Understanding flood zone maps is crucial for real estate decisions. Created by agencies like FEMA, these dynamic maps identify areas prone to flooding based on historical and scientific data. Lenders use them to assess risk, influencing financing and insurance requirements. Map symbols indicate water levels, inundation zones, and critical infrastructure. Staying updated ensures informed decisions, compliance with regulations, and proactive flood risk mitigation measures for borrowers and lenders alike.

In the real estate sector, understanding your property’s location relative to flood zones is paramount for informed decision-making. With climate change amplifying flood risks, accurate and up-to-date mapping tools have become indispensable for buyers, sellers, and investors alike. This comprehensive guide aims to demystify flood zone maps, providing a clear and authoritative resource for navigating this critical aspect of property ownership. By the end, you’ll possess the knowledge to interpret these maps effectively, ensuring both safety and savvy investment strategies.

Understanding Flood Zone Maps: A Basic Guide

Understanding flood zone maps is a crucial step for any real estate transaction, especially as climate change increases the risk of flooding worldwide. These maps, created by federal agencies like the Federal Emergency Management Agency (FEMA), illustrate areas prone to inundation during floods. They serve as vital tools for lenders, buyers, and sellers alike, influencing everything from insurance rates to building regulations.

A flood zone map borrower requirements often mandate that lenders assess properties for potential flood risks before extending financing. This process ensures responsible lending practices and helps mitigate the financial impact of future flooding events on borrowers. For instance, a property in a 100-year flood zone, where there’s a one percent chance of flooding annually, will likely carry higher insurance premiums than one located outside these boundaries.

These maps are dynamic, evolving based on demographic changes, urban development, and new scientific data. Homebuyers should remain updated on their community’s flood zone map changes to make informed decisions. For example, areas previously considered safe might become high-risk zones due to rising sea levels or increased urbanization, leading to stricter building codes and higher borrowing costs for affected properties. Understanding these nuances empowers borrowers to negotiate terms, explore options, and prepare for potential financial implications tied to their location’s flood zone map status.

Interpreting Map Symbols: Decoding Key Features

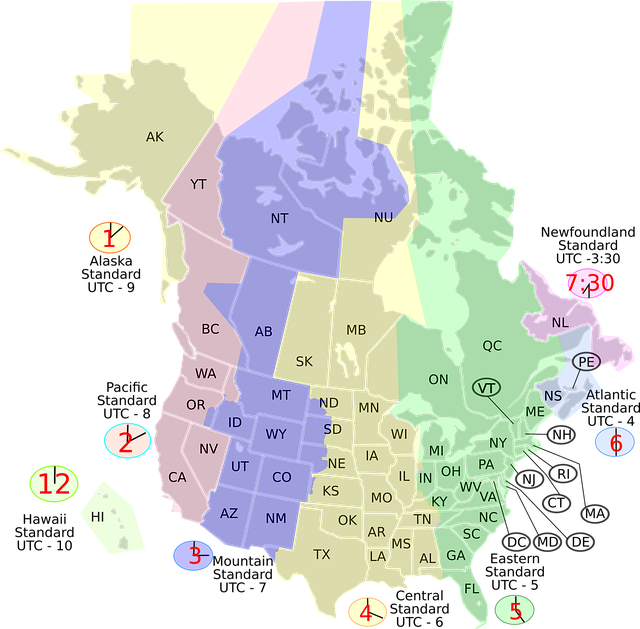

Understanding the symbols on a flood zone map is crucial for anyone buying or financing property, especially in areas prone to flooding. These maps, provided by local governments, offer valuable insights into the historical and potential flood risks within a region. Common map symbols include contours representing water levels, shaded areas denoting inundation zones, and specific icons indicating structures like bridges or dams.

For instance, a raised contour line might represent the 100-year flood level—the height of water expected to be reached during a storm with a one percent chance of occurrence annually. Shaded areas can vary from light gray for minor flooding to dark hues signaling extensive inundation. Borrowers should note these distinctions as they directly impact insurance requirements and loan eligibility, especially for high-risk zones. Lenders often refer to these maps when assessing borrower risks, as they provide a clear visual representation of potential hazards.

The map may also display infrastructure critical to flood management, such as levees or drainage systems. Understanding the layout and capacity of these defenses is essential, as they can significantly affect water flow and local flooding patterns. Moreover, borrowers should be aware of any historical flood events noted on the map, as past experiences can inform future risk assessments. By carefully interpreting these symbols, prospective buyers and lenders can make more informed decisions regarding property acquisition and financing in potentially flooded areas.

Assessing Risk: What the Map Tells You

The flood zone map is a critical tool for both prospective homebuyers and lenders when assessing properties in potential flood areas. These maps, developed by regulatory agencies, depict zones prone to flooding based on historical data and risk assessments. By understanding what these maps indicate, borrowers and lenders can make informed decisions regarding real estate transactions, ensuring safety and financial security.

When reviewing a property, the flood zone map provides essential insights into the likelihood and severity of potential flooding events. It categorizes areas into different zones, from low-risk to high-risk. For instance, Zone A indicates minimal risk, while Zone V represents the highest risk, indicating areas subject to the most frequent and severe flooding. Lenders often require borrowers to conduct a thorough assessment before financing a property in a flood zone, especially for loans insured by federal agencies like Fannie Mae or Freddie Mac. This process involves obtaining a detailed survey and consulting with professionals to determine the exact boundaries of the floodplain. The data from these analyses is then compared against the regulatory flood maps to confirm compliance with borrower requirements.

For borrowers, understanding the map’s implications is crucial. Properties in high-risk zones may require specific measures to mitigate flooding risks and ensure compliance with lender guidelines. These measures can include elevated construction, improved drainage systems, or even relocation, depending on the severity of the risk. Knowing these potential challenges in advance allows borrowers to make informed choices and plan accordingly, ensuring a smoother transaction process.

Moreover, lenders should stay updated on map revisions and changes in borrower requirements. Regulatory agencies regularly review and update flood maps based on new data and advancements in mapping technology. Keeping abreast of these updates ensures that both lenders and borrowers are aligned with the latest standards, facilitating a more efficient and accurate evaluation of flood zone properties.

Mitigating Damage: Using the Map for Preparedness

Understanding a flood zone map is crucial for anyone considering real estate investments or construction projects, especially as climate change increases the risk of severe flooding events worldwide. These maps, meticulously created by regulatory bodies, offer vital insights into areas prone to inundation. By analyzing these visual tools, individuals and lenders can make informed decisions to mitigate potential damage and ensure safety.

One of the primary applications of a flood zone map is for borrowers looking to secure financing for properties in high-risk zones. Lenders are required by law to assess flood risks when processing loans, especially for mortgage agreements. The flood zone map borrower requirements often include identifying properties within special flood hazard areas (SFHAs) and determining the appropriate level of insurance coverage needed. This process not only protects lenders from financial losses but also ensures borrowers have adequate protection against potential flood damage. For instance, in regions like the United States, the Federal Emergency Management Agency (FEMA) provides detailed maps and data that lenders utilize to evaluate flood risks accurately.

Property owners can take proactive measures by understanding their location’s flood zone designation. They can then implement preventive strategies such as raising essential appliances and documents to higher levels, reinforcing doors and windows, and installing water-resistant barriers. Additionally, homeowners with loans secured by properties in flood zones should consult with insurance providers about suitable coverage options, which often include flood insurance policies designed to protect against these specific risks. This proactive approach can significantly reduce the impact of flooding on personal possessions and financial stability.