring contributes to the overall success of the comprehensive plan, ensuring investments remain on a sustainable and profitable trajectory.